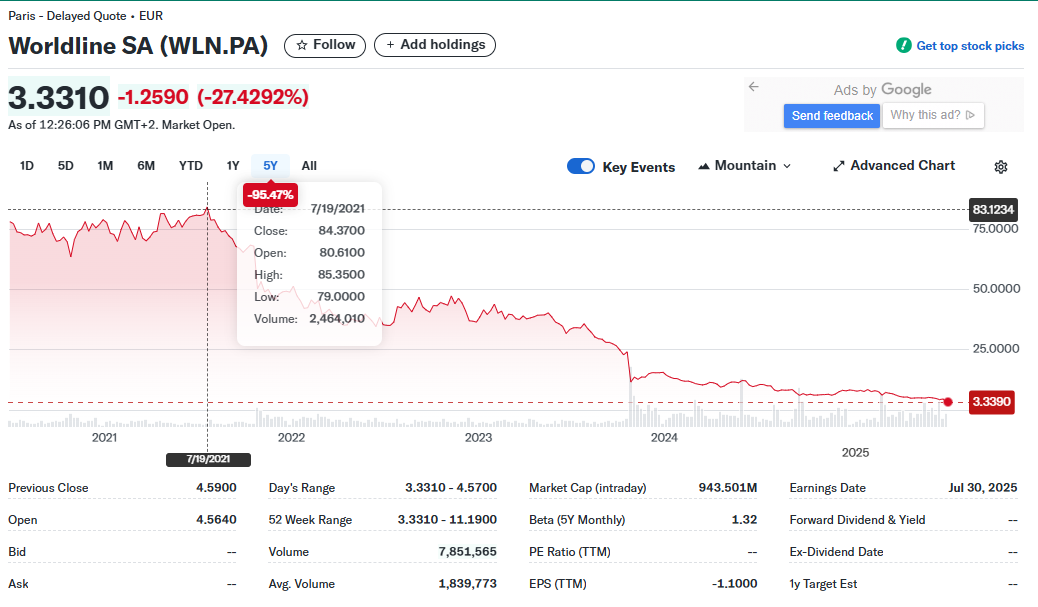

Worldline’s shares fell as much as 25.5% in early Paris trading to an all-time low of 3.3 euros.

Worldline shares lost a quarter of their value on Wednesday after an investigation by 21 European media outlets alleged the French digital payments company covered up client fraud to protect revenue, according to Reuters.

Responding to the reports, Worldline said in a statement that since 2023 it has strengthened merchant risk controls and terminated non-compliant client relationships.

The „Dirty Payments” investigation, which the media outlets said is based on confidential internal documents and data from Worldline, alleged the company accepted „questionable” clients across Europe, including pornography, gambling and dating sites.

The company said it has conducted a „thorough review” of its high-brand-risk portfolio, such as online casinos, stockbroking and adult dating services since 2023, affecting merchants representing 130 million euros in run-rate revenue in 2024.

It said it maintains „zero-tolerance” for non-compliance and engages regularly with regulatory authorities.

Reuters could not verify the allegations made by the outlets, part of the European Investigative Collaborations (EIC) network.

Worldline Statement following the publication of articles by the European journalism network EIC

Worldline operates in a demanding and constantly evolving regulatory environment, especially the one related to HBR (High Brand Risk) sectors, such as online casinos, online stockbrocking or adult dating services.

Since 2023, the Group has strengthened its merchant risk framework to ensure full compliance with laws and regulations, conducted a thorough review of its HBR portfolio— which currently accounts for approximately 1.5% of its acquired volumes — and has terminated commercial relationships deemed non-compliant with its strengthened merchant risk framework.

As indicated in previous financial communications, these decisions affected merchants representing €130 million run rate revenue in 2024. As an indication, according to the latest international schemes reports, Worldline’s fraud ratio is below the industry average.

All HBR clients still active within this portfolio are now subject to enhanced oversight, based on specific procedures. Additional requirements in terms of controls, verifications and evidence documentation have been introduced to ensure ongoing alignment with regulatory obligations and our enhanced internal standards.

Worldline has progressively ramped up its first and second-line resources to implement the enhanced requirements as part of the ongoing Group-wide Financial Crime Compliance (FCC) strategy to pursue reinforcement of supervision and controls with regular engagement with the relevant regulatory authorities.

Wherever the Group identifies indications of non-compliant situations, additional checks are immediately undertaken, potentially leading to termination of the client relationship.

Worldline’s Executive Management and Board of Directors are fully committed to strict compliance with regulation and risk prevention standards and to strictly enforce related rules and procedures with zero-tolerance.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: