A total of 130 countries, representing 98% of the global economy, are now exploring digital versions of their currencies. Almost half of these are in advanced development, pilot phase, or imminent launch, according to a study by the American think tank Atlantic Council. „Worldline is in discussions with many central banks around the globe about the benefits of CBDCs and how a central bank could implement CBDCs.” – according to a recent white paper released by the company.

CBDCs have the potential to significantly redefine our monetary system. As we navigate this time of rapid technological change, it is important to explore the revolutionary possibilities of CBDCs and consider the questions that arise.

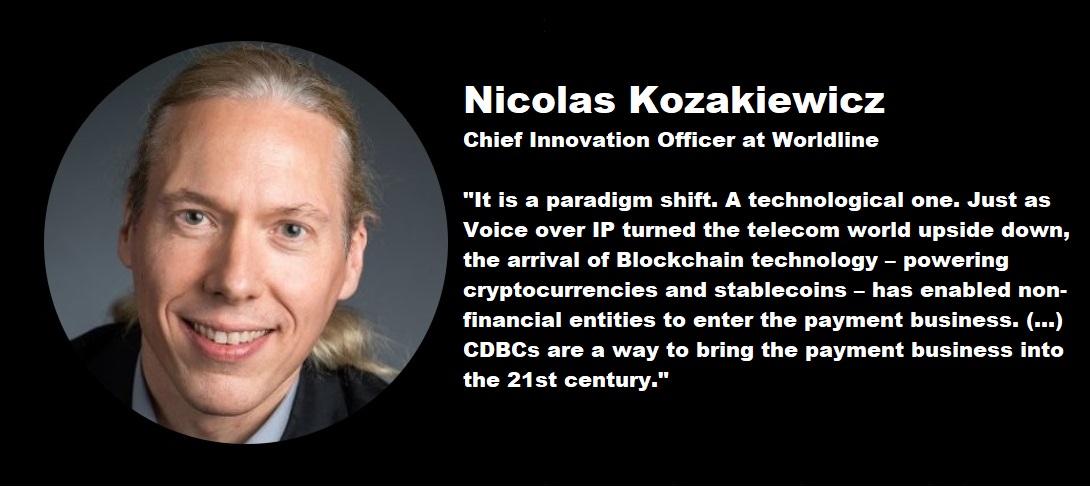

„It is a paradigm shift. A technological one. Just as Voice over IP turned the telecom world upside down, the arrival of Blockchain technology – powering cryptocurrencies and stablecoins – has enabled non-financial entities to enter the payment business. In other words, the barrier to entry suddenly dropped, revealing a risk of new entrants with different goals and different business models joining the competition. That touches the “sovereignty” of States, not directly, but indirectly by weakening their financial institutions. CDBCs are a way to bring the payment business into the 21st century.” – said Nicolas Kozakiewicz – Innovation Executive Advisor.

While the development of CBDCs is still in its early stages,the numerous pilots and initiatives by different financial institutions hold great promise for the evolution and sustainability of digital finance. The decisions and actions we take in the coming years in response to this emerging technology will be pivotal for our economy.

Worldline’s projects

European Central Bank – In 2022, Worldline embarked on its journey in the CBDC sector by being selected by the European Central Bank to develop a prototype of mobile wallet for offline payment leveraging hardware secure element. In 2023, we conducted extensive market research, providing valuable support to the ECB in designing 12 CBDC components.

Bank for International Settlement – Worldline’s commitment to the CBDC sector was further evidenced in March 2023 when the company were selected to develop a CBDC use case for the BIS TechSprint. This project involved integrating Rosalind APIs with our Wallet and POS to demonstrate a streamlined end-to-end payment journey for customers and merchants. Subsequently, in May 2023, Worldline presented its offline solution to BIS Nordics, as part of BIS’s project Polaris.

Reserve Bank of Australia – As part of the exploration of the RBA, ANZ collaborated with Worldline on an offline usecase to demonstrate how an organisation could step in during an emergency to provide immediate financial support through the distribution of a CBDC.

„At Worldline we are in discussions with many central banks around the globe about the benefits of CBDCs and how a central bank could implement CBDCs. For central banks, CBDCs represent a modernised approach to finance, fostering economic stability and adaptability in an increasingly digital financial landscape.” – concluded Sheri Brandon, Chief Market Officer at Worldline Financial Services.

More details here: White paper – Worldline Central Bank Digital Currency

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: