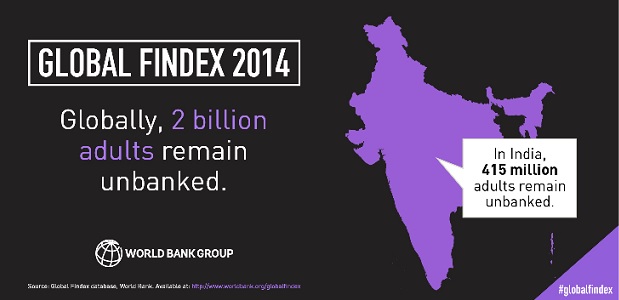

World Bank report: massive drop in number of unbanked

From 2011 and 2014, 700 million people became account holders at banks, other financial institutions, or mobile money service providers, and the number of “unbanked” individuals dropped 20 percent to 2 billion adults, says a new report released by World Bank. However, only in developing countries 1.3 billion adults with an account still pay for electronic, water or trash collection in cash, 500 million pay school fees in cash and 355 million send/receive remittances in cash or over-the-counter. Access to digital payments, through a mobile phone or point-of-sales terminal create opportunities to provide more convenient and affordable payment options.

Between 2011 and 2014, the percentage of adults with an account increased from 51 percent to 62 percent, a trend driven by a 13 percentage point rise in account ownership in developing countries and the role of technology. In particular, mobile money accounts in Sub-Saharan Africa are helping to rapidly expand and scale up access to financial services. Along with these gains, data also show big opportunities for boosting financial inclusion among women and poor people.

The findings come in the latest edition of the Global Findex, the world’s most comprehensive gauge of progress on financial inclusion. Financial inclusion, measured by the Global Findex as having an account that allows adults to store money and make and receive electronic payments, is critical to ending global poverty.

“Access to financial services can serve as a bridge out of poverty. We have set a hugely ambitious goal – universal financial access by 2020 – and now we have evidence that we’re making major progress,” said World Bank Group President Jim Yong Kim. „This effort will require many partners – credit card companies, banks, microcredit institutions, the United Nations, foundations, and community leaders. But we can do it, …”

Studies show that broader access to, and participation in, the financial system can boost job creation, increase investments in education, and directly help poor people manage risk and absorb financial shocks.

The 2014 Findex found there is still more work to be done to expand financial inclusion among women and the poorest households. More than half of adults in the poorest 40 percent of households in developing countries were still without accounts in 2014. And the gender gap in account ownership is not significantly narrowing: In 2011, 47 percent of women and 54 percent of men had an account; in 2014, 58 percent of women had an account, compared to 65 percent of men. Regionally, the gender gap is largest in South Asia, where 37 percent of women have an account compared to 55 percent of men (an 18 percentage point gap).

„Among those of us passionate about advancing access to financial services for the poor, this landmark new edition of the Global Findex provides data that allows us to see what is working, what isn’t, and how we can focus our efforts most effectively to reach the goal of universal financial inclusion,” said H.M. Queen Máxima of the Netherlands, the UN Secretary-General’s Special Advocate for Inclusive Finance for Development and a strong early proponent of the power of data to drive financial inclusion.

In 2011 the World Bank – with funding from the Bill & Melinda Gates Foundation and in partnership with Gallup, Inc. – launched the Global Findex in over 140 countries to study how adults save, borrow, make payments, and manage risk. This update of the Findex tracks progress on global financial inclusion over time, including on the gender gap.

One way to rapidly expand financial inclusion is new technology, particularly mobile money accounts. Consider what is happening in Sub-Saharan Africa: It is the only region where on average more than 10 percent of adults report having a mobile money account. In 13 countries, usage exceeds 10 percent and, among those, Cote d’Ivoire, Somalia, Tanzania, Uganda, and Zimbabwe have more adults using a mobile money account than an account at a financial institution.

Technology also can spur account usage and transform the way domestic payments are made, a new topic probed in the 2014 Global Findex. For instance, 355 million adults in developing countries with an account report sending or receiving domestic remittances in cash or over the counter, including 35 million in Sub-Saharan Africa. Moreover, 1.3 billion adults with an account in developing countries pay their trash, water, and electric bills in cash, and over half a billion adults with an account in developing countries pay school fees in cash. Access to digital payments, through a mobile phone or point-of-sales terminal create opportunities to provide more convenient and affordable payment options.

By paying private-sector wages and government wages and transfers digitally (as opposed to in cash), governments and the private sector can play a pivotal role in rapidly opening accounts and increasing financial inclusion. Globally, paying government transfers and government wages through accounts (instead of cash) can increase the number of adults with an account by up to 160 million.

Europe and Central Asia is home to seven of the 10 developing economies with the highest share of adults who paid a bill or made a payment through the Internet. Account ownership among adults increased from 43% in 2011 to 51% in 2014. The percentage of unbanked adults on the lower 40% of the income ladder dropped by 10 percentage points. 28% of adults use their accounts to receive wage or government transfer payments. The Global Findex points to the challenge of reaching the region’s 105 million unbanked adults—30% of whom say they do not trust banks.

The indicators in the Global Findex database are drawn from survey data covering more than 150,000 people in 143 economies. The survey was carried out over the 2014 calendar year by Gallup, Inc. as part of its Gallup World Poll, which since 2005 has surveyed approximately 1,000 people annually in up to 157 economies, using randomly selected, nationally representative samples of adults age 15 and older. Surveys are conducted in the major languages of each economy.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: