What does MiCA look like in practice?

an article written by Elizaveta Palaznik

In a year from now, the Markets in Crypto-Assets Regulation (MiCA) enters into application for businesses offering crypto-related services and in 6 months for some categories of token offerors. It means that in order to continue to offer these services to European citizens, those businesses will have to apply for the MiCA authorisation in a chosen EU jurisdiction starting from Dec 30st. 2024.

It should be noted that financial institutions are not required to apply for this authorisation, they are “only” mandated to establish and adhere to compliance requirements specific for them.

One thing for sure is that during the last year we have talked a lot about MiCA, from its requirements to its Regulatory Technical Standards (RTSs) and its timeline.

But what does it mean in practice?

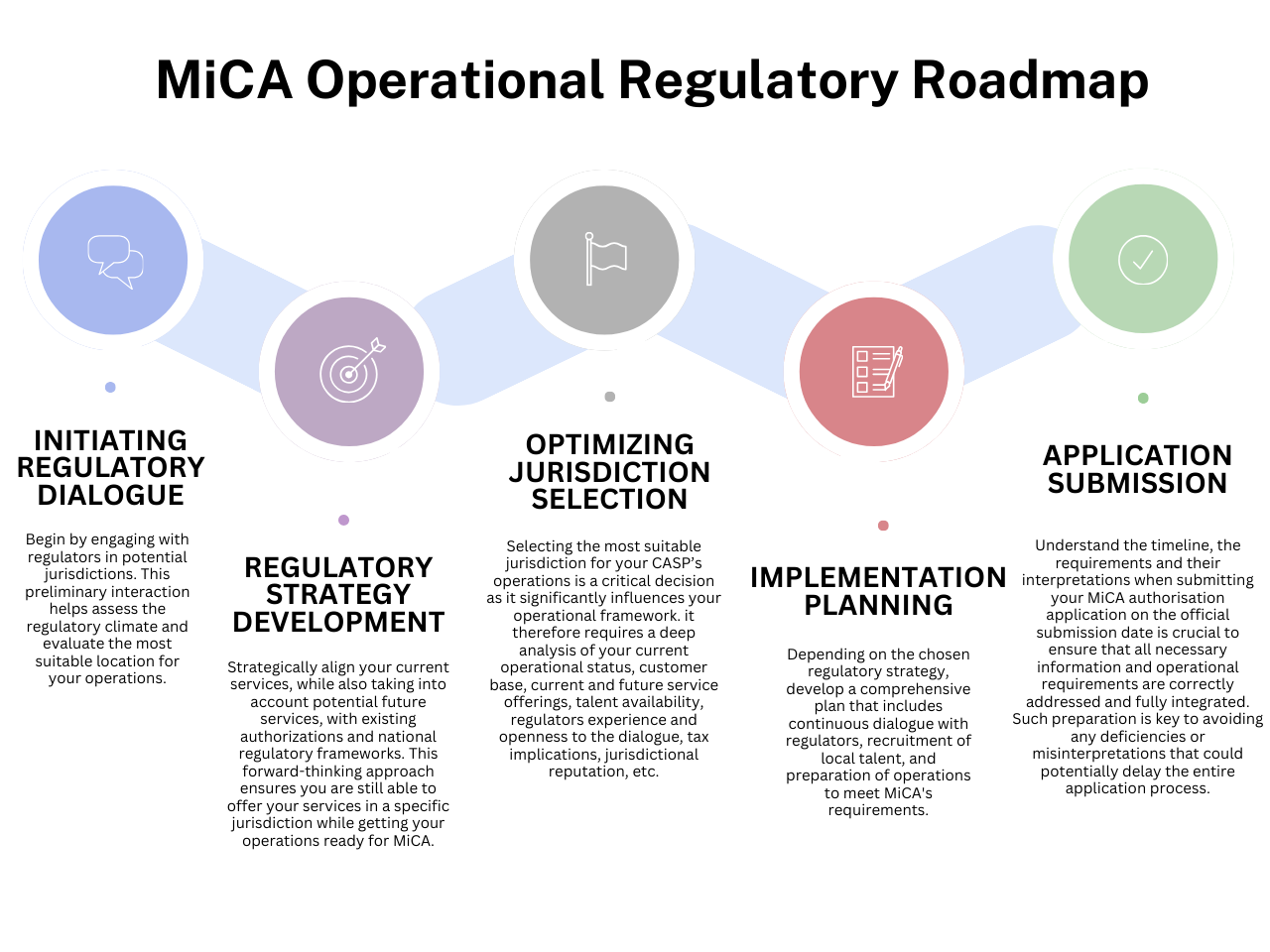

In this article, I suggest a practical regulatory roadmap based on ESMA’s guidelines, discussion with regulators, supplemented with expert insights and of course my own practical experience. For CASPs, to effectively get ready for this new regulatory environment, a strategic and well-planned approach is crucial for the upcoming year. It becomes even more imperative now that we see few jurisdictions either removing or reducing the initially allowed grand fathering period (= transitional period) such as Lithuania.

ESMA recommends shortening the duration of the grandfathering provision.

Indeed, on October 17th, ESMA released a letter inviting the Member State to consider reducing the duration of the grand- fathering clause from 18 to a maximum of 12 months due to the higher risk clients could face applying to theoretically, according to ESMA, to more than 2000 entities currently registered under these national regimes. Additionally, Member States are invited to notify their approach to this grand-fathering clause to the European Commission and ESMA long before 30 June 2024.

Going back to the practical aspect of MiCA. The goal of the steps I am about to share is for CASPs to ensure compliance, maintain client trust, and strategically position themselves in the evolving world of digital assets.

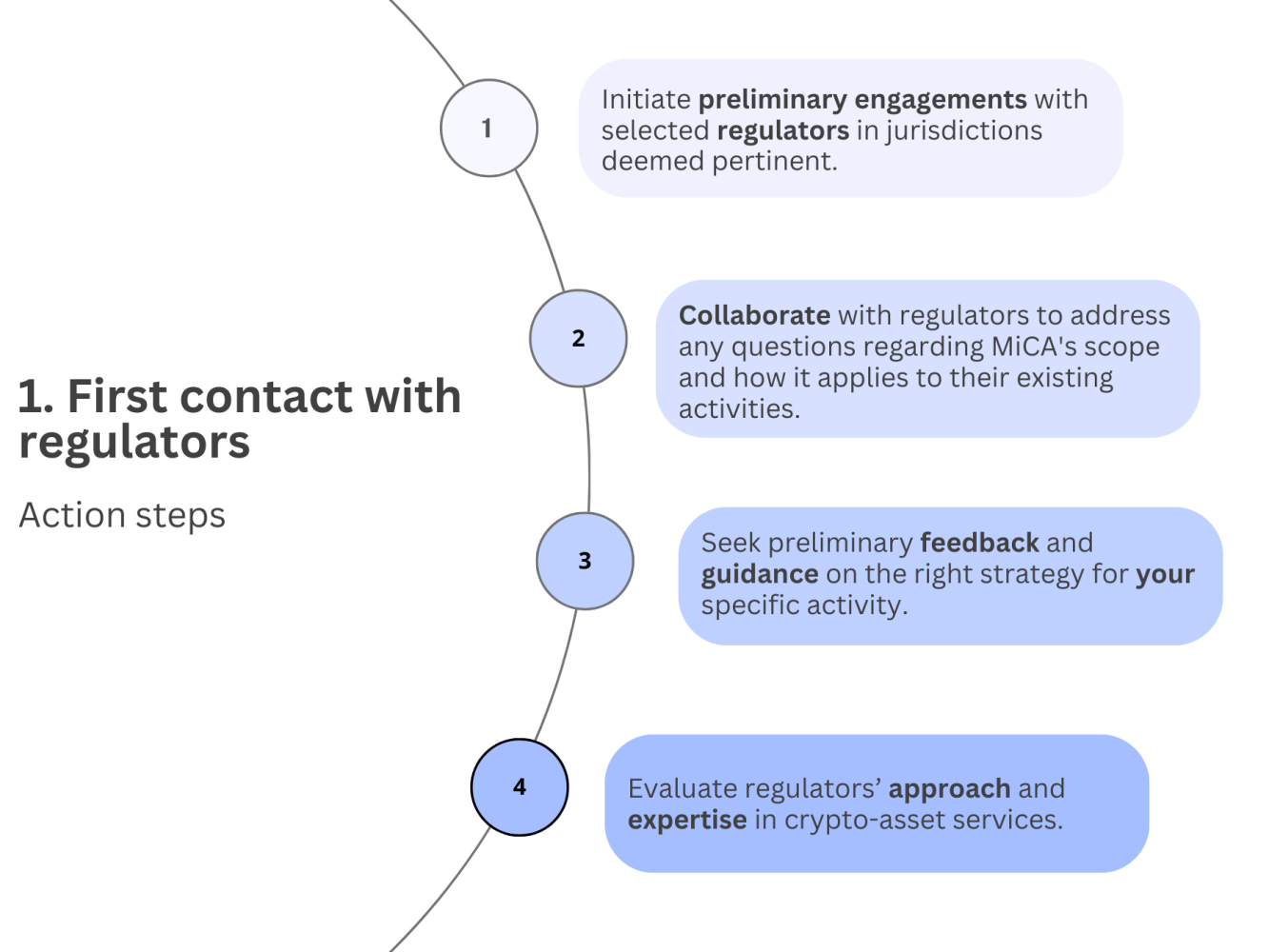

Before deciding the right jurisdiction and the regulatory road you would like to take, to gain an idea if a jurisdiction makes sense for your business, you might want to initiate contacts with different regulators to have an understanding of how the licensing journey look like, how knowledgeable, experienced and open to dialogue they are.

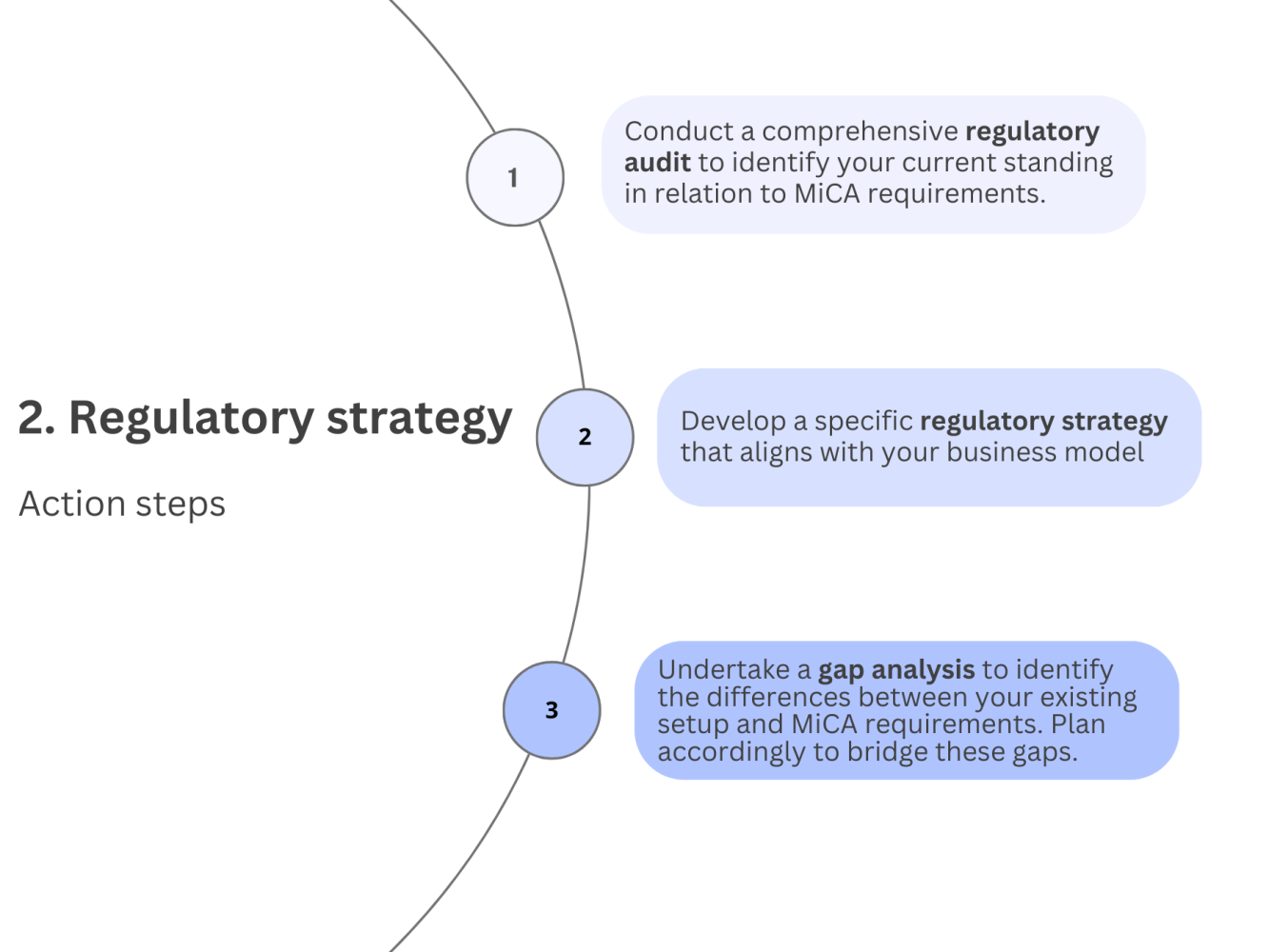

As you prepare for the upcoming MiCA regulation, it’s essential to consider how your current and planned services align with existing authorisations and national regulations.

Depending on these factors, your approach in 2024 could take several distinct forms:

Combining national VASP with MiCA preparation: If your operations are already active, consider securing a national Virtual Asset Service Provider (VASP) license as an initial step. This move allows you to continue offering services before MiCA enters into application in December 2024. Concurrently, adapt and align your operational model with MiCA standards, gearing up for MiCA authorisation as soon as it becomes available on December the 30st, 2024.

Direct focus on MiCA Compliance: For those planning to only initiate crypto-related services in 2024, a strategic focus should be placed on preparing exclusively for MiCA. This path involves gearing up for a direct application for MiCA authorisation at the end of 2024.

Considering MiFID overlap: Assess whether your existing or prospective services, including the types of tokens you intend to issue, might intersect with other financial regulatory frameworks, such as the Markets in Financial Instruments Directive (MiFID). Note that the qualification of crypto-assets as financial instruments are part of the Q1 2024 RTS agenda.

Leveraging existing authorisations: Evaluate the potential benefits of your current authorisations. Determine if and how they can be effectively utilized or adapted under the upcoming MiCA framework.

More details here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: