Will Big Tech destroy Big Banks?

For years, I’ve said that Big Tech will crunch the periphery of finance – payments, cards, credit and such like – but will not try and dig into the core of deposit-taking banking because it’s too regulated and difficult. Instead, they are far more likely to partner with banks than do banking. That view still holds true, and yet the structure gets interesting when Apple partner with Goldman Sachs (now defunct) and Google with Citi (now defunct).

an article by Chris Skinner

Why are Big Tech partnerships with Big Banks failing? Because the two have very different perspectives. By way of example, years and years ago, we all predicted that telecommunications companies would acquire banks and vice versa. Hasn’t happened. Why? Because telcos focus upon the volume of data usage on their network and the bank focuses upon bps (basis points – the difference between debit and credit rates) on their network.

The focus is different.

Having said that, we are seeing the emergence of Big Tech financial services. It’s not banking, but it is eating a lot of what banks do. To explore this, here’s three key articles and reports that explain it:

Is Amazon Building Bank 4.0 and the Future of Finance? by Axisoft

Amazon Pay: Forging the Future of Finance

Amazon’s dedication to „customer obsession” propels its expansion beyond e-commerce, notably succeeding in financial services. Launched in 2007, Amazon Pay facilitates purchases on external merchant sites with Amazon accounts, prioritizing reduced payment friction and superior user experiences. The platform ensures safety, speed, and convenience, offering multi-currency support, payment protection, and zero transaction fees for users. Evolving into a comprehensive financial ecosystem, it now features digital wallets, one-click payments, and instalment plans. Beyond revenue diversification, Amazon’s embedded finance strategy solidifies its image as a reliable, user-friendly payment platform, boasting a 24% user share in the US. Amazon Pay, a pivotal diversification move, holds the key to future innovations in the embedded finance landscape.

Amazon Lending: Shaping the Future of Finance

Since its inception in 2011, Amazon Lending has steadfastly focused on facilitating financing access for U.S. small businesses, presenting a range of options such as term loans, business lines of credit, interest-only loans, and a cash advance program. In a significant move in November 2023, Amazon expanded its partnership to integrate Affirm as the first buy now/pay later option at checkout on Amazon Business (interestingly Apple has done the same). This integration enables small business owners to swiftly secure credit decisions by furnishing basic details like their registered business name and address. Offering customizable payment plans spanning three to 48 months and committed to transparent pricing, this endeavour aims to bolster more than 28 million U.S. sole proprietorships, elevating their purchasing capabilities, optimizing cash flow, and propelling growth. Providing loans allows Amazon to deepen its relationship with small businesses, creating a symbiotic connection where the success of these businesses contributes to Amazon’s overall growth.

Amazon One: Transforming the Future of Finance

Amazon One redefines retail experience with its free, contactless service. Positioned as a potential central ID system, it spans various domains, including payments, loyalty programs, age verification, and integration with health records and corporate IDs. Available at over 500 Whole Foods and Amazon Fresh locations, Amazon One transcends retail boundaries. Panera Bread has embraced this technology, enabling customers to access their MyPanera loyalty accounts and pay with a simple hand wave. Moreover, at Coors Field in Colorado, patrons use Amazon One to verify they are 21 or older when purchasing alcoholic beverages. Amazon One’s versatility extends across businesses, making it a diverse setting beyond traditional retail environments.

Amazon repeatedly innovates in embedded finance, addressing customers’ financial needs directly. Leveraging customer personalization through Amazon Prime and Personalize, the success of Amazon Pay and Amazon Lending is undeniable. As these elements seamlessly converge, Amazon stands on the brink of potentially becoming the world’s largest customer-centric retail bank through the full realization of its embedded financial platform, marking a transformative leap in the financial services landscape.

So Amazon is doing an awful lot of bank-like things, just not core deposit banking. What about Apple?

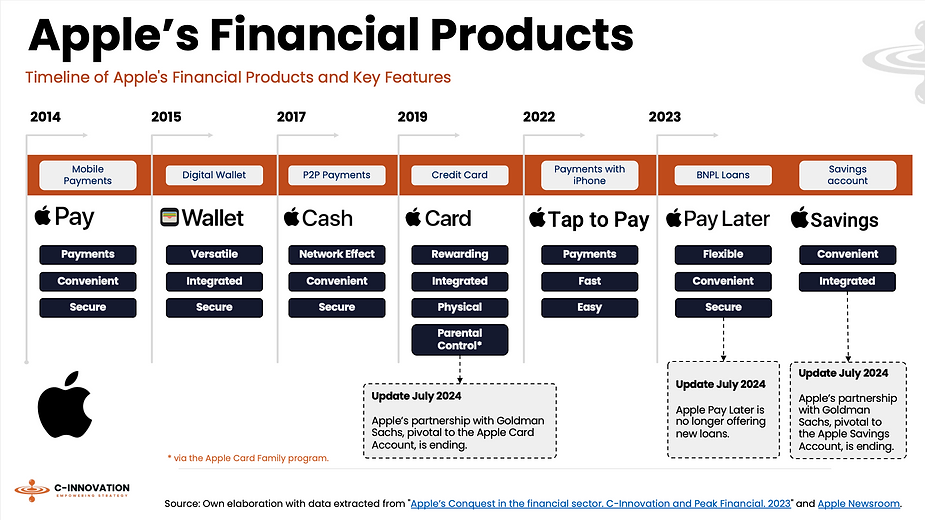

Well, Apple is also making big moves in the financial sector. They’re not just a tech giant anymore, they’ve becoming a fintech powerhouse, demonstrated by:

- A diverse suite of financial services, including Apple Pay, Apple Card, and Apple Savings.

- Strategic moves like ending the Goldman Sachs partnership and discontinuing Apple Pay Later, signalling a shift towards in-house financial services.

- Venturing into AI with Apple Intelligence, aiming to personalize user experiences through generative AI.

This is detailed in a new report by C-Innovation, who ask whether Apple is a tech company or a bank in disguise? A wolf in sheep’s clothing?

The report is well worth a download and concludes that Apple’s financial “experiments so far have been overwhelmingly successful, with many people open to using financial solutions from the company. According to the latest research, 68% of people would consider taking health insurance from Apple, while 62% and 59% are open to using a current account and a savings account, respectively.

“It’s a good omen that the latter (savings) has already been announced, and the others may come on board in time. The chance of success is increased by the fact that Apple’s brand is one of the strongest in the world. A large proportion of users feel a strong attachment to and trust in the company’s devices, which for many represent a prestige purchase. The company expects this feeling to sustain even in a new area such as finance.

“The current account is one of Apple’s most anticipated financial solutions. Low fees, high transparency, attractive interfaces and the simplification of complex financial transactions could make it highly marketable according to experts.

“Others point out that the company has the chance to disrupt habits on this front. Instead of dedicating a separate account to each financial service, it could entirely do away with the concept of accounts. This would entail the creation of a central financial control panel, where elements would be displayed according to users’ needs in a customizable way. Banks often overlook the fact that people do not like dealing with their finances and want to be done with them as soon as possible. Apple, on the other hand, is unlikely to make the same mistake.”

I am more sceptical about Apple opening a bank account, after their failed partnership with Goldman Sachs.

Meantime, Google has given up any banking ambitions. As CNBC reported a few years ago, Google said it will focus “primarily on delivering digital enablement for banks and other financial services providers rather than us serving as the provider of these services.”

And there is the rub.

On the one hand, Big Tech will provide services that make the consumer experience easier and better. Loans, BNPL, credit cards, contactless payments, etc. What they won’t offer is banking because full-service banking is hard. And then, on the other hand, Amazon and Google have a specific dilemma. If they targeted doing full-service banking, then they would be biting the hand that feeds them, as in full-service banks.

Amazon Web Services and Google Cloud have a massive stake in providing cloud computing services to Big Banks. Would they really want to screw that up?

Apple is different, as they’re not really a big cloud company, but Apple is 100% consumer focused and will do whatever they have to do to serve the customer. Does that mean they would ever want to offer a bank account? I don’t see why as, as of today, their focus is 100% focused on making payments easy and, most likely, that’s where they will stay.

So, for every mention of Big Tech replacing Big Banks, my answer would be … have you been smoking some weed mate?

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: