In September, Wise takes another step closer to Mission Zero – cheaper transfers for half of its customers around the world.

Depending on the currency route, sending the equivalent of £1,000 could be cheaper by -6% — or even -50%, in some cases. Overall, 1 in every 4 pounds sent with Wise (26% to be exact) will cost customers less than it used to, Wise says in a blog post.

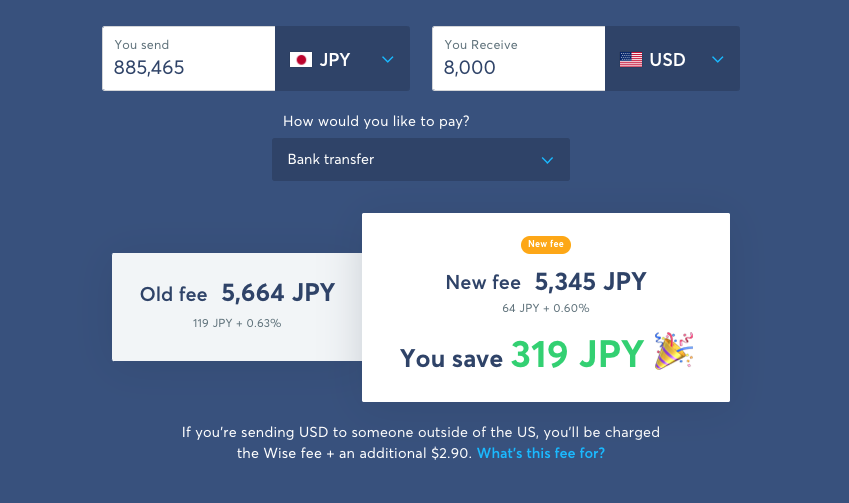

You can check Wise pricing page to see exactly how the changes will benefit your next transfer… but here’s an example of what this price drop means:

When improvements make our product run more efficiently and reduce some of our operational costs, we’re able to pass on savings back to our customers via cheaper transfers.

But what exactly helped Wise make transfers cheaper?

„We’re managing our foreign exchange risk better. At Wise, we offer our customers a guaranteed fixed, mid-market rate. We do this because we believe it’s the best experience for our customers, i.e. they pay and get the same amounts as they saw when they first started their transfer with us,” the company says.

However, that also means that Wise is exposed to the risk of exchange rate fluctuations – from when you send money, until the moment the funds arrive in our accounts. This period may take from a few seconds up to multiple days (e.g. a transfer set up over a bank holiday). And sometimes, the value of the funds is smaller than we’d initially expected by the time we get them.

While banks and other providers tend to add markups to the exchange rate to protect themselves from this risk (and to make a bit of profit), Wise believes in transparency — and offering the mid-market rate is the most transparent way to operate.

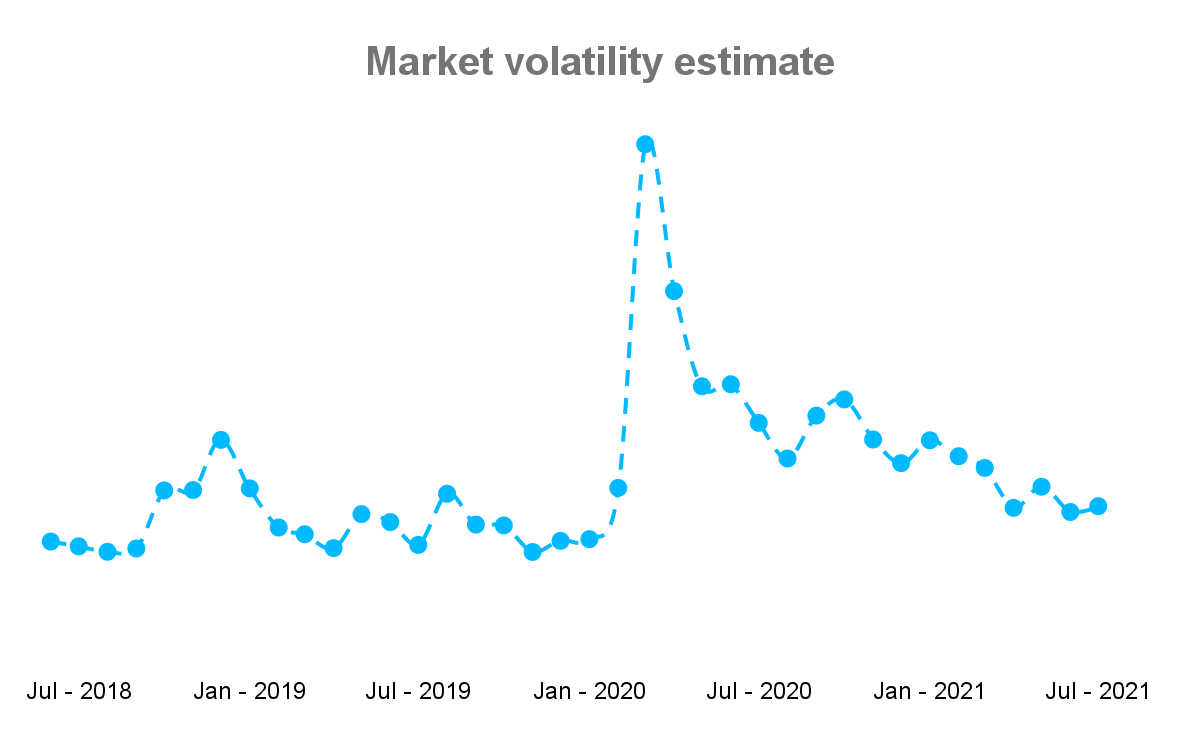

Since the beginning of the Covid pandemic, there’s been extreme volatility in foreign exchange markets, peaking in March and April 2020 and gradually returning to pre-covid levels in May 2021.

„Unsurprisingly, during this period – we saw banks increase their fees; to help cover the cost of the risk. Through this period we saw banks increase their fees (known as spreads) by up to 5 times more,” according to Wise.

In the last 4 months, Wise has seen markets stabilising in comparison to the peak of the pandemic and their risk related costs have gone down respectively. Additionally, these costs are now 15% lower than before the volatility began thanks to improvements in our risk management systems.

„On top of that, we’re serving more customers and more payments, which also helped us scale costs,” Wise says.

Speedier transfers made things cheaper

Surprisingly, making transfer payments faster also makes them cheaper, according to Wise.

„As some of you may have noticed, we’ve shortened fixed rate guarantees for some currencies. We set this period based on how long it takes 95% of our customers to fund their transfers. For example in the UK with faster payments this is a matter of hours, in the US this could take days.

This change has meant that we’ll no longer bear the disproportionate costs of very slow transfers — which was bringing the price of other transfers up.

So, in a nutshell, funding your transfers directly from your Wise account balance makes the payment of your transfer not only faster but also cheaper. Not just for you, but for everybody as it helps us to manage our FX risks even better. That’s because when your money is already on your balance, with us, we can fund your transfer instantly. And, down the line, this is what will enable us to continue lowering our fees for more and more people.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: