Why fintechs are beating the banks in new checking accounts

A new study from Cornerstone Advisors, looking at the financial services providers that Americans opened checking accounts with in 2024, underscores the continued dominance of digital banks and fintechs like Chime, PayPal, and Square in the checking account market. The study found:

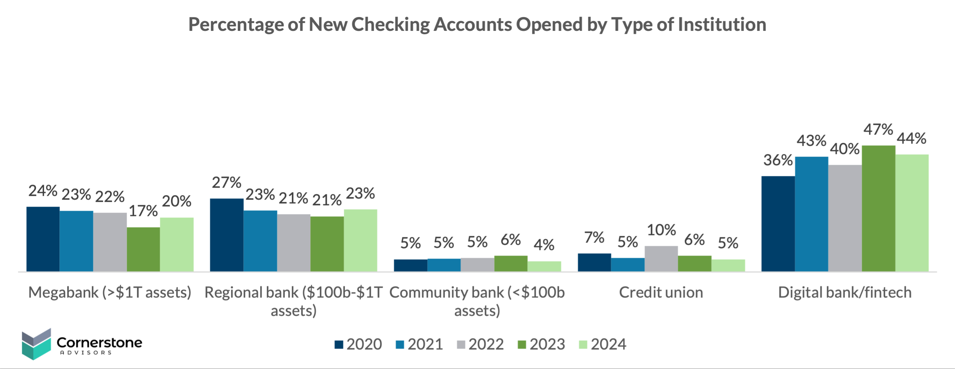

1️⃣ 𝗗𝗶𝗴𝗶𝘁𝗮𝗹 𝗯𝗮𝗻𝗸𝘀 𝗮𝗻𝗱 𝗳𝗶𝗻𝘁𝗲𝗰𝗵𝘀 𝗱𝗼𝗺𝗶𝗻𝗮𝘁𝗲 𝗻𝗲𝘄 𝗰𝗵𝗲𝗰𝗸𝗶𝗻𝗴 𝗮𝗰𝗰𝗼𝘂𝗻𝘁𝘀 𝗼𝗽𝗲𝗻𝗲𝗱…Digital banks and fintechs captured nearly half (44%) of all new checking accounts opened in 2024. Combined, megabanks (Bank of America, JPMorganChase, Citi, and Wells Fargo) and regional banks ($100 billion to $1 trillion in assets) accounted for 43% of all accounts opened.

2️⃣ …𝗮𝗹𝘁𝗵𝗼𝘂𝗴𝗵 𝘁𝗵𝗲𝗶𝗿 𝘀𝗵𝗮𝗿𝗲 𝘀𝗹𝗶𝗽𝗽𝗲𝗱 𝗳𝗿𝗼𝗺 𝟮𝟬𝟮𝟯. Digital banks’ and fintechs’ 44% market share was down from 47% in 2023, as megabanks gained back three points and regional banks won back two percentage points.

3️⃣ 𝗖𝗵𝗶𝗺𝗲 𝗮𝗻𝗱 𝗣𝗮𝘆𝗣𝗮𝗹 𝗱𝗼𝗺𝗶𝗻𝗮𝘁𝗲. Combined, the two companies accounted for nearly half (49%) of digital bank/fintech account openings—up from 43% in 2023—and 21% of all checking accounts opened in 2024.

4️⃣ 𝗪𝗶𝗻𝗻𝗲𝗿𝘀 𝗮𝗻𝗱 𝗹𝗼𝘀𝗲𝗿𝘀. PayPal, PNC, and Wells Fargo each grew their share of new accounts opened by two percentage points in 2024. Community banks’ share, however, declined by two percentage points, while TD saw its share drop by 2.5%. The biggest decline was turned in by a digital bank—Varo Bank—whose share of new accounts opened dropped 2.7%.

Half of the Americans who opened a checking account in 2024 have two or more checking accounts. They’re opening accounts to get a free or lower-fee account (from the one they already have), or simply to try out a new account. They’re not necessarily making their new account their primary account, however.

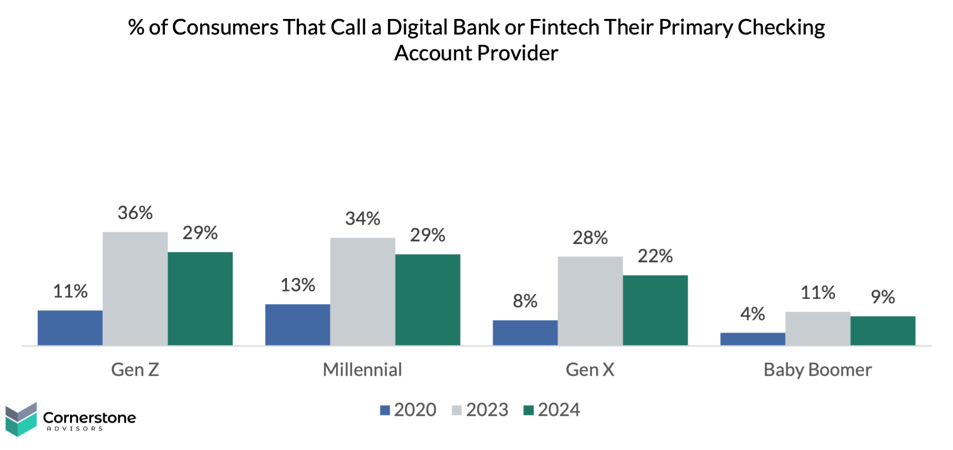

Last year, more than third of Gen Zers and Millennials, and nearly three in 10 Gen Xers, called a fintech or digital bank their primary checking account provider. Today, just 29% of Gen Zers and Millennials—and just 22% of Gen Xers—consider a fintech or digital bank to be their primary checking account provider.

More details in the latest Fintech Snark Tank post on Forbes, titled Why Fintechs Are Beating The Banks In New Checking Accounts, which addresses:

▶️ Why do digital banks and fintechs continue to dominate?

▶️ What did the big banks do to fight back in 2024?

▶️ What’s the looming primary problem facing fintechs?

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: