Why fintech upstarts have failed to unseat UK banks – Financial Times

Companies such as Monzo, Starling and Revolut have transformed digital banking but traditional lenders still dominate the market – an article written by Akila Quinio – Financial Times.

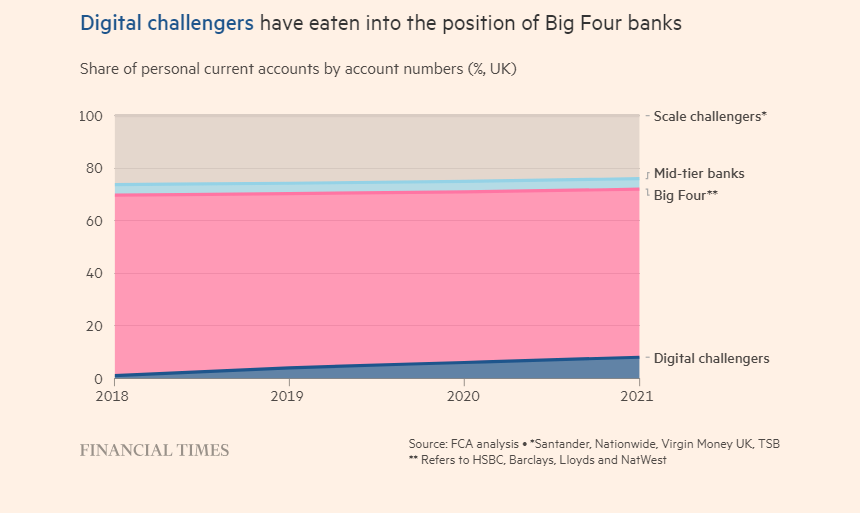

In a 2018 letter to new staff members, digital bank Monzo outlined a lofty series of ambitions. The company said it aimed “to do for personal finance what Facebook has done for keeping up with your friends, or Google for finding information”. The company, barely three years old at the time, also set a “long-term goal” of reaching a billion customers worldwide. Alongside a new cohort of challengers that also included Starling and Revolut, it was on a mission to usurp “legacy” banks, particularly the Big Four of HSBC, Barclays, Lloyds and NatWest that dominate the UK market.

A decade after these fintechs burst on to the scene, they have arguably succeeded in their mission of setting new standards for digital banking; features such as foreign currency transactions and bill-splitting, along with reliable, smartphone-friendly technology, are loved by younger customers.

“They have been amazing at challenging some of the norms in the industry,” says Tom Merry, a partner at consultancy Accenture.

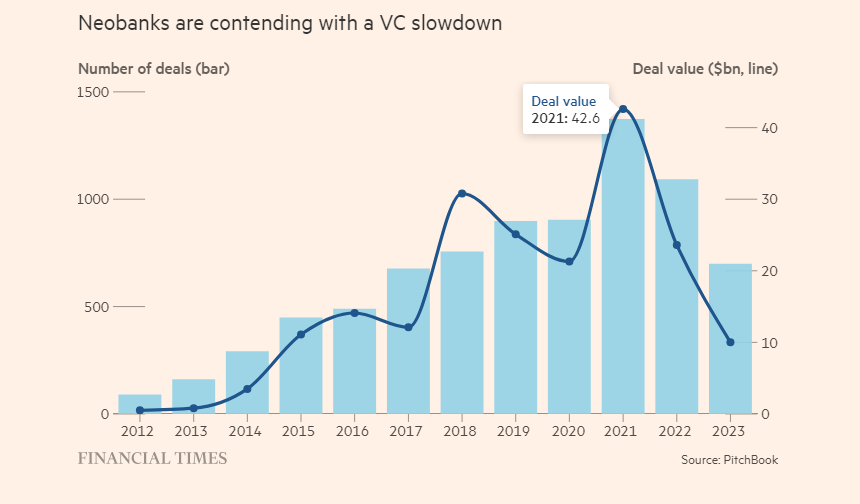

But they are now being tested in a downturn. The plentiful venture capital that financed their heady growth — globally, the sector attracted $102bn in investment in 2021 — is drying up. Yet they are still burning through cash to acquire new customers while higher interest rates are driving increased competition for consumer deposits.

Traditional high-street banks have raised their game by upgrading their own digital banking services, with the result that about 60 per cent of adults living in Britain now use a mobile banking app, up from 33 per cent in 2015, according to trade body UK Finance.

Critics say consumers are using neobanks as a convenient payment management service, rather than as a replacement for traditional current accounts. Investors in fintechs are increasingly scrutinising the neobanks’ differing business models and assets, looking for proof they can be durably profitable and attract sufficient deposits to fund lending. Their managers are working out alternative ways to generate revenue, including monetising data and licensing technology to others.

“Are neobanks an evolution or are they a revolution? They feel like an evolution,” says Tom Mendoza, fintech partner at EQT venture. “Many of them are good companies but they will not fundamentally disrupt the fabric of retail banking.”

Sir Ron Kalifa, who authored a government-commissioned review into the competitiveness of fintech in the UK, says collaboration between big banks and fintechs would benefit the industry as this would allow the latter to combine their tech and agility with the scale, customer bases and regulatory expertise of traditional banks. But others argue that the main beneficiaries of the investment that has poured into fintechs have been consumers.

“It’s silly to suggest that neobanks have materially challenged the hegemony of traditional institutions,” says Barkley. “Arguably, their only lasting impact is pushing big banks to improve their own digital platforms.”

Read the article in full here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: