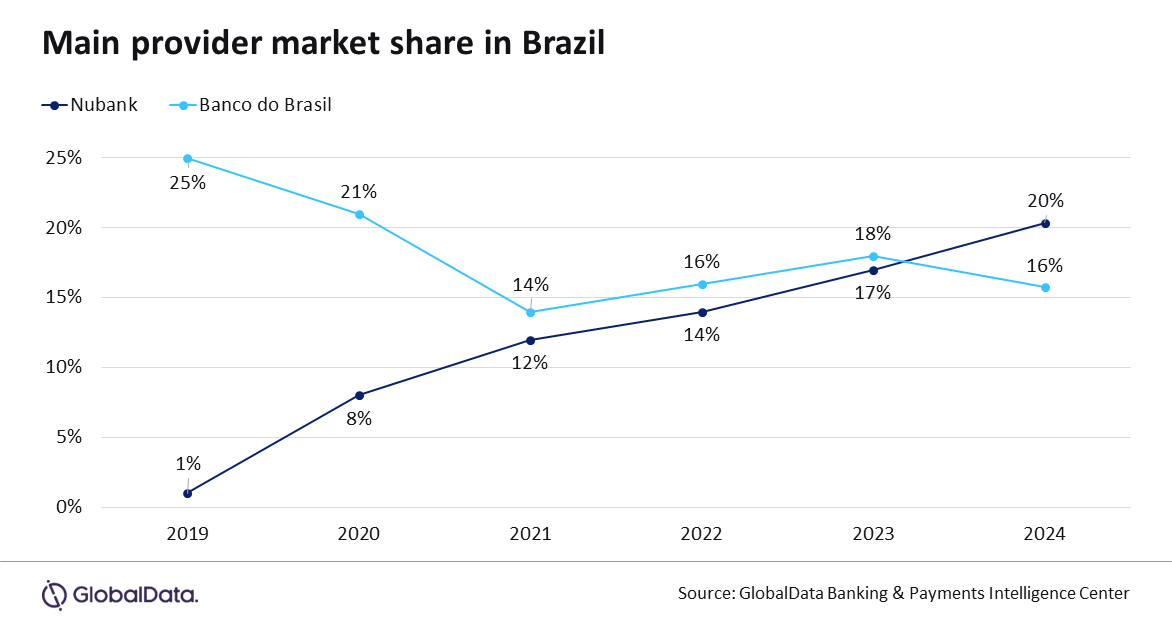

With 100 million customers and a 20% market share in November 2024, the digital lender Nubank became the main bank provider in Brazil

Digital lender Nubank’s ascent to Brazil’s number one bank provider by dethroning Banco do Brasil, the country’s oldest bank founded in 1808, signifies a paradigm shift in the banking industry. „By prioritizing digital-first strategies and financial inclusion, the neobank has reshaped consumer expectations, exposing legacy banks’ challenges in user experience and innovation, and setting a new benchmark for the future of financial services”, says GlobalData, a leading data and analytics company.

GlobalData’s Global Primary Banking Relationship Analytics 2024 shows that with 100 million customers and a 20% market share in November 2024 the challenger became the main bank provider in Brazil.

Blandina Hanna Szalay, Banking & Payments Analyst at GlobalData, comments: “Nubank is the first digital bank globally to achieve this status, underscoring the transformative power of fintech in reshaping traditional banking hierarchies.”

Over half of Brazilian adults are now Nubank customers, and a fifth of all adults—approximately 20 million people—consider this digital-only provider their primary banking relationship. This number exceeds the total customer bases of most challenger banks worldwide. Nubank’s rapid growth has been propelled by its strong appeal among Gen Z and Brazil’s lower mass market, boasting market shares of 35% and 25% within these groups, respectively.

Szalay continues: “By focusing on financially underserved communities, Nubank has demonstrated that inclusion and innovation can drive both social impact and business success.”

These achievements, however, do not only speak to the success of an inclusive neobank—they also demonstrate legacy banks’ ongoing struggles with user experience.

According to GlobalData’s Annual Financial Services Consumer Survey 2024*, 35% of recent bank switchers in Brazil did so to receive a better digital banking experience, making this by far the most cited reason. This figure rises to 47% among those switching to Nubank. This emphasizes the urgency for traditional banks to modernize their offerings or risk further erosion of their market share.

Szalay concludes: “Ultimately, while digital user experience remains a key battleground, the race will also hinge on building and sustaining customer trust. As more players vie to become central to consumers’ financial lives, trust will likely prove as pivotal as technology in determining long-term success.”

___________

*Annual Financial Services Consumer Survey 2024: Total respondents: 67,292; Brazil: 3,008

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: