Wipfli’s banking outlook for 2024 shows 56% of banks expect growth of only 1%-5%

Wipfli’s annual research report into the state of banking reveals a slowdown in aggressive growth, a reluctance to embrace AI and a surprising number of cybersecurity instances. Nearly 400 banks across the United States participated in Wipfli’s “State of banking” research report.

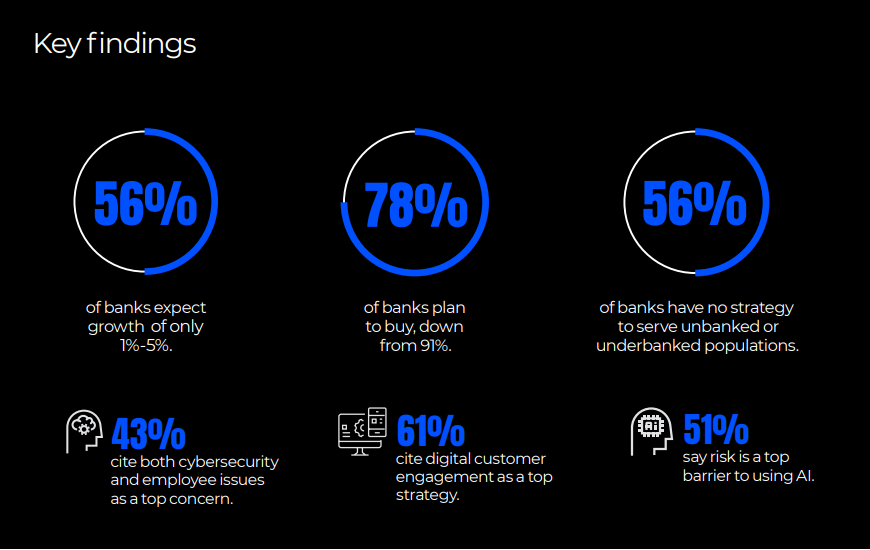

Among the key findings:

61% cite digital customer engagement as a top strategy

56% of banks expect growth of only 1%-5%

78% of banks plan to buy, down from 90%

43% cite both cybersecurity and employee issues as a top concern

65% of banks report at least one identified instance of unauthorized access to data or networks

51% say risk is a top barrier to using AI

56% of banks have no strategy to serve unbanked or underbanked populations

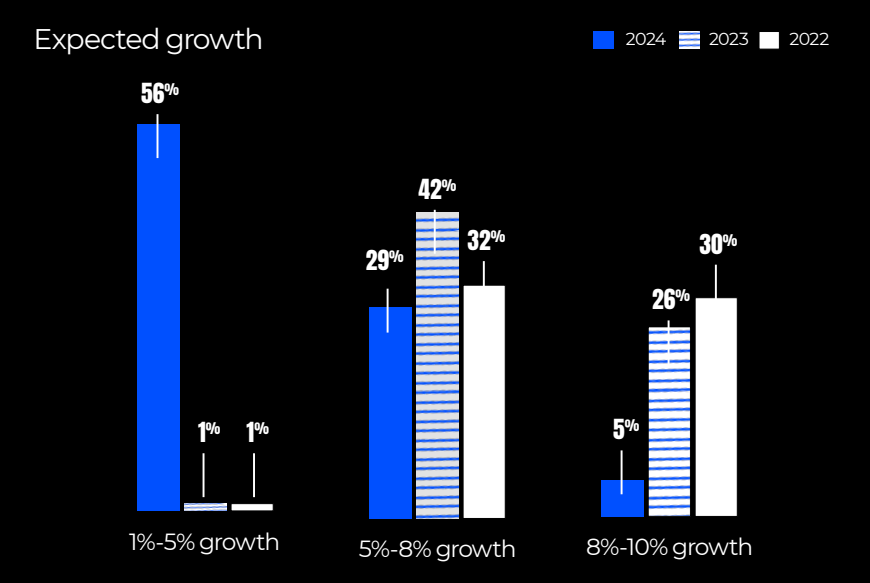

More than half of the financial institutions surveyed said their projected growth for 2024 is only in the 1%- 5% range. Last year, 77% of those surveyed predicted growth of 5%-10% or more, and in 2022, that number was 62%. Five percent of banks this year said they expect to retract in the coming months.

AI — how to use it and how to protect from it.

Only 23% of banks say they are very likely to implement or expand AI services in the next 12-18 months, and 51% cite risk as a key factor in that decision. Some conflicting numbers also represent confusion

and uncertainty about AI. While the majority of banks are hesitant to use AI, 46% of executives said

data analytics/AI is a top strategy in the coming year, and more than half plan to use AI for financial reporting.

Those numbers reflect that some traditional forms of machine learning (ML)/AI tied to mining data or increasing efficiencies are taking hold in banks, while more innovative customer-direct generative AI tools — like using OpenAI for customer support — are still lagging.

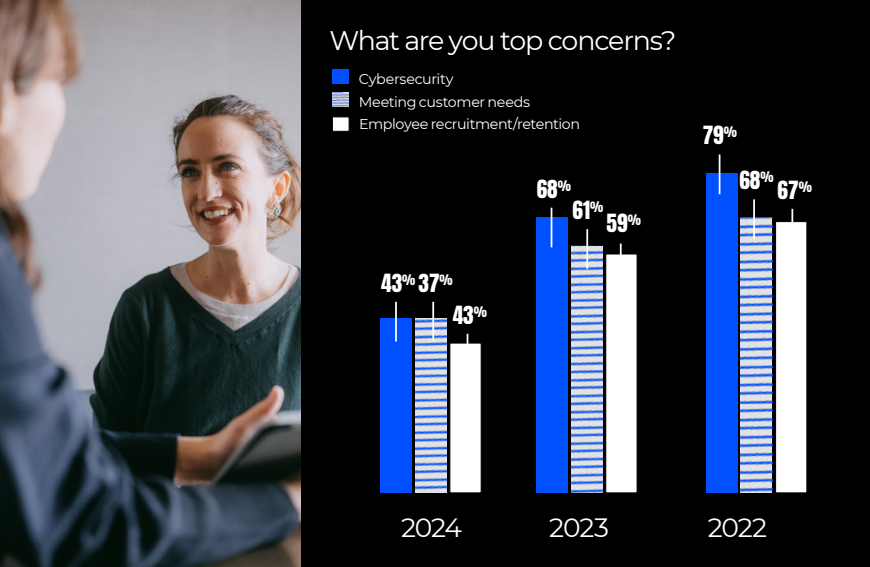

Top concerns

Cybersecurity, employee recruitment/retention and meeting customer needs again rank among concerns among all financial institutions — although they swapped positions. The consistency of these three top concerns reflects a systemic shift in the banking landscape. Fighting off cybercriminals, finding quality employees and enhancing services for an increasingly demanding customer base are now just a part of doing business — not a temporary challenge that banks can rise to.

And the juggling of their position as the top three concerns reflects that they are intertwined. You need

the tech to fight criminals and provide new digital experiences. But you also need the staff to not just

run the tech, but also see into the future to build the tech of tomorrow.

It’s worth noting that for regional banks, regulatory compliance beat out cybersecurity as a top concern,

but the cluster of numbers for banks reflects how closely intertwined they are

■ Regulatory compliance: 37%

■ Meeting customer needs: 34%

■ Cybersecurity: 33%

People, processes and technology. While the specifics might change, concerns also circle back to these

three foundational things.

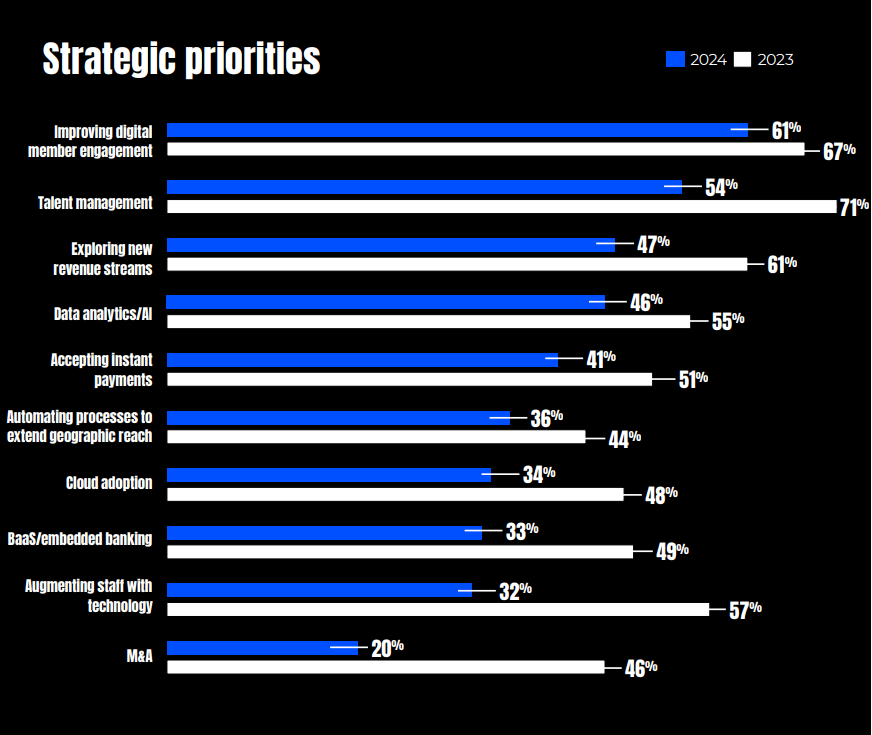

Top strategies

Not surprisingly, the top strategies banks are focusing on in 2024 to address their top concerns are:

customer engagement, talent and revenue streams. While these top priorities are in line with last year’s

numbers, we are seeing more diversity in the focus banks are placing on each.

“The top message for banks to take away from this report is that the time for sitting in the wings and watching others lead the innovation charge is over,” said Anna Kooi, the national financial services leader for Wipfli. “Delivering better digital experiences to customers, solving the talent pipeline drought, transforming digitally, adopting AI, keeping out cybercriminals … all of these are critical for banks hoping to survive and prosper in 2024.”

Of the institutions that were surveyed, 22% had assets under $500 million dollars; 13% had between $500 million and $1 billion; 20%, $1 billion and $3 billion; 19% $3 billion to $5 billion; 16%, $5 billion to $10 billion; and 10% more than $10 billion.

“What surprised us the most were the banks with $3 billion to $5 billion in assets,” Kooi said. “They’re showing higher adoption numbers of technology and AI, more plans to buy other banks and more strategies to serve unbanked and underbanked people.”

“The $3 billion to $5 billion banks are the rocks stars. It may be that they’re sandwiched between the big and small banks so they don’t have deep pockets or long-term customer loyalty, but whatever the reason, they are reporting more strategic and aggressive strategies than other banks,” Kooi added.

“It was also heartening to see the number of those participating in the survey increase,” Kooi said. “In a time where survey fatigue is prevalent, the fact that more executives participated is a reflection of their dedication to exploring and collaborating as a community on navigating an uncertain future.”

Download the report now to learn more about what the banking industry is expecting in 2024.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: