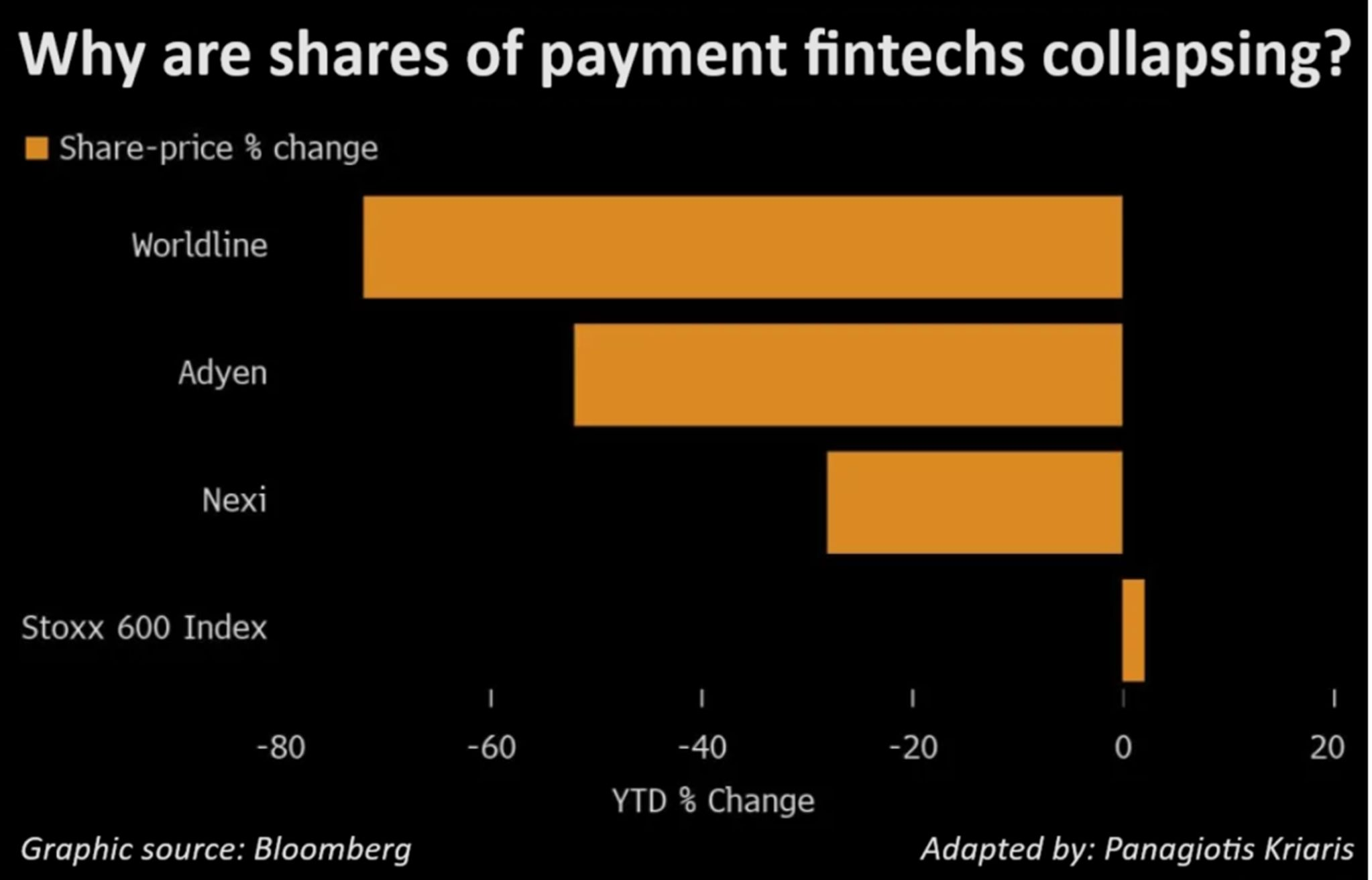

Why are shares of payment fintech collapsing? Is this a coincidence or is there a trend behind?

The sell-off of Worldline’s shares is a harsh reminder that the fintech landscape has changed dramatically. Not everyone has realized that. Let’s take a look.

an article written by Panagiotis Kriaris, who will give a keynote speech at the international conference Banking 4.0

Following a disappointing full-year guidance, Worldline shares fell on Wednesday by 58% with the impact and repercussions being felt across the industry: shares at Adyen, Nexi, Block and PayPal dropped too. Just the previous day shares of UK-based CAB Payments plunged by 72%, following again a revenue guidance.

Just a few months ago the shares of Adyen and PayPal had plunged after bad results.

What’s wrong with some of the biggest and most successful payment fintechs in Europe and globally?

Is this a coincidence or is there a trend behind?

Fintech players and especially the ones focusing on payments experienced a remarkable growth trajectory in the previous years, which was however driven – to a large extend – by macroeconomic conditions and external factors: record-low interest rates fueled for years easy growth and boosted valuations to exorbitant levels, whereas the pandemic forced people and businesses online overnight benefiting exactly such players.

The problem today is that all of this is gone:

– The pandemic business boost is history

– Interest rates are now record-high

– Growth business models have been replaced by sustainability and profitability targets, with the U-turn however proving difficult for many

– Consumers are holding back on consumption

– Next to an ongoing war in Ukraine, the attack on Israel is heating up the entire Middle East with repercussions potentially impacting oil prices

– Germany, Europe’s biggest economy, is practically in a recession, which is bad news for players like Worldline with a strong European exposure. Investors are now looking at the EU exposure of major players and how this may affect their results (i.e. PayPal has a relatively high European exposure – around 1/5 of revenues in 2022). US is for now in a better shape, but high borrowing costs pose a threat to the economy with chances for a recession increasing.

The above notwithstanding the most important factor driving this situation is that investing can be sometimes a zero-sum game. Let me explain: record-high interest rates may be bad for business for fintechs (they increase consumer defaults, curtail funding and bring down valuations), but they are the exact opposite for banks. Look at the performance of banks globally, and you will notice soaring profits. Why? Net interest margins are sky-high. They just sit and make easy money.

And of course, investors are taking notice. Suddenly, the traditional banking business model has become attractive again. Not for everybody and especially for the long-term (many banks’ profits are not sustainable without transformation), but for now it seems like a good alternative, vis-à-vis fintech business models not geared (and unprepared) for a slowing economy.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: