Web3 entertainment on an internet scale. Age of Zalmoxis is one of the most exciting gaming projects in the Elrond ecosystem. The studio that creates the game comes to Banking 4.0.

Web3 technologies are set to open new horizons for gaming. They will unlock value created within the confines of each product. Players will be able to truly own their assets and achievements, and use them across the vast space of interoperable environments orchestrated by blockchain technology.

For these spaces to finally fuse into what will be collectively known as The Metaverse, the underlying blockchain networks will have to be truly scalable and interoperable. It is therefore no surprise that several projects are thinking at their long term place in the Metaverse, and start building with internet-scale blockchain tech.

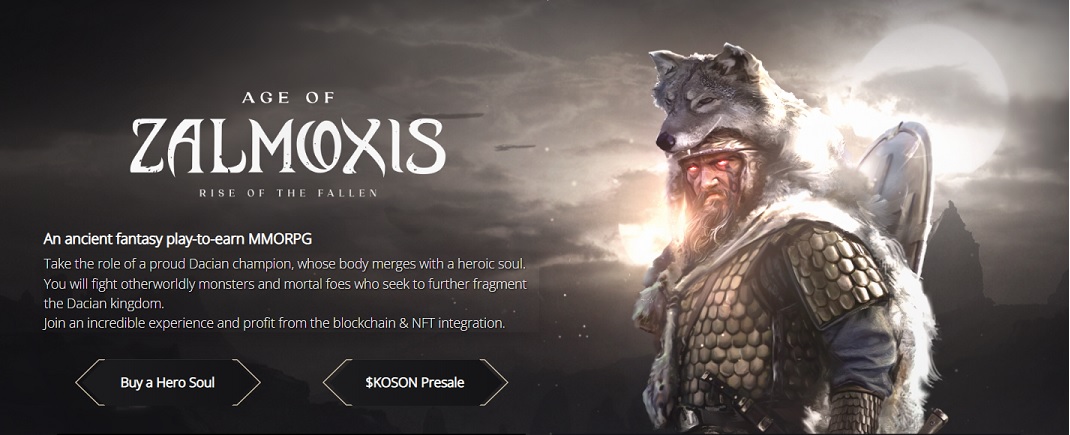

Age of Zalmoxis is one of the most exciting gaming projects that are starting to emerge in the Elrond ecosystem. The game is a third person multiplayer action RPG with NFT and Blockchain integration taking place in an ancient fantasy version of the Dacian kingdom, grounded in history, where threats from other realms converge.

Age Of Zalmoxis is being developed by Wenmoon Studios Ltd. which is a new generation game studio founded in 2021. The company will be represented at Banking 4.0 by Emilian Burcea, Technical Director.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: