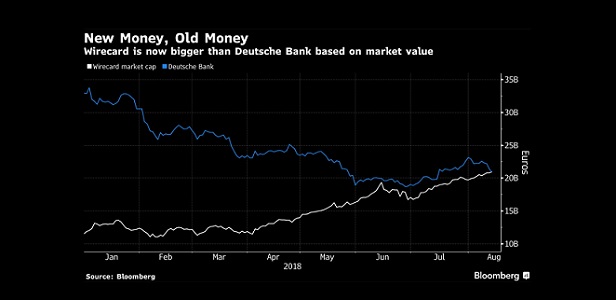

Investor enthusiasm for payments companies is rising: Wirecard, the German fintech that’s now worth more than Deutsche Bank

A payments provider that gets 5 percent as much revenue as Deutsche Bank AG is now worth more than the German lender deemed by regulators to be one of the world’s most important banks, according to Bloomberg.

Wirecard AG, based in a the Munich suburb of Ascheim, overtook Germany’s biggest bank by market value on Monday, riding a wave of investor enthusiasm for payments companies. The stock, which has climbed by more than 84 percent this year, is set to join the country’s benchmark DAX index next month, possibly at the expense of Commerzbank AG.

Wirecard’s growth mirrors the success of Adyen NV, a European-based payments startup whose shares have more than doubled since their debut in June. Payments companies are popular with investors because they can profit from the rapid global growth of online commerce and the use of mobile devices for banking – without having to bear the costs of providing and managing long-term credit to the economy.

Wirecard, whose market value stands at about 21.1 billion euros ($24.1 billion), provides software and systems for online payments and fraud prevention. Revenue at the 19-year-old company is expected to grow to about 2.5 billion euros by the end of 2019 compared with 1.5 billion euros last year. By contrast, Deutsche Bank’s revenue has fallen by more than 10 percent in the last three years and Chief Executive Officer Christian Sewing has announced further cuts this year, leaving analysts skeptical about its ability to grow.

Anders Olofsson – former Head of Payments Finastra

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: