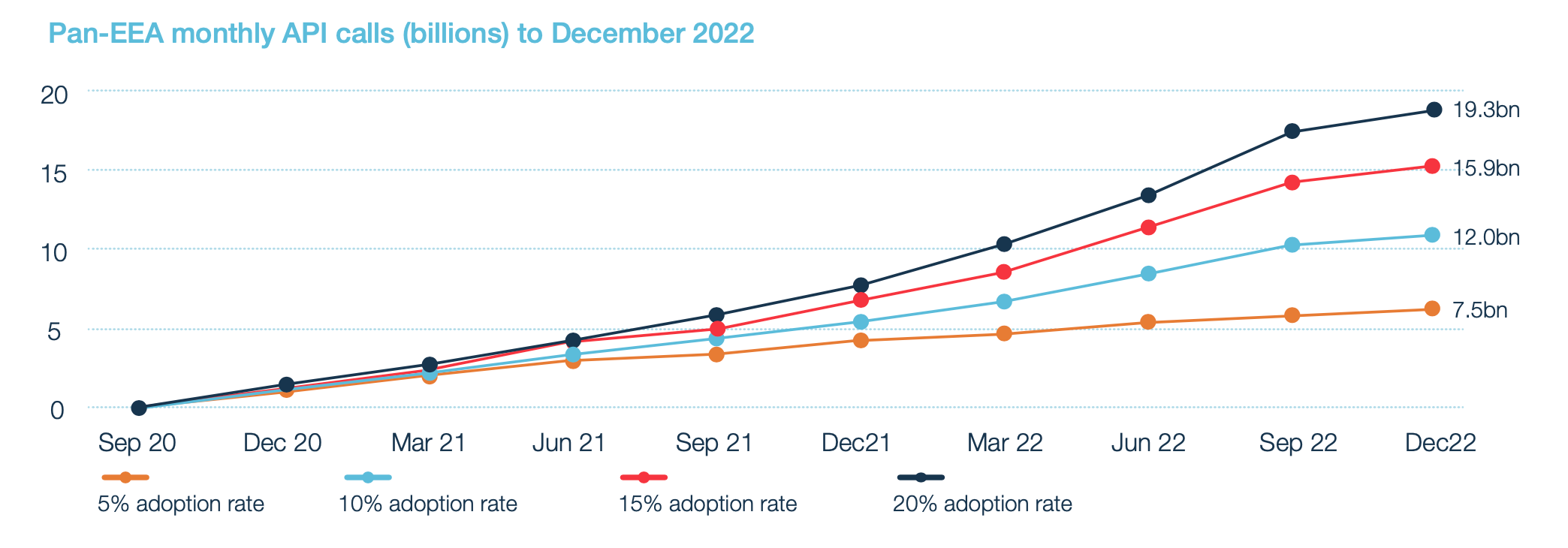

Will monthly open banking API calls reach 20bn by December 2022? Possible scenarios over the next two years.

„Regardless of whether the open banking adoption rate reaches 5%, 10% or 20%, we are confident nearly all countries within the Economic Euro Area (EEA) will be experiencing millions of API calls every month by the end of 2022,” according to Konsentus.

Since the implementation of PSD2 open banking a year ago, the number of Third-Party Providers (TPPs) across the EEA has more than doubled, according to a Konsentus report. Passporting ‘rules’ mean that these third parties can offer their services outside their ‘Home’ regulated country enabling them to take advantage of the opportunities this cross-border flexibility brings.

At the end of August 2020, every country in the EEA had at least 62 TPPs approved to provide services and monthly opening banking API volumes across the region reached an estimated 1.5bn.

This report analyses volumes over the next two years based on open banking adoption rates ranging from 5% to 20%, as well as looking at the time it will take selected countries to reach the numbers being reported in the UK today.

Methodology

- All projections are based on UK API calls (AISP) as published by OBIE

- Trajectories are based on the UK having a Payment Service User (PSU) adoption rate of 2% in June 2020 and a 5/10/15/20 % adoption rate by December 2022

- Figures are based on June 2020 TPP numbers (including passporting data) for each country.

- These numbers are then cross-referenced with the month the UK had the equivalent TPPs – with the corresponding API calls at that point in time taken as the starting point

- This establishes how far behind the UK each individual country is and represents each country’s starting point with volumes extrapolated based on the UK curve

- API volumes are adjusted in accordance with the population in each country

- Figures are increased by 25% to reflect the whole UK market position (not just CMA9)

- Monthly data points are provided from September 2019 until December 2022

Key findings

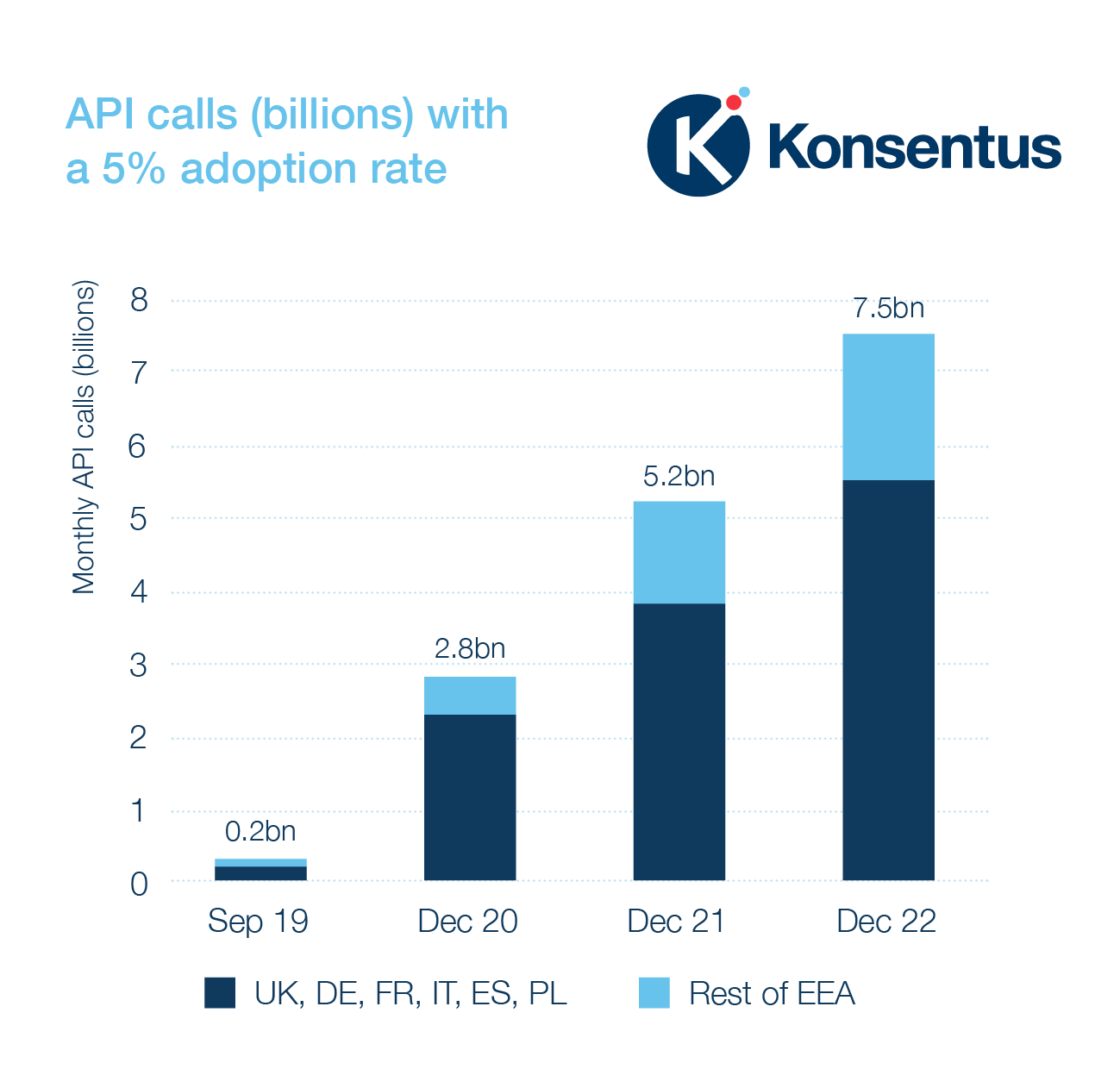

- By December 2020, the total number of monthly API calls across the EEA is expected to reach between 2.8bn (5% adoption rate) and 3bn (20% adoption rate); with Germany, France, the United Kingdom, and Italy all experiencing over 300m calls per month.

- By December 2021, Germany, France and Italy will join the UK in experiencing monthly volumes in excess of 500m (even with the lowest adoption rate of 5%).

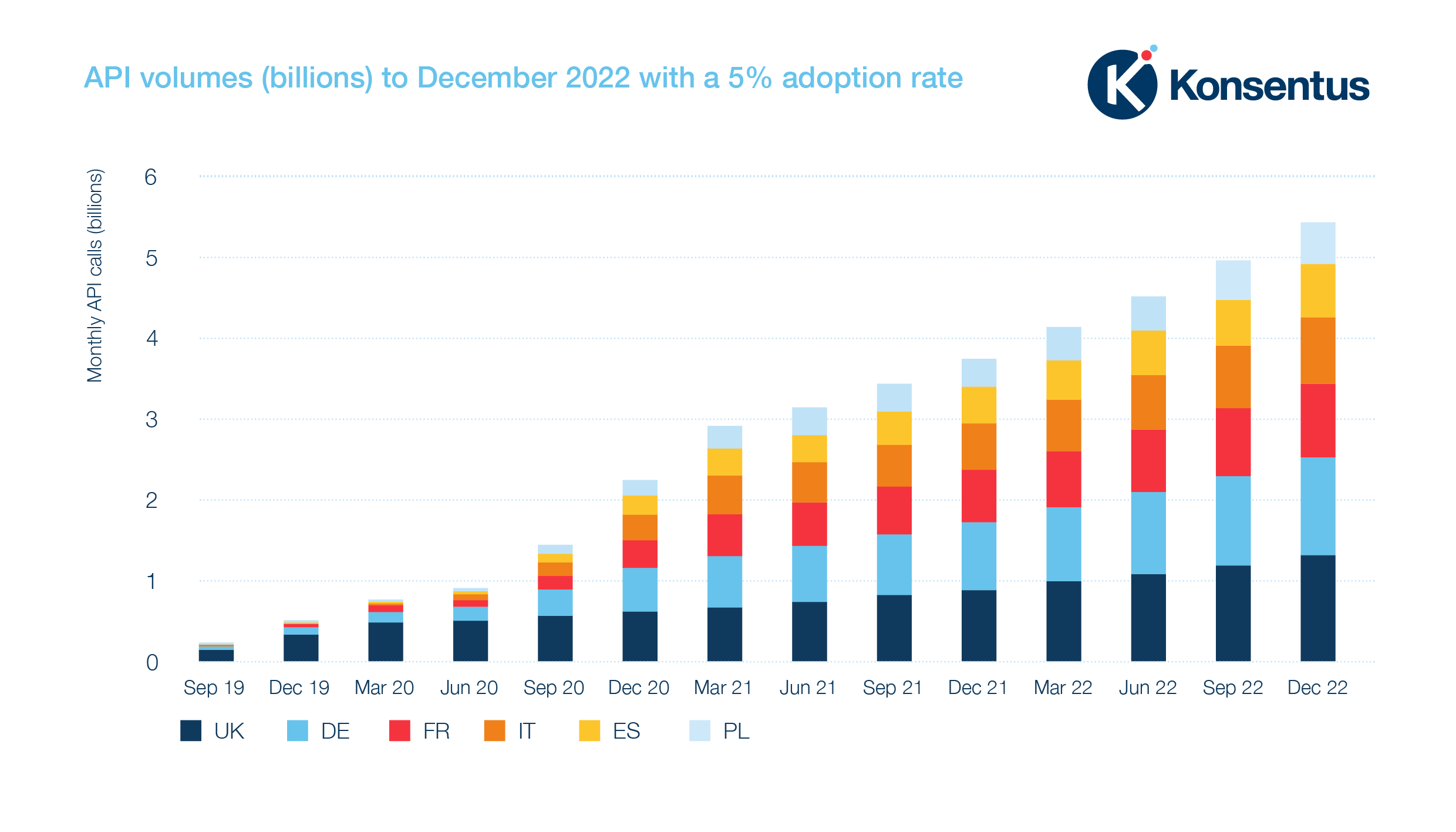

- By December 2022, with our lowest projections of a 5% adoption rate, Germany and the UK should be experiencing monthly transaction volumes in excess of 1bn. If the adoption rate is as high as 20%, Spain, France, Italy and Poland will also experience monthly volumes in excess of 1bn.

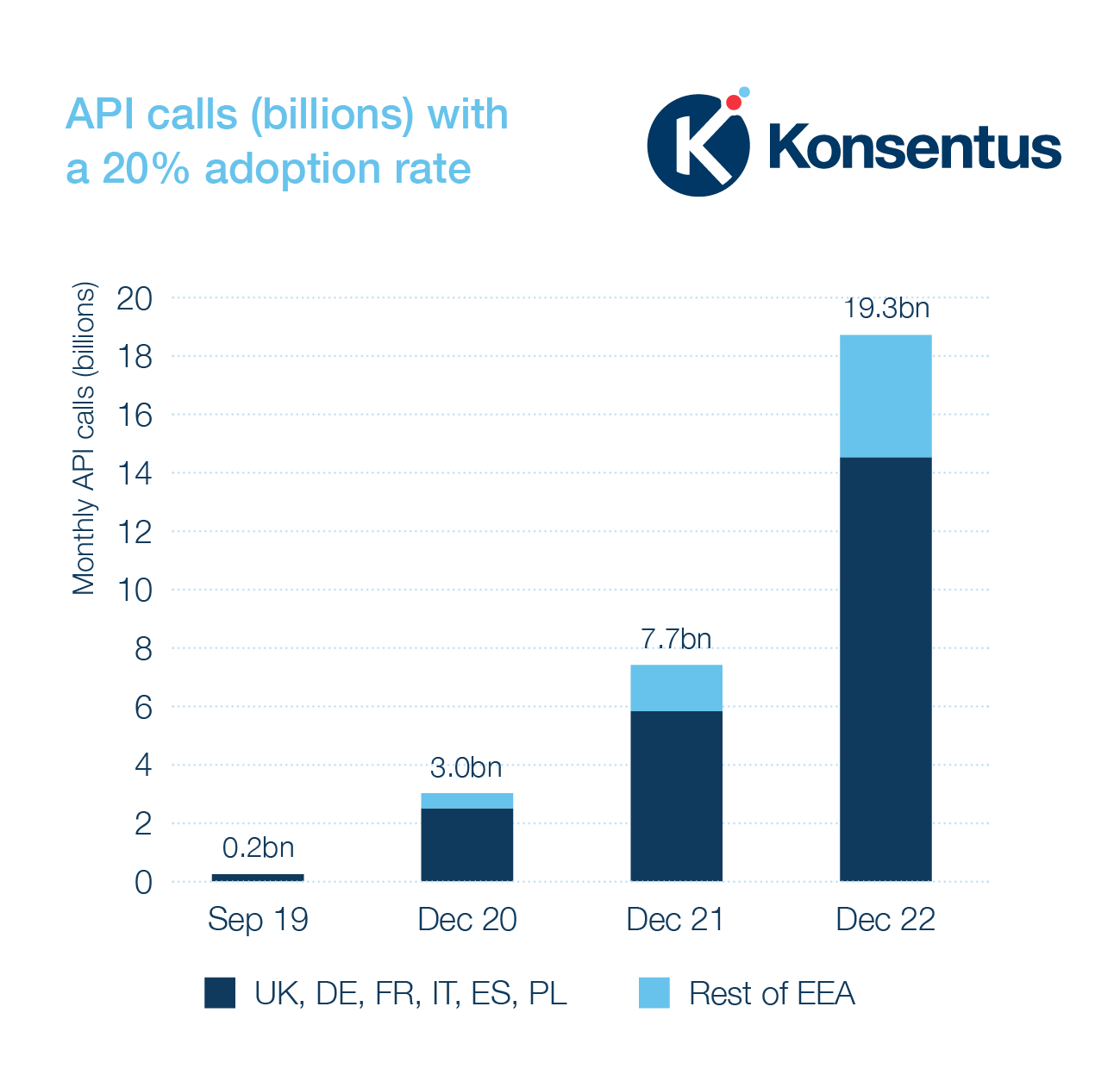

| 5% adoption rate | 10% adoption rate | 20% adoption rate |

| By December 2022, the total volume of calls across the EEA is anticipated to be in excess of 7.5bn. | By December 2022, the total volume of calls across the EEA is anticipated to be in excess of 12.0bn. | By December 2022, the total volume of calls across the EEA is anticipated to be in excess of 19.3bn. |

| 15 countries will be experiencing volumes of over 100m per month by the end of December 2022. For a Financial Institution with a 10%+ market share, this could mean 300k+ open banking API calls a day. | 8 countries will be experiencing volumes of over 250m per month by the end of December 2022. For a Financial Institution with a 10%+ market share, this could mean 800k+ open banking API calls a day. | 7 countries will be experiencing volumes of over 500m per month by the end of December 2022. For a Financial Institution with a 10%+ market share, this could mean 1.6m+ open banking API calls a day. |

| Selected countries would hit 1bn API calls by the following dates: the UK by March 2022, Germany by June 2022. | Selected countries would hit 1bn API calls by the following dates: UK by June 21, Germany by Dec 21, France by June 22, Italy by August 2022. | Selected countries would hit 1bn API calls by the following dates: UK by March 21, Germany by October 2021, France by March 22, Italy by April 22, Spain by July 22, Poland by October 22. |

In September 2019, the top 6 markets (UK, Germany, France, Italy, Spain and Poland) make up 96% of all transactions. However, by the end of 2022, their share ranges between 73% (5% adoption rate) and 77.8% (20% adoption rate) indicating that we are seeing the adoption of open banking in other EEA countries.

The graph above shows that even with a conservative 5% adoption rate, API calls in the top six markets will collectively reach just under 5.5bn API calls per month by December 2022. This reinforces what we’ve seen in our TPP tracker where third parties being approved for services in Southern Europe and Poland have been particularly high over the past few months. We expect the level of monthly calls to reach 0.5bn in Italy by August 2021, Spain in April 2022 and Poland in November 2022.

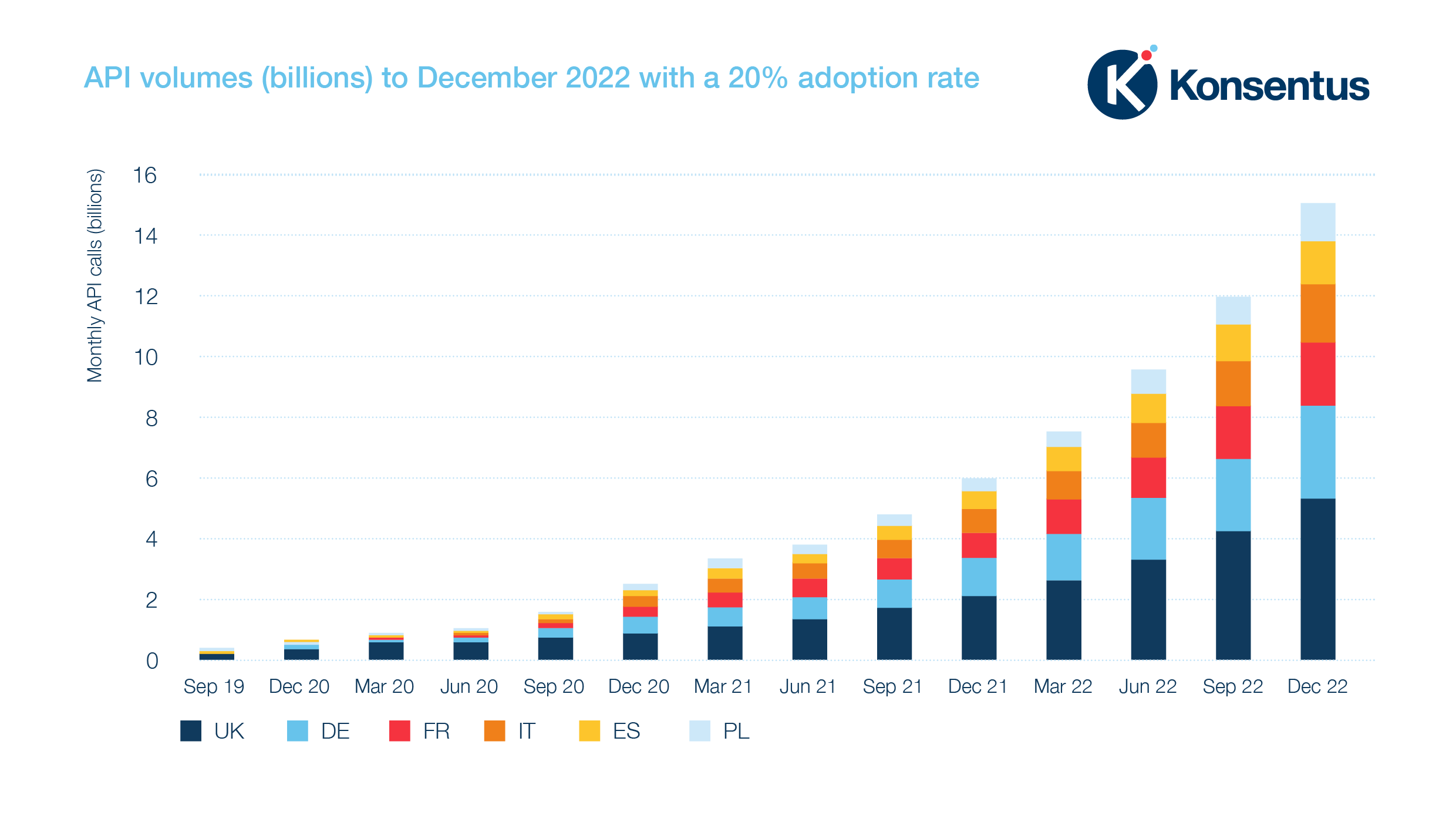

The graph above shows that if adoption rates are at the top end of our scenarios (20%), thirteen countries within the EEA can expect to see over 100m API calls per month by the end of 2021, with Germany and the UK both seeing over 1bn at this time, growing to 5.3bn and 3.1bn respectively by the end of the following year.

What are we experiencing today and what are future realistic numbers?

A year after the implementation of PSD2 open banking, we estimate that there are already 12 countries within the EEA that are experiencing monthly volumes in excess of 20m. The chart below shows these countries and their respective volumes.

Regardless of whether the open banking adoption rate reaches 5%, 10% or 20%, we are confident nearly all countries within the EEA will be experiencing millions of API calls every month by the end of 2022.

The global pandemic over the past six months has driven consumers on-line looking for the best products and services to manage their accounts and financial data – rather than finding these deals and offers on the high street, as they historically might have done. This sentiment is reinforced by the surge in new TPPs being approved for services – they can see that there’s a ready market. Surely with innovation fuelling usage, the rest of the EEA will follow the UK’s lead. The determining factor will be trust and confidence in open banking.

Mike Woods – CEO, Konsentus: “The move towards a digital economy could not be more evident than this quarter with 82 new TPPs being approved for services. We expect this growth trend to continue into Q3 when the number of TPPs across the EEA is expected to reach 417. This shows that PSD2 Open Banking is supporting a thriving appetite for new products and services.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: