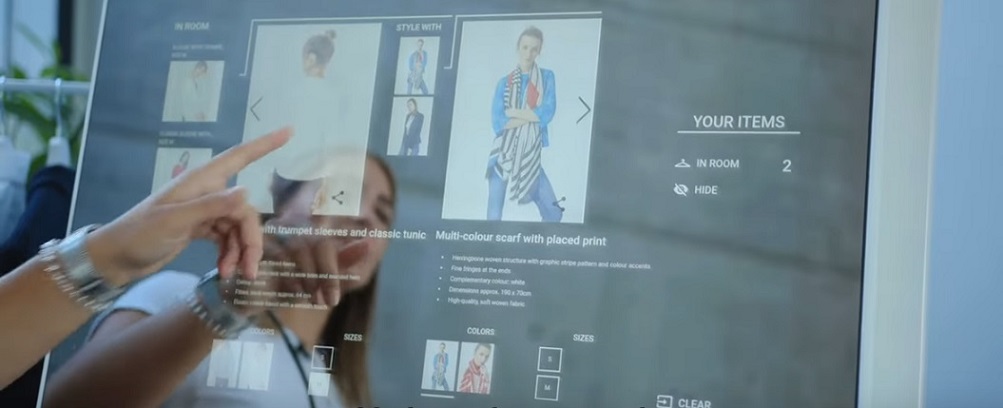

Customers enjoy a fully personalized digital shopping experience including tailored recommendations, availability information and online ordering option. „It is Germany’s first intelligent mirror through which consumers can also pay.”, according to the press release.

The unique offering offers a completely new customer journey in-store by enabling customers to access a wide range of information directly through the mirror: alternative sizes, different colors, matching products – everything appears on the mirror’s display.

„If the consumer clicks on “purchase” and scans a QR code, the payment is triggered. This eliminates the need to search for alternative sizes and colors and avoids long lines at the checkout. The goods can also be picked up afterwards or delivered home.”, the company said.

Watch the new shopping experience in this video:

Jörn Leogrande, EVP Wirecard Labs, said, “The shopping experience is made unique by the buying process on the Smart Mirror: it offers individual recommendations and the possibility to request other colors or sizes without leaving the changing room. This concept is not only appealing to customers, but also offers merchants many benefits from additional sales opportunities. One of the key features is the easy and fully digital checkout, which can be done with the customer’s own device – no need to queue or take out their credit or loyalty cards.”

„The mirror is particularly relevant for fashion retailers, but can also work as a sales assistance tool in any retail outlet. Due to the unique feature set, it enables stores that want to provide a seamless shopping and checkout experience to differentiate themselves from the competition.”, according to Wirecard.

Merchants also have the opportunity to tailor the feature set to meet their needs for example to maintain their preferred level of consumer interaction and to support Unified Commerce by fully integrating all channels such as offering options to order and pay for their items in-store and have them delivered home. In addition they can integrate surveys, targeted discounts as well as options to share on social media.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: