Visa study: Romania is in top 7 European countries with the highest proportion of mobile payments users

According to Visa’s 2016 Digital Payments Study, the number of consumers regularly using a mobile device – whether a smartphone, tablet or wearable – to make payments has tripled in the past year. Currently, 54% of consumers surveyed regularly use a mobile device to make payments for a range of activities, compared to just 18% who were asked whether they used mobile payments to pay for everyday goods and services when the same study was conducted last year.

The study, which surveyed more than 36,000 online consumers in 19 European countries, reveals how consumer adoption of digital payments has shifted dramatically in the last 12 months. One year ago, 38% of the people surveyed said they had never used a mobile device to make payments and had no plans to do so. Today, that number has dropped to 12%.

Who are they and what are they buying?

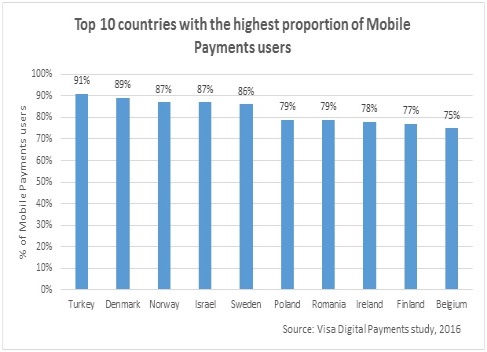

When looking at the top ten countries where mobile payments are most prevalent, they fall into two categories: developing markets such as Turkey and Romania, which have been leapfrogging traditional payment methods to adopt new technologies faster; and developed markets – particularly the Nordics – which are evolving to new technologies at differing paces. In the UK, nearly three-quarters (74%) of the people surveyed are Mobile Payments users. More than half of these users use their device to transfer money to friends and family (59%) and just under half use it to buy take-away meals (45%).

Interestingly, Mobile Payments users also say that they are as comfortable making more expensive purchases on mobile devices as they are with everyday payments. In the UK, over two-fifths (43%) purchase high-value items such as holidays and electronics on a mobile device as well as regular transactions such as paying household bills (42%) and buying bus or train tickets (41%).

Mobile Banking on the rise

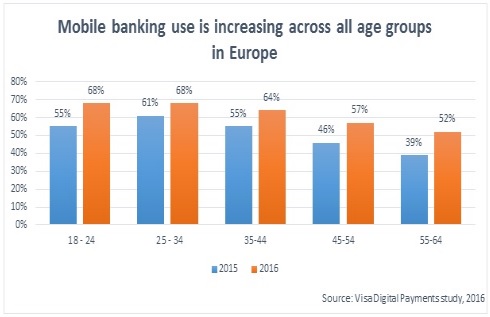

The research also shows that mobile banking activity is increasing across all age groups. For the first time, more than half of European respondents in all age brackets are using mobile banking. Whilst millennials remain the most prolific category, other age groups are rapidly catching up. With a growth rate of 33%, the highest growth rate is the 55-64 year olds, while millennials 18-34 have a growth rate of 24%.

In the UK, the growth rate among older users has increased by 18%. Nearly half (46%) of 55-64 year olds currently use a mobile device for banking compared with 39% of respondents who accessed online banking through an app in 2015.

Across Europe, the uptick in the number of respondents using mobile banking is also helping more people to keep track of their spending and financial responsibilities – two-fifths (41%) say they regularly check their balance online or via a banking app.

Kevin Jenkins, UK & Ireland Managing Director at Visa said:

“This data is a confirmation that the future of digital payments has arrived, with consumers across the length and breadth of the UK and Europe embracing a variety of new ways to pay. Visa sees smartphones and wearables as the beginning of a broader trend, with millions of new connected devices making it simple, safe and secure to integrate daily commerce transactions into almost any technology.

“In Europe, we’ve recently seen Apple Pay launched in the UK, France and Switzerland, Samsung Pay has launched in Spain and Android Pay in the UK. We’ve also seen a new era of wearable payments: smartwatches, wristbands and even clothing. It’s clear that this trend will continue to accelerate, enabling consumers to choose the connected device that fits with their lifestyle.”

Correlation with contactless

This increase in engagement with digital payments coincides with greater adoption of contactless technology. The research indicates that, across all age groups, contactless payments are now the norm. In the UK, more than half the people surveyed (58%) used contactless cards this year, up from 20% in 2015.

Europe-wide, contactless users are also consistently more open to embracing newer payment methods than those who don’t use contactless cards. The study highlights the correlation between contactless usage and new payment methods, revealing that contactless card users are more interested in using a mobile device as a payment method in a shop (52% contactless card user vs 32% non-contactless card user), shopping via a retailer app (49% vs 31%) or using a mobile device to pay for a meal (50% vs 30%).

Jenkins continued:

“The uptake of contactless cards has made a significant impact on normalising digital payments in the minds of British consumers, regardless of age. The near-ubiquity of contactless card usage is gradually helping everyone engage with newer ways to pay, including mobile banking.

“Visa’s commitment to constant innovation increasingly enables people to make safe and seamless payments wherever they want and on whatever device they choose, regardless of time, place or channel.”

About the ‘Digital Payments’ report

A Mobile Payments user is defined as someone who uses their phone, tablet or wearable to manage their money or make a payment in person, online or in-app.

Visa commissioned the Digital Payments research with Populus. The research was conducted between August and September 2016 in 19 European countries: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Netherlands, Norway, Poland, Romania, Slovenia, Spain, Sweden, Switzerland, Turkey and the UK. The total sample size was 36,843 consumers, with approximately 2,000 respondents per country.

Source: Visa

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: