an article published by hernaes.com

This weekend Apple acquired mobile payment company Mobeewave, a Canadian-based startup that allows merchants to use their smartphone as payment terminals without any external accessories. What will this mean for banks and the payment industry?

This acquisition follows several moves that show that Apple has its eyes set on the payment industry. Ever since the launch of Apple Pay back in 2014, Apple has continued their push towards the mobile payment market by safeguarding NFC access on their smartphones as well as P2P payments and launching an Apple-branded credit card to compensate for slow adoption rates of mobile payments. However, the market for mobile payments is estimated to amount to 3,4 trillion USD by 2022, with a compound annual growth rate of 33.4 percent, it is worthwhile to be patient. With this acquisition, Apple is placing another long term bet on payments.

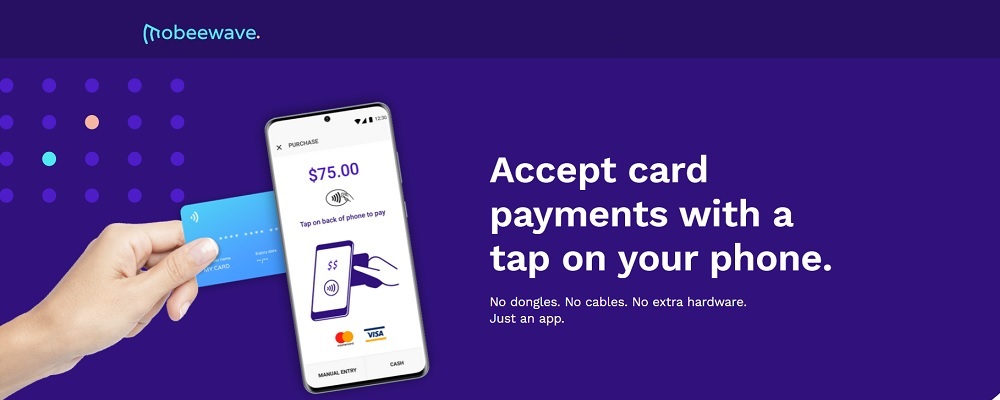

Bloomberg was first in spotting the $100 million acquisition and reports that this acquisition puts Apple in direct competition with Square, a provider of smartphone-enabled POS terminals for small businesses. By allowing the smartphone, itself to become a payment terminal, Apple effectively eliminates the need for external peripherals such as the ones provided by Square and iZettle, and lets buyers tap either their phone or credit card directly on the merchant’s phone to process the payment. You can see how it works on Mobeewave’s website.

Apple is not the only one who has shown interest in Mobeewave’s technology, and according to Pitchbook, Samsung Ventures has previously invested in the company, as well as signing a deal to allow their phones to use the technology. According to PYMNTS, this partnership resulted in a pilot program with over 10,000 downloads of Samsung’s POS app, which smaller businesses used as a boost for their sales.

Whether or not this deal will still be on the table following the acquisition is not disclosed in the press release, but it will be in my opinion in Apple’s interest to let this deal continue, as a large installed base will ultimately be positive for Apple.

Looking beyond the obvious that this will increase competition in the POS market, this acquisition has several potential implications for the payment industry and the incumbents in the industry such as banks, credit card schemes, and payment processors.

With the ability to serve merchants in physical retail, Apple strengthens its ecosystem and thus takes one step further towards mobile wallet dominance. This is a subject I have covered previously and may lead to disintermediation of the customer interface, allowing Apple to act as a gatekeeper for potential cross-sales through every banking interactions. This scenario may be a costly outcome for incumbents. Looking at how other industries like the hospitality industry where players like Expedia take commissions between 10 to 15 percent have been disintermediated; there is likely a willingness to pay to be the default payment option if third-party wallets become dominant players for digital payments.

Even if Apple should become dominant in the customer interface, Apple is still depending on VISA/Mastercard or local schemes such as Interac to act as the rails for payments, to process payments through Apple Pay. Thus acting as a frenemy of incumbents with a mutual dependency, where revenues are still distributed between existing players (after Apple gets their share of course) through interchange fees.

However, if Apple succeeds in widespread adoption on both the consumer and merchant side, they could in theory bypass traditional payment schemes and banking infrastructure, and process their own payments. This will not only have an impact on scheme providers such as Visa/Mastercard but also banks that get a portion of their transactional revenues from interchange fees every time a card payment is processed. The European Commission reports that on average (although this varies across member states), revenue from payments is estimated at about 25 percent of total bank revenue, and interchange fees play a significant part in the revenue pool.

According to ECB, the total interchange fee paid by acquirers to issuers for consumer card transactions within the EU was about EUR 7,800 million, and even after the effect of the IFR market cap, where interchange fees decreased by EUR 2,700 million the revenue pool for interchange fees is still significant. One interesting finding from the study is that while Issuers have lost revenue of EUR 2,950 million per year. Acquirers, instead, have gained revenue of EUR 1,200 million coming from lower interchange fees. Not surprisingly this is the part of the value chain that Apple targets through their newly acquired POS capabilities.

The timing is also impeccable in the midst of the ongoing pandemic, where many small merchants stray away from cash as their primary means of payments. The use of cash is already on the decline, but will likely accelerate as people fear that cash may act as people far that banknotes may spread the disease and many stores encourage customers to use cards or mobile payments. According to Nets, contactless adoption rates in the Nordics are increasing at a never before seen rate. Mobile payments in physical retail have proven to be a slow train coming so far, but the option to authenticate a payment on your own phone rather than handling a potential germy PIN-pad may be the spark that accelerates mobile payments.

Lastly, going back to the Square comparison one should not mistake Square for a mere provider of easy to use and cheap POS-hardware. The real value of Square lies in its unique positioning in its customer value chain. By placing themselves in the midst of their customer’s income stream, Square is able to leverage this position to provide small business loans. Through square cash, merchants will receive a loan offer based on their card sales, and the ability to repay it automatically with a percentage of their daily card sales through Square.

To strengthen this offering, Square received the nod by federal and state regulators to open a bank in Utah. The company will be able to use this opportunity to boost Square Capital to achieve increased flexibility in its small business lending program. That means Square will soon be able to originate commercial loans to merchants that process card transactions through its payments system.

It remains to see how far Apple will venture into this territory, but a glance at how Square is redefining everyday banking services through their ecosystem, combined with the ability to bypass existing infrastructure by closing the loop on payment processing and strengthened position as a mobile wallet provider shows the potential implications for incumbents.

###

Interchange fees are transaction fees that the merchant’s bank account must pay whenever a customer uses a credit/debit card to make a purchase from their store. The fees are paid to the card-issuing bank to cover handling costs, fraud and bad debt costs and the risk involved in approving the payment. Source: Bigcommerce

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: