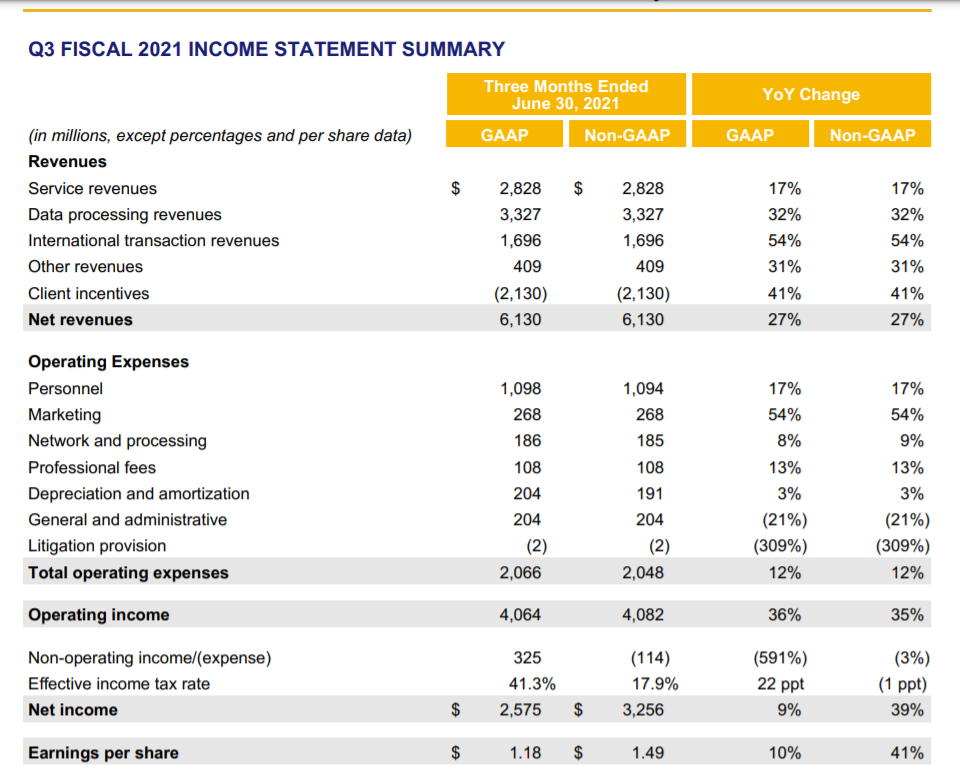

Net revenues in the fiscal third quarter were $6.1 billion, an increase of 27%, driven by the year-over-year growth in payments volume, cross-border volume and processed transactions, according to Visa.

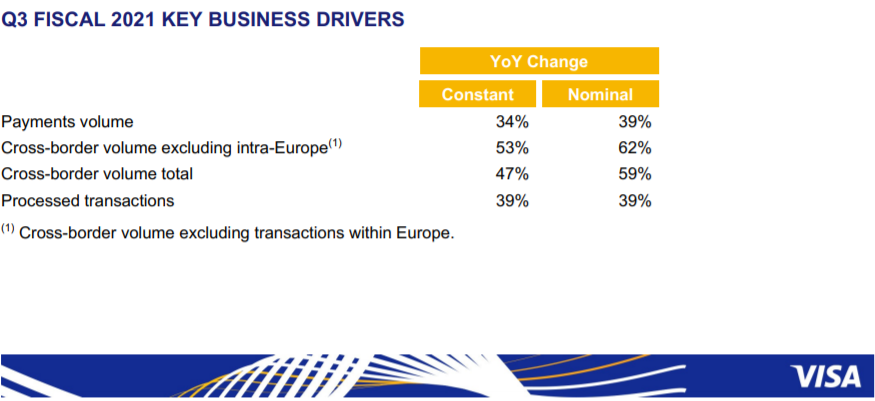

Payments volume for the three months ended March 31, 2021, on which fiscal third quarter service revenue is recognized, increased 11% over the prior year on a constant-dollar basis. Payments volume for the three months ended June 30, 2021, increased 34% over the prior year on a constant-dollar basis.

Cross-border volume excluding transactions within Europe, which drive Visa international transaction revenues, increased 53% on a constant-dollar basis for the three months ended June 30, 2021. Total cross-border volume on a constant-dollar basis increased 47% in the quarter.

Total processed transactions, which represent transactions processed by Visa, for the three months ended June 30, 2021, were 42.6 billion, a 39% increase over the prior year, led by domestic transactions.

Fiscal third quarter service revenues were $2.8 billion, an increase of 17% over the prior year, and are recognized based on payments volume in the prior quarter. All other revenue categories are recognized based on current quarter activity.

Data processing revenues rose 32% over the prior year to $3.3 billion. International transaction revenues grew 54% over the prior year to $1.7 billion. Other revenues of $409 million rose 31% over the prior year. Client incentives, a contrarevenue item, were $2.1 billion and represented 25.8% of gross revenues.

Alfred F. Kelly, Jr., Chairman and Chief Executive Officer, Visa Inc., commented on the results:

„Visa delivered another strong quarter as many key economies are well into a reopening-driven recovery. This was best demonstrated by credit and face-to-face spending bouncing back while debit and eCommerce volumes remained robust from accelerated cash digitization sparked by the pandemic. Additionally, crossborder travel spending improved as vaccination rates rose and more borders opened. Visa grew net revenues 27% and non-GAAP EPS 41% while continuing to make investments in strategies that will drive future growth.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: