Why is Open Banking so scary?

an article written by Chris Skinner

The UK implemented Open Banking in January 2018 and now, almost two years later, you would think it’s doing really well.

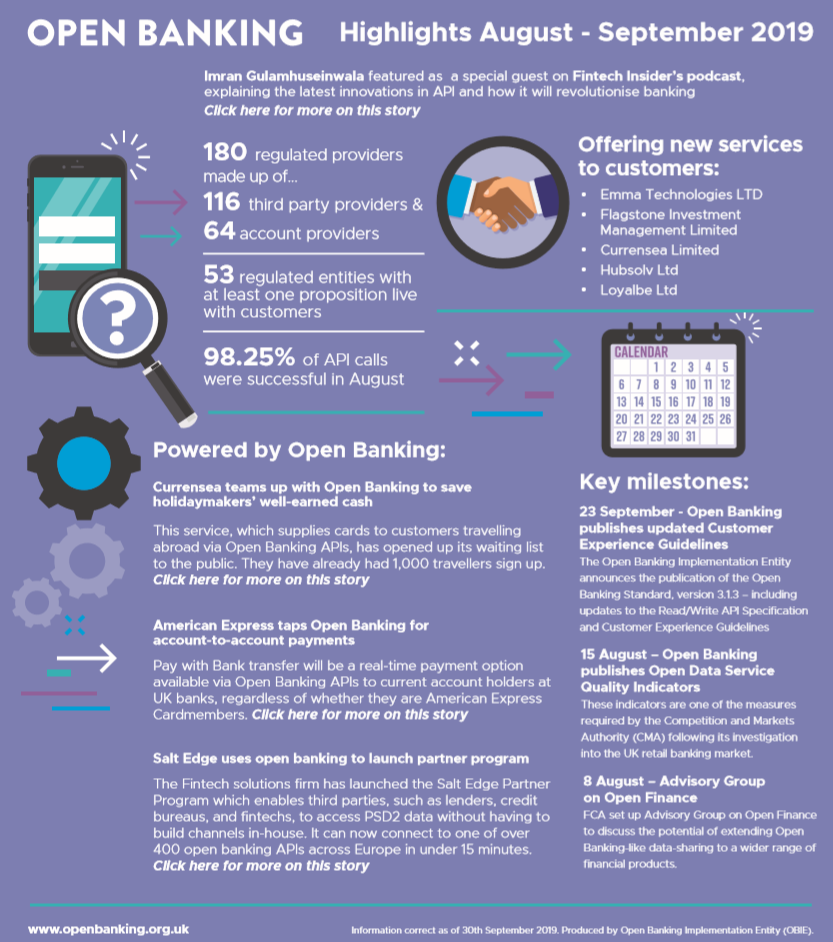

This is why the momentum is building. The Open Banking Implementation Entity (OBIE) shared figures that show there are 49 million data sharing requests monthly, doubling in just seven months and up from just 720,000 requests in May 2018. There are 180 regulated providers of APIs, up from 67 in 2018. These are made up of 116 Third Party Providers (44 the year before) and 64 deposit account providers (DAPs) (up from 23) in the United Kingdom.

What are they using it for? Well, one of the main uses is for credit checks. 40% of those data sharing requests https://www.experianplc.com/media/news/2019/demand-for-open-banking-ramps-up-as-experian-handles-20-million-requests-a-month/ flow through Experian and are used by landlords to check the credit of prospective tenants via firms like Credit Ladder https://www.innovatefinance.com/news/yes-consumers-are-engaging-with-open-banking-creditladder-reaches-100m-rent-reporting-milestone/ . There’s lots of other ways to use Open Banking though. For example, a new company called Currensea https://www.currensea.com/about-us/ lets users spend abroad from their UK bank accounts directly, but without transaction charges and at decent FX rates. It’s all through Open Banking APIs to access the bank from the card. Salt Edge https://www.saltedge.com/ allows FinTech firms, lenders, credit bureaus and more to access PSD2 data without having to build their own APIs to do it via their Unified Gateway. Even American Express is getting in on the act https://www.finextra.com/newsarticle/34453/american-express-taps-open-banking-for-account-to-account-payments . In September, AMEX launched a new checkout service called Pay with Bank Transfer, which allows UK users to pay online direct, account-to-account, even if they’re not an AMEX or credit card user. It pays direct from their bank account, quickly and easily instead.

In other words, there are many services being launched that are making finance and banking data interwoven into other services and processes without even necessarily having the client, customer, user aware of it.

This is one of the big areas where I’ve personally had an issue. For example, when Open Banking came into force, there was a mass of negative news in the media about how it would probably make bank accounts more vulnerable to hacking. That is obviously not the case – why would a regulator bring in a law that would make you more likely to lose money? – but it is the way it was reported. Equally, there is clear requirement that the customer must give permission for third parties to be able to access their data and banks made it pretty hard for customers to give that permission. The more difficult it is to do something, the less likely you are to do it, and so this move to make permissions difficult would ensure that Open Banking would not work.

These two factors are reinforced in many surveys: consumers are scared of ‘open’ banking. A survey in Spring 2019 https://www.simon-kucher.com/en-us/about/media-center/simon-kucher-partners-survey-examines-potential-open-banking-unlock-new-streams-revenues-banks by Simon-Kucher & Partners, a global strategy and marketing consulting firm, found that 75 percent of bank customers felt they were unlikely or very unlikely to allow their banks to share their account information, and 39 percent said they would re-think their online transactions when told that the product or service would access their bank account data. That’s not a great sales pitch.

It may not be a great sales pitch, but OBIE is addressing this. For example, an OBIE report https://www.openbanking.org.uk/wp-content/uploads/Consumer-Priorities-for-Open-Banking-report-June-2019.pdf released in June shows that Open Banking, if properly utilised, could unlock up to £18 billion a year for the British economy. £12 billion of that is for consumers, who could save costs and overheads through tailored services. According to the report, Open Banking will be particularly beneficial for those in financial distress, who could make savings of £287 per year using Open Banking. Maybe that’s why Open Banking is now being discussed in many other markets, with Australia being one of the first to copy the UK programme.

All in all, Open Banking has not been an easy roll. Initially misunderstood by consumers and resisted by banks, it was a slow burn to take off. Nevertheless, as those who get it, get it, the numbers have risen substantially – 49 million data shares a month is not insignificant by anyone’s count – but whilst that usage is mainly for business use and credit checks, consumers and the real world will remain in the dark about what Open Banking is and why they need it. That will only change as banks start educating customers in the needs and benefits of the service.

More about the author

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal’s Financial News. To learn more click here…

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: