„Suddenly, contactless payments have gone from a nice-to-have for speed and convenience to a must-have for safety. Since April, more than 70% of face-to-face Visa transactions in Europe were made using contactless technology,” according to Visa.

With rising demand for safer ways to travel, Visa said it is now offering „touchless” payment methods for public transportation in over 500 cities.

The payment-solutions company is launching contactless Visa-branded cards with Cubic Transportation Systems in cities including London, Miami, New York, Sydney, and Vancouver.

Visa’s tap-to-pay project is already live in Brussels, Bratislava, Bucharest, Hong Kong, Santo Domingo, and Turin, with more deploying quickly, it said.

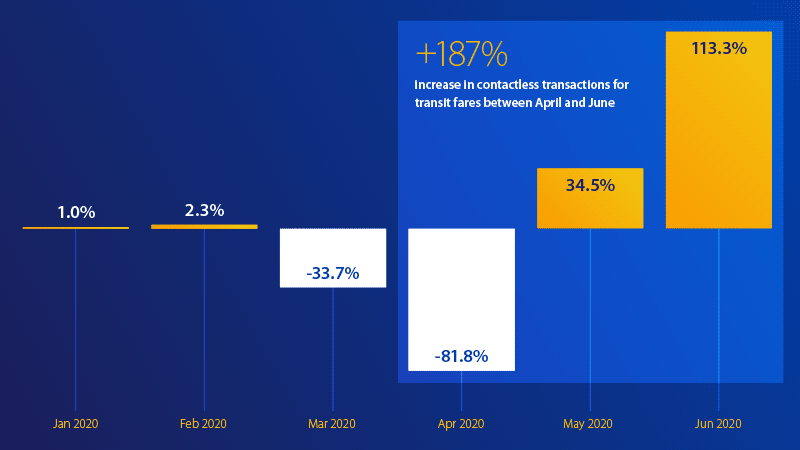

Demand for contactless transactions reached a global low in April and were still below pre-virus levels but has substantially recovered over the last two months.

„After reaching a global low in April and while still below pre-COVID levels, contactless transactions for transit fares have been on the upswing for the last two months, recovering +187% by the end of June,” Visa said.

Global Visa contactless fare payments start to rebound (% change from previous month)

„With open loop, contactless payments, riders can simply tap their contactless card or contactless-enabled mobile device at the terminal and ride,” the company said.

Citing statistics, Visa said about 50% of US citizens want better safety measures as they think using public transport poses a high health risk during the COVID-19 pandemic.

The US has been slow to uptake on contactless cards for fear of security breaches and lack of infrastructure to accept such payments, according to Greg Mahnken, a credit industry analyst at Credit Card Insider.

„65% of cards on the market will be contactless by the end of this year,” he said, citing a study that noted a 6% to 8% increase in cards using radio-frequency identification (RFID) because of the pandemic.

Coronavirus has spread awareness of contactless payments especially in Europe and non-US markets, but popularity in the US has been comparatively low – as was the case with chip cards when first introduced.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: