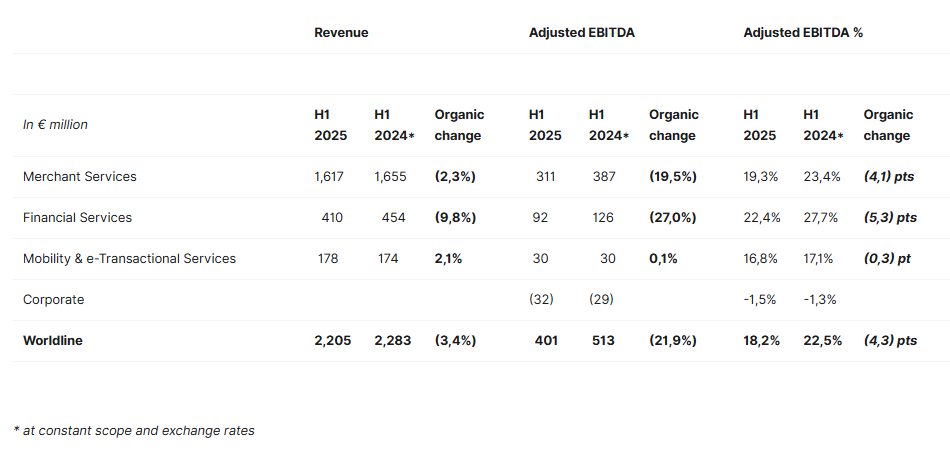

Worldline’s H1 2025 revenue reached €2,205 million, 3.4% below H1 2024(+0.8% excluding merchant terminations and the hardware base effect), according to the press release.

In the context of soft consumer spending, Merchant Services recognised €1,617 million in external revenue, 2.3% lower than H1 2024 (5.5% on a net net basis). The continuous off-boarding of the high brand risk (HBR) portfolio, along with remaining challenges in POS terminals, negatively impacted performance.

SMB still suffered net churn in core geographies but encountered robust growth in several markets where it holds challenger positions, such as Australia, Greece, Italy, and Poland. Adjusted EBITDA totalled €311 million, representing 19.3% of revenue, and was impacted by lower revenue and a less favourable client and sector mix.

Financial Services’ H1 2025 performance (€410 million in revenue, representing a 9.8% organic decline) reflected the impact of re-insourcing specific contracts, which overshadowed the stability of issuing processing and good performance of our licensing activity. Adjusted EBITDA reached €92 million, or 22.4% of revenue, reflecting the impact of lower sales.

Lastly, Mobility & e-Transactional Services achieved €178 million in revenue, with organic growth of 2.1%, supported by strong momentum in the UK for Ticketing solutions and Business Pay, as well as by new business developments in France. Adjusted EBITDA reached €30 million, representing 16.8% of revenue.

Corporate costs amounted to €32 million in H1 2025 (€29 million in H1 2024) in relation to the enhancement of the Group’s legal and compliance activities, as well as the reinforcement of strategic and financial steering.

The Group’s adjusted EBITDA therefore reached €401 million in H1 2025 (18.2% of revenue), as the impact of lower revenue, unfavorable client and sector mix, and underlying cost inflation outweighed the benefits of the Power24 program.

Given recent underperformance and challenges, as well as the acknowledgement that the change in environment in Europe and the payment market is long-lasting, the Group has recognised impairments on goodwill for an amount of €4.1 billion, exclusively attributed to the Merchant Services activity.

This impairment has no impact on the Group’s cash position or its normalized net income. It has a direct effect on the net income Group share, which comes to -€4,218 million, also affected by a €142 million lower fair value of TSS preference shares based on a prudent approach to terminal market prospects. Following this impairment, Worldline equity amounts to €4.9 billion. On a normalized basis (excluding other operating income, net of tax, and asset impairments), the Group’s net income share reached €121 million.

Pierre-Antoine Vacheron, CEO of Worldline, said: “Beyond the results of the period that reflect our current challenges, H1 was a defining period for Worldline. We laid the groundwork for the future, by restoring project delivery, strengthening our brand through independent portfolio audits, consolidating our financial position, and executing on our commitment to focus on our core portfolio. As a first step, the contemplated divestment of MeTS will enable the organization to operate more efficiently and focus on its leading positions in payments.

The extensive renewal of our leadership team, with international and diverse profiles selected for their ability to transform, demonstrates the attractiveness of Worldline and the trust in the Company’s potential. Moving forward, we are focused on boosting short-term momentum while engaging the transformation required to unleash Worldline’s growth and cash flow potential.„

2025 Outlook

For 2025, Worldline expects a low single digit percentage organic decline in Group sales, with an improvement in H2 compared with H1, thanks notably to the tapering off of one-off items.

EBITDA is expected to be in the range of €825-875m, impacted by lower revenue and a continued negative client and sector mix, while being supported by our cost savings program.

As a result, at the mid-point of EBITDA guidance, free cash flow is expected to be neutral, with strict control over capital expenditure. Restructuring cash outflow, excluding Power24, is expected to amount to around €150m, including costs driven by the portfolio pruning in progress and workforce optimisation.

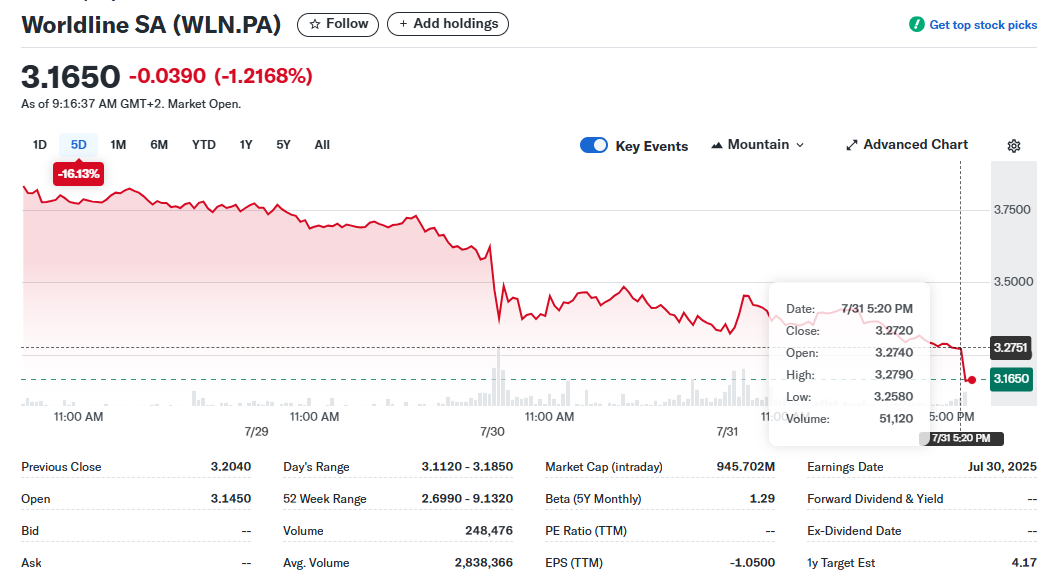

New York Stock Exchange reaction

Worldline announces a renewed management team to lead its transformation

Madalena Cascais Tomé (photo center) will assume the role of Head of Financial Services, effective 1 October, succeeding Alessandro Baroni, who has decided to leave Worldline to pursue other opportunities. Over the recent years, Madalena has been serving as CEO of SIBS, one of the leading European interbank payment player. Her extensive experience in addressing banks needs in payments and digital services and her visionary leadership position her perfectly to guide Worldline’s Financial Services division through its next phase of innovation, growth and transformation. Madalena will be based in Paris.

Anika Grant (photo left) will join as the new Chief People Officer of Worldline, effective 1 September. She succeeds Florence Gallois who has decided to leave Worldline to pursue other opportunities. Anika will be based in Paris and brings a wealth of international experience in digital and transformational environments, having held senior HR leadership roles at Uber and as Chief People Officer at Ubisoft. Her extensive experience in leading organizational transformation and people-driven change will be instrumental in supporting Worldline through its next phase of growth and evolution.

Srikanth Seshadri (photo right) will be the new Chief Financial Officer of Worldline, effective 8 September, replacing Gregory Lambertie who has decided to leave Worldline to pursue other opportunities. Srikanth is an experienced global finance leader, with a broad expertise in financial control, corporate finance, and funding. His background, shaped by Audit & Risk consulting at Arthur Andersen and leadership roles in complex international environments at Alstom, will be key to driving transformation & streamlining efforts at Worldline.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: