Visa Inc: A Buy Or A Sell?

2013 was a good year for Visa Inc. (V). Shareholders of the company must be quite happy as its share price moved more than 43% last year, from $155 per share to more than $222 per share. The company has also shown decent growth in its top and bottom lines, and delivered a high return on equity.

Visa has shown a great interest in increasing their point-of-sale presence in many emerging countries. Its goal is to achieve more than 50% of its total revenue from international markets by 2015. The company has opened more than 38 million point-of-sale terminals in the last five years, and this number is projected to reach 76 million in the next five years. In the U.S. only 20% of on-site payments are made with cash and less than 7% are made with checks, signaling less growth potential in already mature market. In developing markets like India and Russia, nearly 70% of all payment transactions are done with cash.

This indicates that Visa has more room for growth in developing markets than already mature markets.

India has been identified as a market with a large potential for growth. It is among the fastest growing markets for Visa. The card market in the country is growing, and the pace is accelerating. India is the fourth-largest country in terms of the number of resident high net worth individuals (HNWIs). The number of HNWIs in the country is expected to increase from 290,555 in 2012 to 547,893 in 2016. To benefit from this growing niche segment, banks and card issuers have increased their focussed this group as HNWIs traditionally show a greater willingness to use non-cash payment methods such as credit, debit and prepaid card.

According to Visa’s estimate, the target population for credit and debit cards in India would be around 200 million. There are also 400 million Indian people who don’t have access to a bank account. It is this combined 600 million, which should be viewed as the true target market for prepaid cards. India is also pretty much an incubator of new ideas and innovations. In the UBS Global Tech Conference in November of 2013, the company mentioned certifying a mobile payment device in the next 18 months in India, allowing for 75,000 to 100,000 additional point of sale terminals. Also, the low competition in India provides Visa a large potential for growth.

Besides India, China and Russia are also becoming important growth markets for credit card companies. China will be the next growth market for Visa in the coming years. China has recently shown promising signs of issuing foreign credit cards, allowing for Visa to become an even bigger international player. There is a possibility that Visa will be issued by Chinese financial institutions that will grow its revenues in the future. About 60% of the company’s global payments come from debit cards. And in China, growth of debit card payments is faster than that of credit cards. Currently, China does accept Visa cards from foreigners and Visa strategically partnered with Chinese financial institutions to recommend and issue their cards for foreign travel.

Marketing and advertising is a major component of Visa’s success. The company has been a worldwide Olympic Games sponsor since 1986 as well as a worldwide sponsor of the Paralympic Games since 2002 and is the exclusive payment card and official payment network of the Olympic and Paralympic Games. Furthermore, it is also one of six global FIFA partners with global rights in the „Financial Services” product category to all FIFA World Cup activities. This positioning connects the world’s leading payment brand with soccer; the world’s most followed sport. With both the Sochi Olympics and Rio World Cup around the corner, Visa will continue to reach large global audiences and initiate programs that benefit their business.

Visa faces stiff competition as it competes in the global payment market place against all forms of payment. Some of its major competitors include: MasterCard (MA), American Express (AXP), Discover financial services (DFS) and Japan Credit Bureau (JCB). Many of these competitors are concentrated in specific geographic regions, such as JCB in Japan and Discover in the United States.

As the global payments industry continues to undergo dynamic change, Visa may face increasing competition from emerging players in the payment space such as PayPal, Google Wallet and Isis. Although, these competitors do compete directly in many cases, it also presents Visa the opportunity to partner with these companies and expand through them.

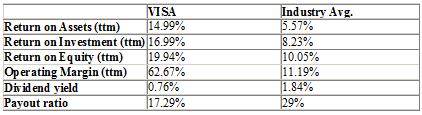

Source: Reuters

These ratios indicate that Visa is potentially more profitable than the average firm in its competing industry. Its profit margins are much higher than the industry average. In addition, having an ROE that is greater than the industry ROE, the company has a greater prospect for generating abnormal earnings.

Analysts are also bullish on Visa. According to Yahoo finance estimates, the company will report revenue of $12.76 billion this year and $14.16 billion next year. EPS is estimated to be $8.99 and $10.40 in 2014 and 2015, respectively.

Bottom Line

Visa is an established company that is still seeing double digit growth both in revenue and EPS. Over 60% of the world’s payment transactions are still completing in cash. The company has positioned themselves better than any other company to capitalize this market share. It has promising growth opportunities in Asian markets like China and India. In my opinion, Visa is a strong buy right now.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: