Walmart launches mobile money sending platform

Money receivers do not need a Bluebird Account; rather, they can simply pick up their funds at any 11,593 Walmart store within minutes of the online transfer.

Three years ago, Walmart introduced its money transfer service, Walmart2Walmart Powered by Ria, with the goal of bringing customers dramatically lower costs and a simpler money transfer experience. Since that time, „Walmart’s customers have enjoyed nearly half a billion dollars in fee savings through using this service, putting more hard-earned money back into their pockets”, the company says.

Today, Walmart – together with Ria Money Transfer and American Express – announced further improvements to the service. Despite already offering some of the industry’s lowest prices on money transfers, Walmart is slashing prices again on its Walmart2Walmart money transfer service.

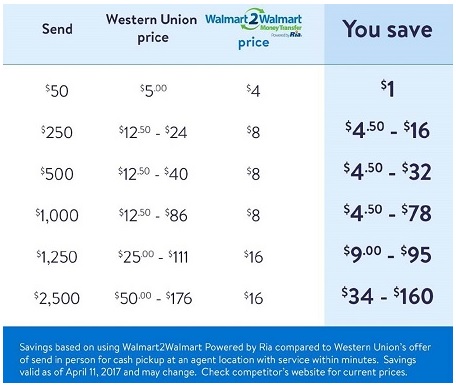

„The new fees, available beginning today, allow customers to save 20 to 90 percent on cash transfers versus the leading competitor.”, according to the press release.

Walmart2Walmart offers transparent national pricing in all Walmart stores, as opposed to other leading competitors, who often vary prices location by location (price does not include state taxes).

Easy Mobile Money Transfers via Bluebird

Also, beginning in May, Walmart and American Express will introduce the Bluebird2Walmart Money Transfer Service (provided by Ria), which allows accountholders of Bluebird – a checking and debit alternative – to digitally send money for cash pickup at Walmart store locations.

Pickup is available in all 50 United States and Puerto Rico. The daily money transfer limit is $2,500 across all of your Bluebird Accounts, and a per-transaction limit of $499.99 applies to money transfers picked up in Arizona. A fee of $4 for each money transfer up to $50, $8 for each money transfer of $50.01- $1,000, and $16 for each money transfer of $1,000.01-$2,500 applies.

Accountholders can access the new service by visiting Bluebird.com or by using the Bluebird app on their smartphone. Money receivers do not need a Bluebird Account; rather, they can simply pick up their funds at any Walmart store within minutes of the online transfer. Pricing is consistent with the new Walmart2Walmart prices.

“We are extremely proud of the significant savings our customers have enjoyed in the three years since Walmart2Walmart was introduced. For the millions of customers who rely upon transferring money to help family and friends – whether regularly or in times of urgent need – we know saving money on costly fees can make a big difference,” said Kirsty Ward, vice president, Walmart Services. “Now, with even lower fees for Walmart2Walmart, as well as the option to send money digitally with Bluebird, we continue to deliver on our mission to save customers’ money, as well as time.”

Earlier this year, Walmart announced enhancements to the Walmart app to create a faster, easier and more convenient experience for money transfer customers. The new capabilities, which began rolling out to Walmart stores in March, enable app users to use a designated express lane in stores.

Money transfer services are just one of many financial services offered at local Walmart MoneyCenters and Walmart Customer Service desks. Other services include check cashing, bill pay, money orders, tax preparation services and pre-paid card programs, as well as Walmart.com Pay with Cash.

Each week, nearly 260 million customers and members visit 11,593 Wall-Mart stores under 63 banners in 28 countries and e-commerce websites in 11 countries. With fiscal year 2016 revenue of $482.1 billion, Walmart employs approximately 2.4 million associates worldwide.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: