As of October 2023, there were 5.3 billion Internet users – amounting to around 66% of the world’s population. Increasingly, consumers are choosing to interact, shop, and engage with their primary service providers online, and banks are no exception. The growth of web and mobile as primary delivery channels is pushing the banking sector to modernize customer experiences in line with fintechs’. Correspondingly, there has been a notable drop in the global population of “unbanked consumers” (individuals without a formal account at a financial institution or with a mobile money provider). A 2021 survey by the US Census Bureau reports that the percentage of unbanked households has declined to 4.5%, its lowest level since the survey began in 2009.

The digital transformation doesn’t stop at the user experience; banks are overhauling virtually every aspect of their technological strategy to comply with emerging regulations, cyber threats, and macroeconomic shifts. New technology standards beg the need for partners adept at navigating the digital landscape– for banks, partnering with fintechs will be key to staying ahead of the technological curve.

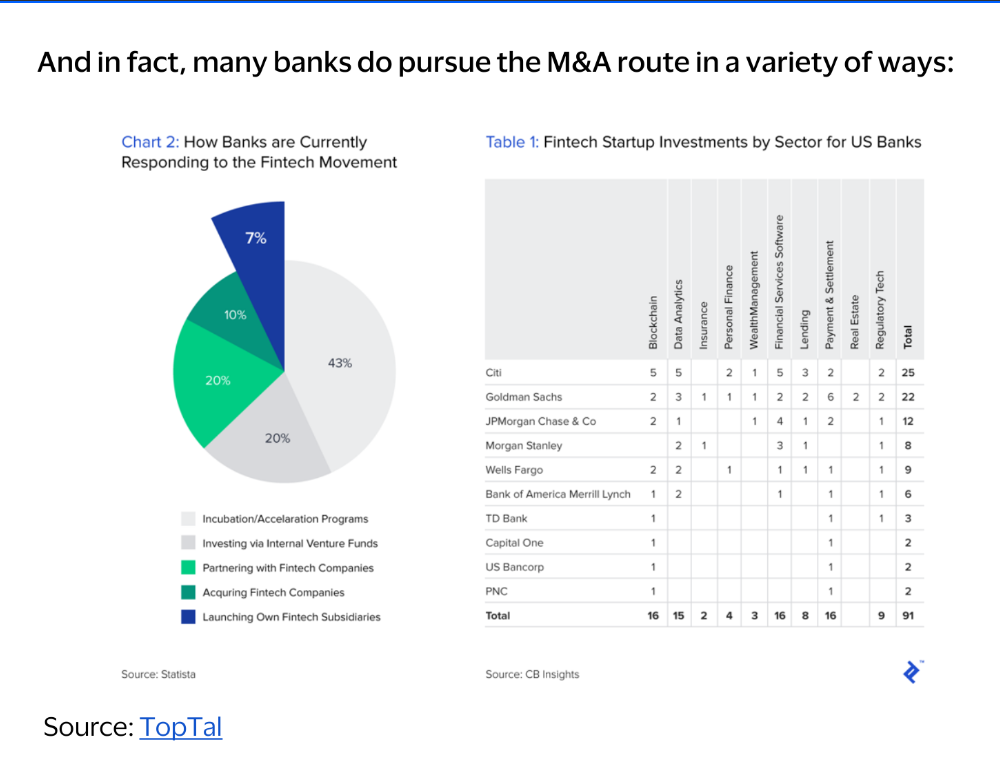

Whereas fintechs have been in longstanding competition with the banking sector, evolving market conditions are increasingly driving banks to forge mutually beneficial alliances with fintechs. Partnerships between banks and fintechs take many forms, not least M&A; JP Morgan Chase (the largest bank in the world by market capitalization) has acquired over 30 fintechs since 2021, underscoring the potential for banks to pursue M&A in upgrading in-house technological capabilities. Many banks and fintechs are also working to jointly offer products– HSBC’s partnership with Tradeshift to deliver a working capital solution, Cross River’s with Revolut in personal credit, and Citi’s with Intrafi to facilitate deposit sweeps are a few such examples.

Bank-fintech partnerships are unlocking capabilities historically unseen in commercial banking. Algorithmic decisioning is enabling real-time decisioning on credit and account opening applications; modern fraud and risk management tools are curbing banks’ fraud losses; personalized banking experiences enhance customer experiences and further upsell opportunities; bleeding-edge technologies like cryptocurrencies or artificial intelligence are fundamentally shifting how the banking sector does business.

In spite of these advancements, banks and fintechs both face headwinds that will continue to shape their relationship over the coming decade. In the context of ever-changing market conditions, what does the next decade look like for bank-fintech partnerships? How can 1 + 1 really equal 3 when it comes to “coopetition” between these historically unaligned players?

More details here: What lies ahead for bank and fintech partnerships?

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: