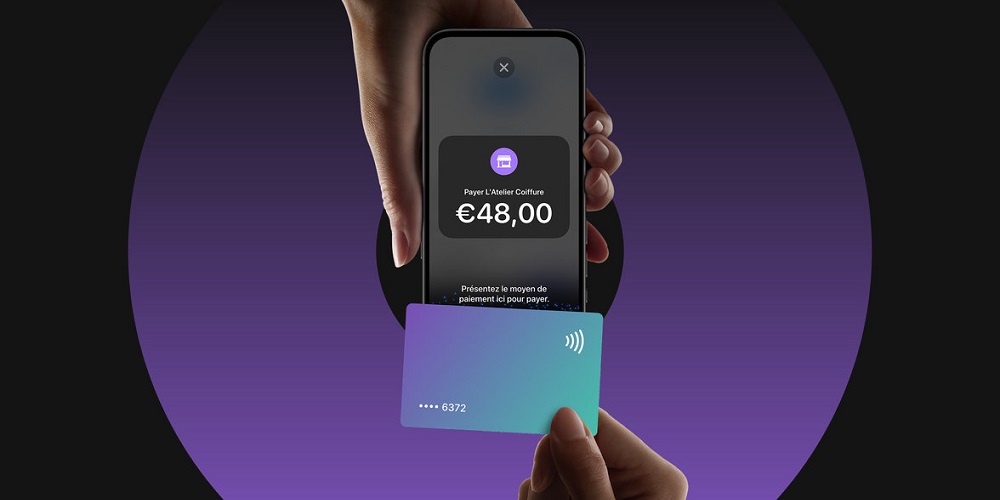

An easy and secure way to accept contactless payments with only an iPhone, no additional hardware needed

Worldline, a global leader in payment services, announces it has enabled Tap to Pay on iPhone for large merchant customers in France. With Tap to Pay on iPhone, merchants can seamlessly and securely accept in-person contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets, using only an iPhone and the Worldline Tap on Mobile iOS app. No additional hardware or payment terminal is needed.

This technology breakthrough is another step for Worldline Tap on Mobile solution.

„Tap to Pay on iPhone with the Worldline Tap on Mobile solution is easy, secure and private. At checkout, businesses will simply prompt their customers to hold their contactless Mastercard or Visa, their iPhone or Apple Watch to pay with Apple Pay, or other digital wallet near the business’ iPhone, and the payment will be securely completed using near-field communication (NFC) technology.” according to the press release.

Apple’s Tap to Pay on iPhone technology uses the built-in features of iPhone to keep businesses’ and customers’ data private and secure. No cardholder data is stored on the device or on Apple servers.

„There are many ways Tap to Pay on iPhone can support a business with a smooth, simple and reliable payment solution, whatever their sector of activity. In addition to the convenience of providing simple payment acceptance anywhere, the solution offers many other opportunities to optimise their business operations through use cases like queue busting (to manage in-store traffic during peak times), payment on delivery or at the restaurant table, and much more.” the company explains.

“We are very proud to have enabled Tap to Pay on iPhone for our merchants across multiple countries. Having launched in Australia and the Netherlands earlier this year, we are now set to open a whole new chapter in the end-user journey at our large customers in France by giving them a flexible and secure way to accept payments with nothing more than an iPhone and Worldline Tap on Mobile iOS app.” said Marc-Henri Desportes – Deputy CEO of Worldline.

To learn more about Tap to Pay on iPhone with Worldline Tap on Mobile visit this dedicated page.

Tap to Pay first arrived in February 2022 in the US, and allows iPhones to accept payments via Apple Pay, contactless credit and debit cards, and other digital wallets. All transactions are encrypted, and Apple has no information about what is purchased or the person who made the purchase.

The banking group BPCE (Banques Populaires, Caisses d’Epargne and Payplug) and along with Adyen, myPOS, Revolut, SumUp, Viva Wallet, and Worldline now offer Tap to Pay on iPhone to French customers. They will soon be joined by BNP Paribas, Crédit Coopératif, Market Pay, Stancer and Stripe, according to Apple.

Tap to Pay on iPhone requires iPhone XS or newer models, and works for customers as any normal Apple Pay transaction would. Sellers just need to open up the app, register the sale, and present their iPhone to the buyer, who can then use an appropriate contactless payment method.

France becomes the eighth region to support Tap to Pay, following similar rollouts in the U.K., Australia, Taiwan, Brazil, Ukraine, and the Netherlands earlier in the year.

______________

With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated a 4.4 billion euros revenue in 2022.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: