Wall Street Journal: Apple talks to banks about P2P mobile payments service

Apple is in talks with some of America’s biggest banks about launching a Venmo-style mobile person-to-person payments service, according to the Wall Street Journal. Citing sources, the Journal says that Apple has discussed the issue with JPMorgan Chase, Capital One, Wells Fargo and US Bank but that it is „unclear” whether agreements have been reached.

The service, which could launch next year, would see users able to send money from their bank checking accounts to recipients via Apple devices. Technical details are unknown but Apple could simply link up to the bank-owned clearXchange platform and integrate with its Apple Pay offering.

Under the discussions, Apple wouldn’t charge the banks for participating in its person-to-person payment service, said the person familiar with the talks. That is different from Apple Pay in which the banks pay Apple for each transaction.

Watch this video for more details:

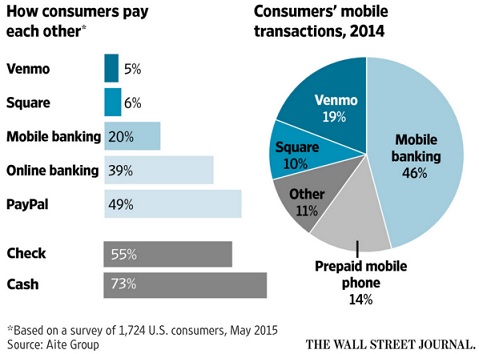

With young Americans increasingly turning away from cash and cheques, the P2P payments market is seen as a huge, fast-growing market. Venmo, the service acquired by PayPal when it bought Braintree in 2013, has established itself as the market leader, but other tech giants, including Google, Facebook and Square are all competing.

“The winner may be the place where people are already spending their time,” said Patrick Moorhead, principal analyst at Moor Insights & Strategy.

Speaking on Wednesday at Trinity College in Dublin, Apple Chief Executive Tim Cook said that digital-payments systems like Apple Pay will become so pervasive in the future that “your kids will not know what” cash is.

Most people prefer to pay each other using traditional methods. Fewer than one in five North Americans use their mobile phones to make at least one payment a week, according to a report issued last month by consulting firm Accenture.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: