Wall Street Journal: The crypto party is over

“The reality is that like stock, with crypto, everyone is a genius in a bull market,” said Mark Cuban, who became a billionaire during the dot-com boom in the ’90s and has more recently invested in a number of crypto projects. “Now that prices are falling for both, those companies that were unnaturally sustained by easy money will go away.”

On Super Bowl Sunday, a Crypto.com ad featuring billionaire NBA star LeBron James lit up millions of Americans’ TVs. “If you want to make history, you gotta call your own shots,” Mr. James said in the 30-second spot for the popular cryptocurrency-trading platform. The words that splashed across the screen as the commercial ended read “Fortune favors the brave.”

Last week, Crypto.com laid off 5% of its workforce as its chief executive officer said on Twitter that the company was making “difficult and necessary decisions.”

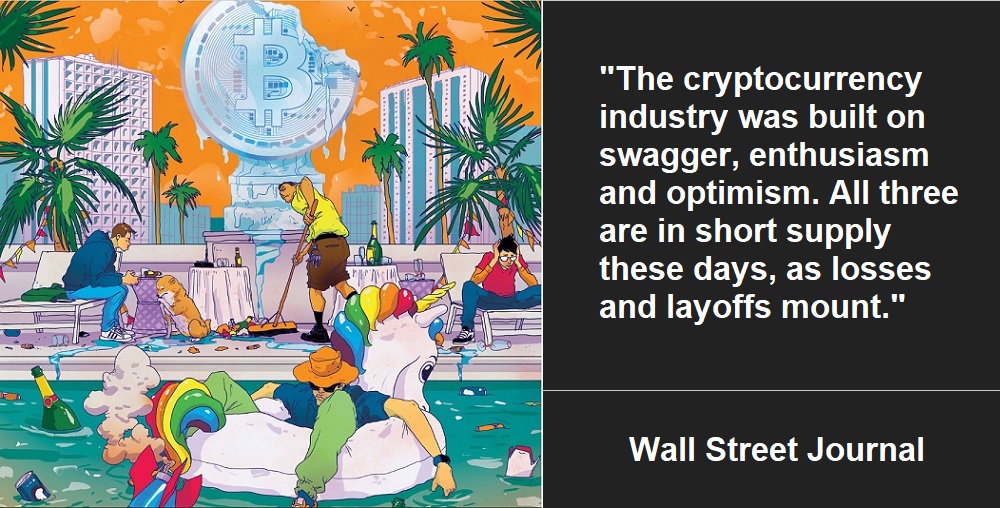

The cryptocurrency industry was built in part on swagger, enthusiasm and optimism. Bitcoin backers’ rallying cry to rebuff skeptics was, “Have fun staying poor.” Those who didn’t buy in were letting the future pass them by.

At times, crypto has looked like a combination of Beanie Babies, dot-com stocks and the Velvet Underground: It is manic, it is money, and all the cool people are into it. It has also shared characteristics with other bubbles throughout history, marked by speculation bordering on delusion, disregard and disrespect for risk, and greed.

Now, with markets sliding and inflation plaguing the global economy, cryptocurrencies have been among the first assets sold. Since bitcoin hit an all-time high in November, roughly $2 trillion of cryptocurrency value—more than two-thirds of all the crypto that existed—has been erased. Bitcoin itself has plunged to $21,206, roughly 69% off its all-time high of $67,802.30. Crypto exchanges are bleeding users, crypto companies are laying off workers with at least one contemplating restructuring.

The crypto world is no stranger to booms and busts, which many in the industry refer to as “winters.” But many investors and workers are feeling this crypto crash more acutely than previous ones. When the dust settles, some crypto products and companies may no longer exist.

“The reality is that like stock, with crypto, everyone is a genius in a bull market,” said Mark Cuban, who became a billionaire during the dot-com boom in the ’90s and has more recently invested in a number of crypto projects. “Now that prices are falling for both, those companies that were unnaturally sustained by easy money will go away.”

“There was absolutely a lot of hubris across a lot of asset classes. That led to a lot of greed and unsustainable business models and a lot of leverage in crypto. That’s collapsing now,” said Alex Thorn, head of firmwide research at Galaxy Digital Holdings Ltd, a crypto-focused financial-services firm. “A large number of crypto funds will not survive this.”

Many don’t appreciate the degree to which the sector’s growth has been aided by a long-running bull market in stocks and the market-juicing policies of the world’s central banks, said Joel Kruger, a strategist at asset exchange LMAX Digital. It was the very system crypto sought to replace.

“The irony of it all is the easy-money conditions since the 2008 crisis have lent themselves to the greatest period of risk-taking we’ve ever seen,” Mr. Kruger said. “That benefited cryptocurrencies.”

Access the full article here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: