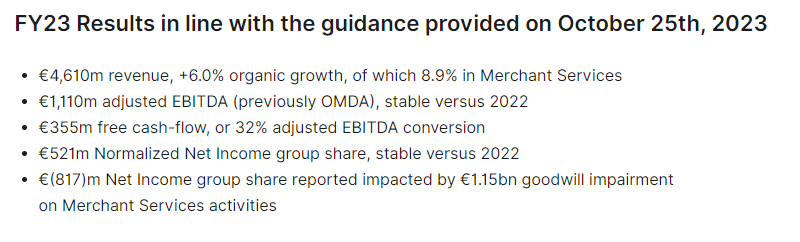

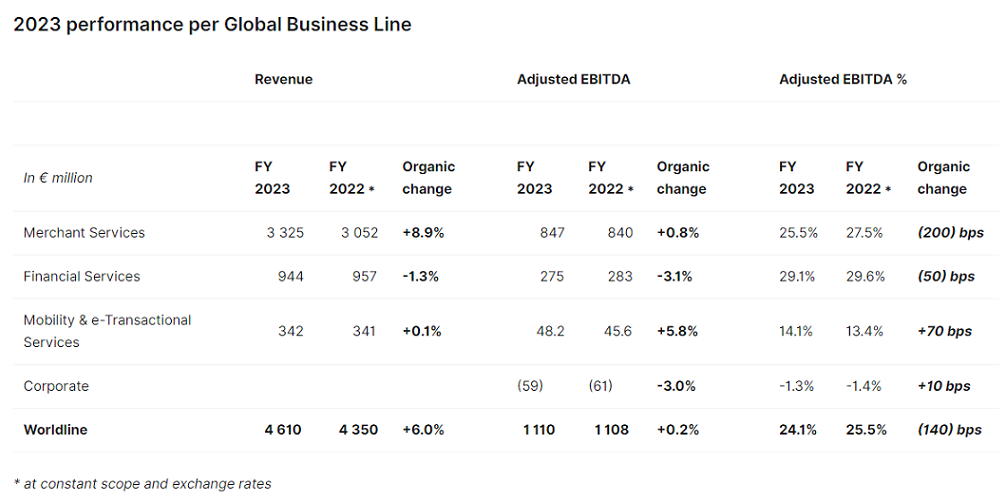

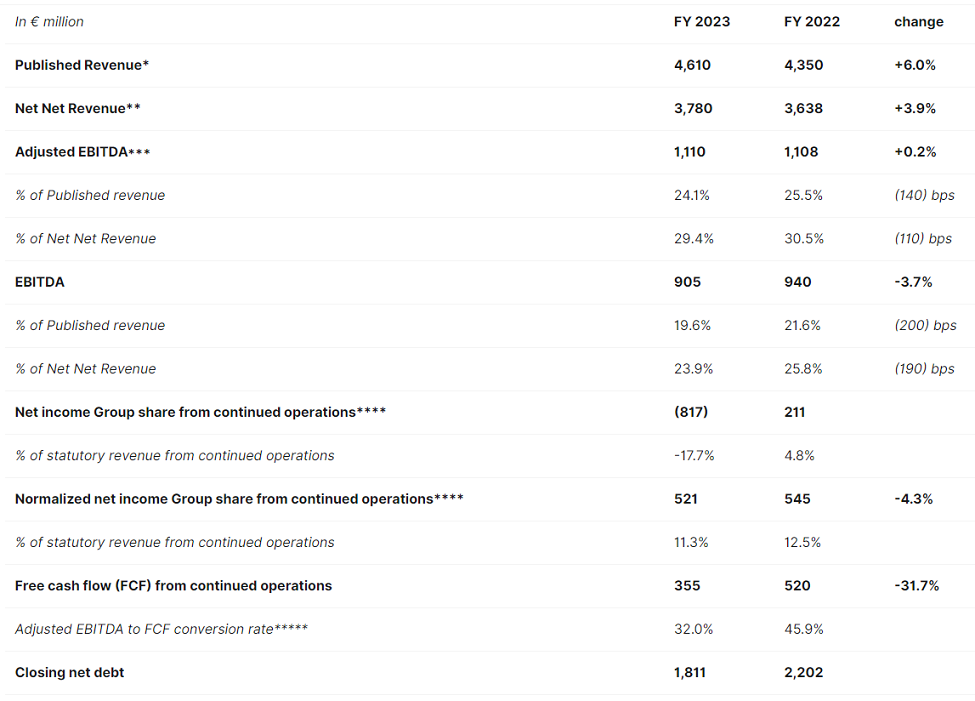

Worldline’s FY 2023 revenue reached € 4,610 million, representing +6.0% revenue organic growth. „Merchant Services (€ 3,325 million revenue, +8.9% organic growth) experienced a contrasted performance between a good first half and a second half of the year.” according to the press release.

„This was due in particular to the economic and consumption slowdown in Europe, which further deteriorated during the fourth quarter versus the third quarter, and to the impact of announced online merchants termination which represented circa €30 million impact in H2 2023.” the company explained.

Financial Services performance (€ 944 million revenue, 1.3% organic decline) „reflected the low conversion of pipeline opportunities, which was partially offset by the good resilience of Issuing activities”. Lastly, Mobility & e-Transactional Services (€ 342 million revenue, +0.1% organic growth) „achieved a stable performance driven by a good underlying growth in e-Ticketing”, the company said.

Gilles Grapinet, CEO of Worldline, said: „After a strong first semester and despite a positive commercial momentum in 2023, Worldline’s second half was materially impacted by a gradual overall macroeconomic and consumption slowdown in our core geographies, as well as by the impact of the termination of some of our online merchants, based on tighter regulatory framework. Despite further deterioration macroeconomic observed during the fourth quarter, we could deliver our revised guidance as communicated in October 2023.„

Net income Group share from continued operations was € -817 million, „mainly impacted by the € 1,147 million goodwill impairment mostly materialized in Merchant Services, based on conservative assumptions reflecting the change in valuation paradigm in the payments’ Industry” the company explained. On a Normalized basis (excluding unusual and infrequent items, Group share, net of tax) reached € 521 million, stable in absolute value versus 2022.

Outlook

After further deterioration of the macro environment during Q4 2023 and a still soft outlook for GDP growth and consumption in Europe, „2024 will be for Worldline a year of active transformation”, focusing on major internal initiatives, leading to the following objectives:

. Organic revenue growth at least 3%, assuming unchanged macro environment in the group’s core geographies with softer growth in H1’24 mainly due to merchants’ termination impact (Implied organic revenue growth above 5% excluding such termination impact).

. Adjusted EBITDA at least € 1.17 billion, with first benefits of Power24 ramp-up associated to operating leverage accelerating in H2’24.

. Free cash flow at least € 230 million, Including c.€ 150-170 million one-off Power24 implementation costs.

Gilles Grapinet added: „As a pan European leader in digital payments, we have the mission to constantly adapt to a fast changing industry and environmental trends. 2024 will be a pivot year to achieve this transition to a streamlined Group through a reinforced focus and rigorous execution and the combined support of our talents and strategic partners. As early as 2025, the Group will benefit from strengthened operational leverage that will drive solid medium-term performance dynamics in terms of organic growth, profitability and cash generation.”

_____________

The Group has reached a strategic scale after its strong focus on M&A over the last decade. It is now focused on finalizing its integration efforts. In this context, Worldline announced Power24 in October 2023, accelerating its existing post-integration transformation ambition. This planned transformation is expected to deliver c. € 200 million run-rate cash costs savings by 2025 with €80 million run-rate impacts already secured for 2024. The overall implementation cash costs should be circa € 250 million, with circa 2/3 of implementation costs impacting 2024, and the remainder in 2025.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: