Worldline reported Q3 2025 external revenue of €1.15B, down 0.8% organically, with merchant services flat and financial services down 4.5%. Management confirmed narrowed FY guidance for adjusted EBITDA (€830–€855M) and free cash flow (−€30M to €0+), citing operational improvements and divestment progress. The company says that these results, „showing some sequential improvement relative to recent performance thanks to the waning effect of identified one-off items” – according to the press release.

Pierre-Antoine Vacheron, CEO of Worldline, said: “Over the last three months, we have continued to build momentum at Worldline, leveraging on the accelerated ramp up of our renewed executive team. Q3 revenue is in line with our expectations, and while our performance still reflects the challenges we have been experiencing over the last quarters, it also shows that initial measures are starting to bear fruit. Thus, we can narrow 2025 outlook.

The external review of merchant portfolio and assessment of our control risk framework have been finalised. We are now focusing on delivering the plan to ensure consistent enforcement, further automation and ongoing commitment to compliance with rules and our defined risk appetite.

We have made significant progress on our pruning strategy, with the announcement of an agreement on our North American Business. Finally, we have simplified the organisation to accelerate our transformation. We are now heading to the capital markets day, where we will share our plans to return to sustainable growth and cash flow generation going forward”.

„Not everything is fixed yet, by any means, but the progress we have delivered (Wero, GoPay e-commerce within Groupe Crédit Agricole, or the successful deployment of a large card portfolio on our new issuing platform) testifies to the Worldline in Motion we all want to see.” – added the CEO of Worldline.

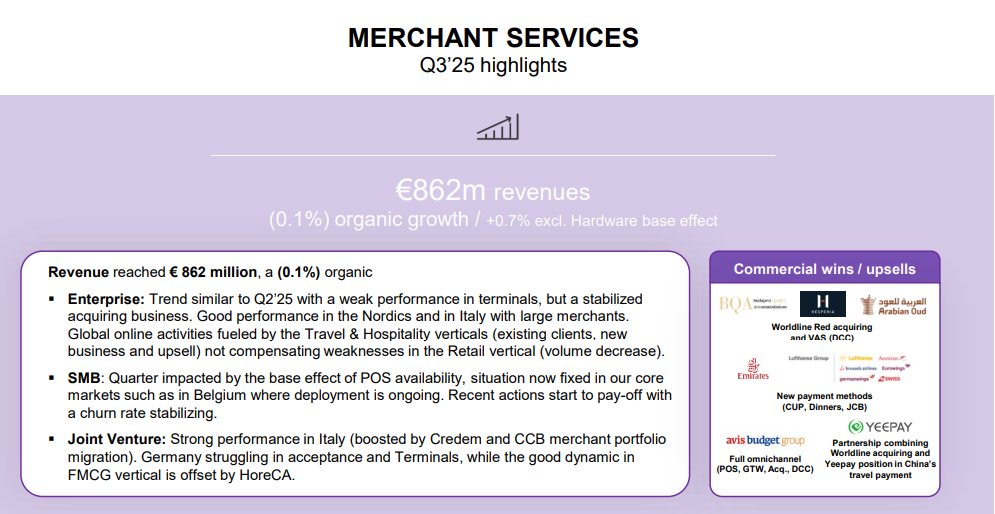

Merchant Services

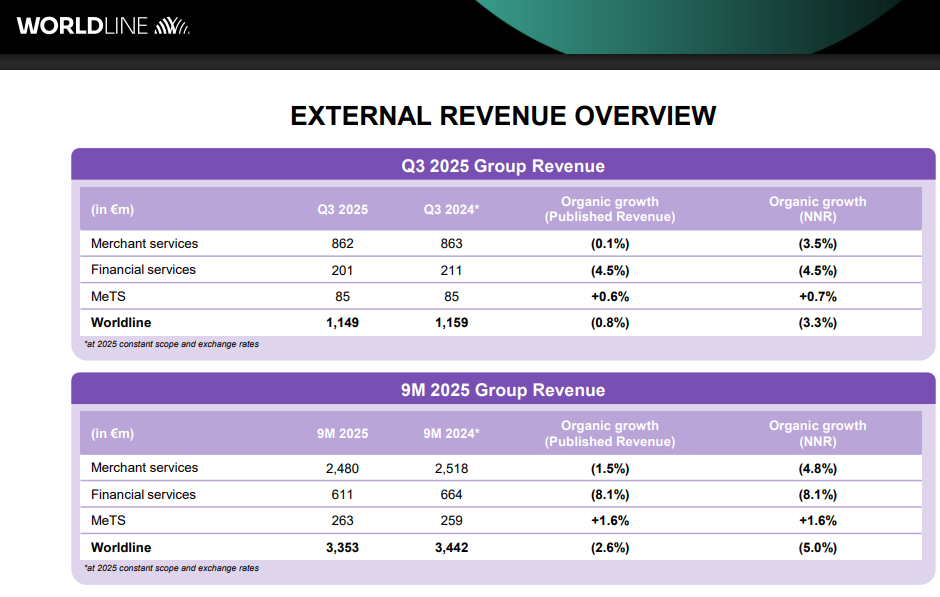

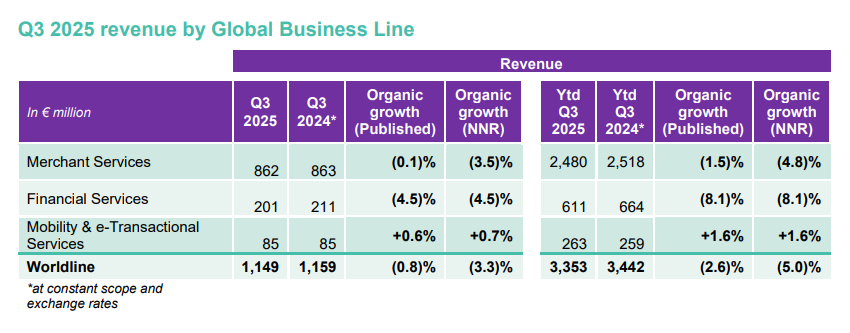

Merchant Services’ revenue in Q3 2025 reached €862 million, a slight decline of 0.1% vs Q3 2024

and down 3.5% on a net net revenue basis.

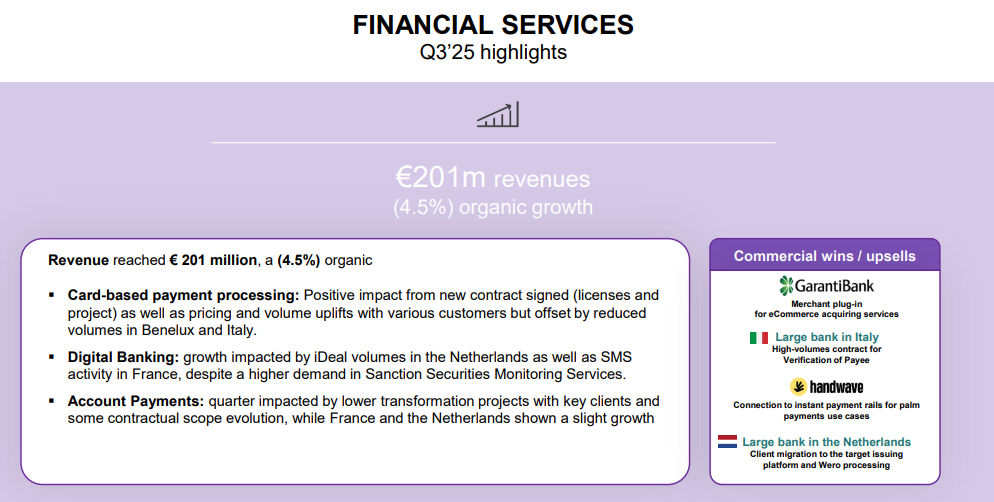

Financial Services

Q3 2025 revenue reached €201 million, declining 4.5% vs Q3 2024.

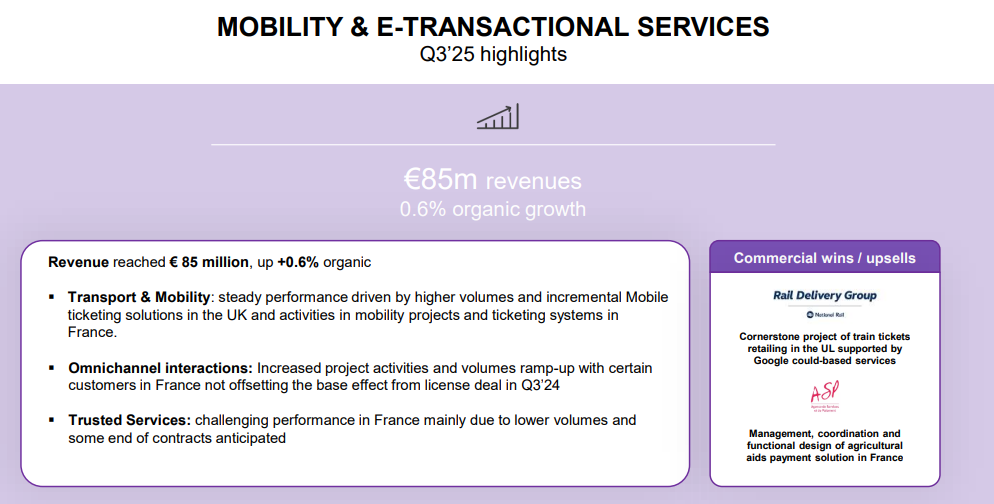

Mobility & e-Transactional Services

Revenue in Mobility & e-Transactional Services was up 0.6% vs Q3 2024 to €85 million.

2025 Outlook range narrowed

For 2025, Worldline expects a low single digit percentage organic decline in Group External revenue,

with an improvement in H2 compared with H1, thanks notably to the tapering off of one-off items.

Management maintains its strong focus on cost control and confirms the run-rate €50 million cash

costs savings by end-2025.

Adjusted EBITDA is expected to be in the range of €830-855m, impacted by lower revenue and a

continued negative client and sector mix.

Free cash flow is expected to be in the range of €(30)-0m+, depending on adjusted EBITDA with strict

control over capital expenditure and increase in financing costs. Restructuring cash outflow, excluding

Power24, is expected to amount to around €150m, including costs driven by the portfolio pruning in

progress and workforce optimisation.

Worldline announced in July the planned sale of its Mobility & e-Transactional Services unit to Magellan Partners for an enterprise value of 410 million euros.

„We plan to finalize these transactions in the course of H1 2026, and we should be in a position to announce some additional transactions in the coming weeks,” chief executive Pierre-Antoine Vacheron said in a call with reporters.

New York Stock Exchange reaction

Worldline has lost about 90% of its market value since its pandemic peak, hit by multiple profit warnings, governance shake-ups and media reports accusing it of concealing client fraud. Belgian prosecutors are investigating potential money laundering at its local unit.

However, in just the past week, Worldline jumped 16.0%, and the past month showed an 18.0% gain. That’s the kind of pace that turns heads, especially for a company whose five-year return stands at a jarring -95.6%. Even so, it is clear that short-term optimism is bubbling up after a prolonged slide. This suggests that investors are reconsidering the risks and potential rewards after years of harsh selling and anxiety in the European payments space.

Related documents:

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: