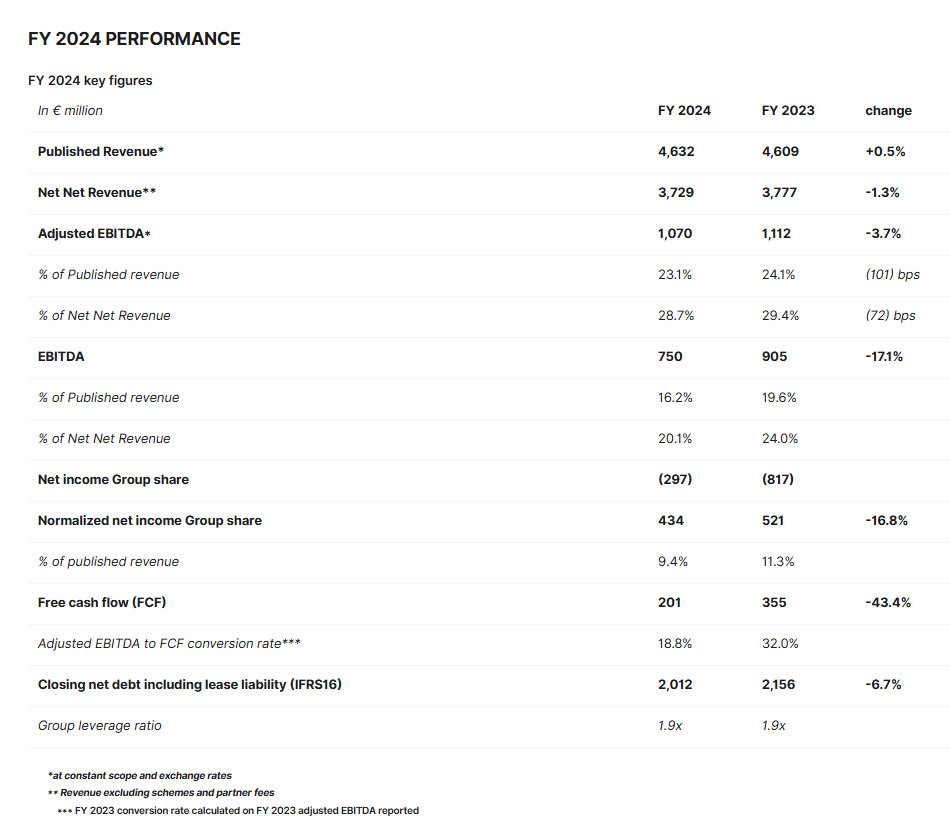

Worldline’s FY 2024 revenue reached €4,632 million, representing +0.5% organic revenue growth, „with a slowdown in the second half of the year driven by an overall soft consumption context, the re-insourcing process of a large customer in Financial Services and some specific challenges in Merchant Services over the summer” – according to the press release.

The Group’s adjusted EBITDA reached €1,070 million in FY 2024, representing 23.1% of revenue, in a challenging context in Merchant Services and Financial Services.

Net income Group share from continued operations was €-297 million, mainly impacted by the €349 million change in fair value of TSS preferred shares.

Free cash flow came to €201 million or 19% adjusted EBITDA conversion rate (free cash flow divided by adjusted EBITDA), mainly impacted by the Power24 plan which represented €139 million.

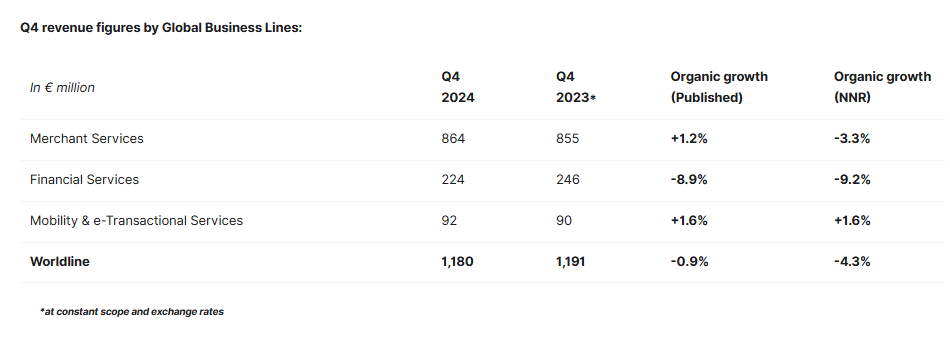

Worldline’s Q4 2024 revenue reached €1,180 million, representing -0.9% organic growth. In a soft macro-economic environment in Europe and despite the impact of merchant terminations and delays in the delivery of next-generation hardware products, the Merchant Services division delivered positive growth thanks notably to continued favorable momentum in Southern Europe. The Financial Services division was impacted by the re-insourcing process of a large customer, as in Q3, while Issuing and Instant Payments were still well oriented. Mobility & e-Transactional Services achieved growth across all segments, driven in particular by Worldline’s Contact solutions in France.

Merchant Services

Merchant Services’ revenue in Q4 2024 reached €864 million, representing an organic growth of +1.2%. In a soft macro-economic context, activity in the quarter was held back by the termination of merchant contracts, with the impact of the latter coming to an end in H1’25, as well as delays in the delivery of next-generation hardware products. The specific issues encountered in Q3’24 were resolved as planned, with Australia back to accretive growth and a strong improvement in the online verticals which had declined in the summer. By division, the performance was the following:

Commercial Acquiring: Good growth driven by market share gains in Southern Europe and solid activity levels in Central Europe, partially offset by some online contract terminations and a soft performance in Northern Europe.

Payment Acceptance: Solid growth driven by the recovery of some online verticals.

Digital Services: Decline as a result of hardware delivery delays offsetting good activity in Turkey.

During the fourth quarter, Merchant Services benefited from robust commercial activity with a number of contracts signed, for example with Fortech, myWorld, Wix, RCH and various airlines including Qatar Airways.

In parallel, Worldline renewed its contract with PayPal to provide gateway services to branded and unbranded businesses in the Mexican and Brazilian markets, demonstrating the Group’s ability to navigate complex partnerships and deliver innovative solutions.

Financial Services

Q4 2024 revenue reached €224 million, a -8.9% organic growth, largely affected by the re-insourcing process of a significant client which had already impacted Q3’24 revenue. The performance by division was the following:

Card-based payment processing activities (Issuing Processing and Acquiring Processing): good growth driven by new projects and greater demand, notably in Finland.

Digital Banking: sales lower year-on-year as greater activity in Sanctions Securities and Monitoring solutions was more than offset by lower volumes overall.

Account Payments: the one-off re-insourcing of a large client drove a significant decline in sales, as expected, while the dynamic was good in the Netherlands.

In the 4th quarter, Financial Services maintained a positive commercial momentum and recorded new wins including with Argenta in issuing, Dimoco in open banking and Garanti Bank in instant payments. This should support a return to growth for this division in H2’25, supported by the end of the impact of the one-off re-insourcing process.

Mobility & e-Transactional Services

Revenue in Mobility & e-Transactional Services grew +1.6% to €92 million, driven by new business developments in France. The performance by division was the following:

Trusted Services: slight growth thanks to increased activity in France, notably with ANCV (Chèques Vacances) and Caisse Nationale d’Assurance Maladie.

Transport & Mobility: moderately higher sales driven by ticketing solutions in France which more than offset lower activity in the UK.

Omnichannel interactions: Good growth thanks to increased Contact volumes in France more than offsetting slightly lower sales in Iberia.

In the fourth quarter, Mobility & e-Transactional Services signed a new 5-year contract with Transport for Wales Rail Limited, and notably won contracts in France with Pays de la Loire to improve mobility services and with the Ministère des Transports linked to the experimentation of a unique, national transport ticket.

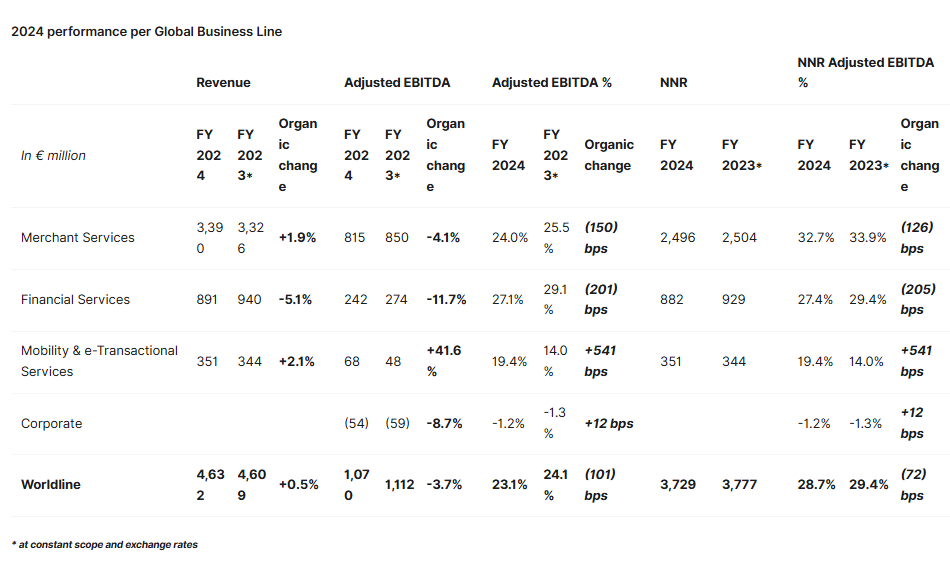

Merchant Services revenue in FY 2024 reached €3,390 million, representing an organic growth of +1.9%. Despite a good momentum in our core geographies such as Central Europe and strong activity driven by market share gains in Italy, Merchant Services’ performance was impacted by softer macroeconomic conditions during the year, the termination of some of our online merchants as planned, specific performance issues in our Asia-Pacific business and in some global online verticals over the summer which were resolved in Q4’24, as well as delays in the delivery of next-generation hardware products. Adjusted EBITDA amounted to €815 million, 24.0% of revenue, impacted by a soft revenue performance, as well as by an unfavorable country mix linked to the outperformance of Southern European markets relative to Central Europe.

Financial Services revenues in 2024 reached €891 million,down by 5.1% compared with FY 2023. The continued positive momentum in acquiring and issuing processing was more than offset by the large one-off re-insourcing process that started in the second quarter of 2024 in the Account Payments activity. Adjusted EBITDA reached €242 million, representing 27.1% of revenue. The division was affected by the soft revenue performance which was not offset by cost-based mitigation actions launched at the end of the first half.

Mobility & e-Transactional Services revenue reached €351 million, up 2.1% organically, mainly driven by increased activity in France inTrusted Services and new projects won in the second half of 2024 in the Omnichannel interactions division. Adjusted EBITDA reached €68 million, representing 19.4% of revenue driven by the strong productivity improvement in project roll-outs.

Grégory Lambertie, CFO of Worldline, said:

„Thanks to our teams’ efforts to tackle specific challenges faced during the summer, we managed to deliver our 2024 financial results despite a slowdown in Europe. We remained focused on cost control across the organization as demonstrated by our free cash flow performance.

In 2024, we successfully executed the Power24 plan to reorganize the company and adapt it to the evolving competitive landscape. In 2025, we will continue to reposition Worldline on a sustainable growth trajectory so as to accelerate by the end of this year.

We will also continue to manage operating costs, capital expenditure and working capital tightly in order to deliver steady growth in unlevered free cash flow in 2025 and beyond.

Furthermore, following a decade of market consolidation, we have started our portfolio pruning so as to refocus on our core activity and drive value creation for all stakeholders in the medium term.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: