Throughout the pilot, Visa tested over 100 biller and consumer use cases and over 40 exceptions, leveraging multiple payment initiation channels providing a comprehensive end-to-end pilot.

Visa announced that „it has facilitated the first request to pay message sent and received using Pay.UK’s standards, ahead of the anticipated commercial launch of request to pay later this year.”

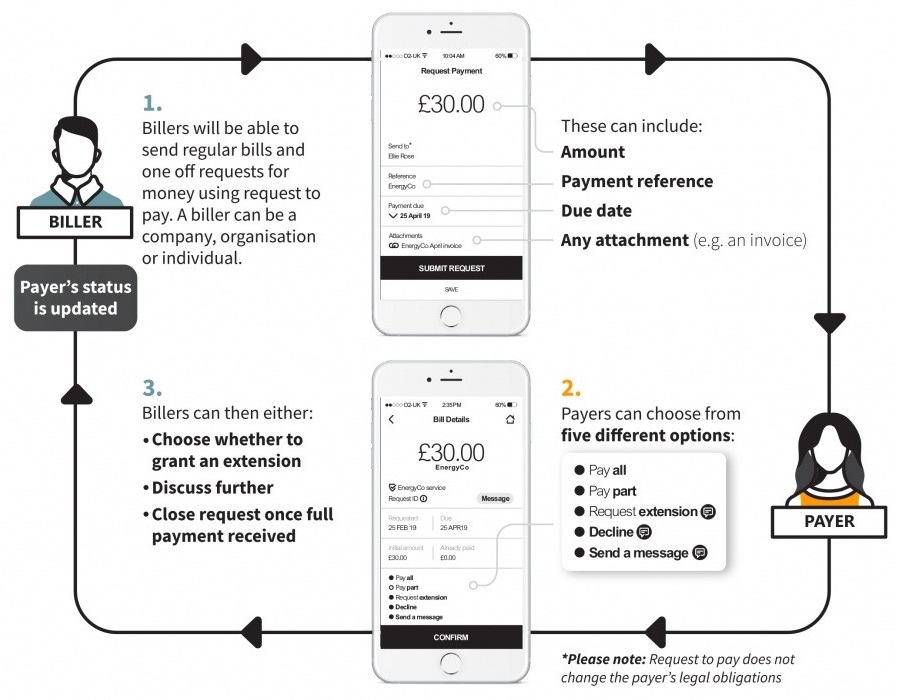

Request to pay is a new, flexible way to settle transactions between businesses, organisations and individuals. The messaging service is designed to complement existing payment infrastructure.

The service enables billers to directly request funds rather than sending traditional invoices. For each request, receivers are asked whether they would like to pay in full or in part, request an extension, communicate directly with the biller, or decline to pay. A customer’s response does not change their legal obligations.

„Once the service is available it will sit alongside Direct Debit and other existing bill payment methods to give consumers and businesses additional choice and flexibility. It could save billers an estimated £1.3 billion per year.”, according to Pay.UK.

Mat Lane, Head of Europe Real Time Payments & Global Applications, Visa, said: “Our support for Pay.UK’s request to pay pilot is a natural extension of our existing role as a global and open payments network. We are pleased that our knowledge and technical expertise played into the success of the pilot. We are keen to continue working with Pay.UK to develop the offering and join the full service when it launches as we continue to head towards our shared goal of modernising payments to meet the demands of digital payment services available to both individuals and businesses.”

Paul Horlock, Chief Executive, Pay.UK, said: “The huge variety of companies that have been involved in request to pay’s development and testing phases – more than 400 in all, from start-ups to large payment service providers – is a clear demonstration that there is market appetite.„

“The expertise of our pilot participants such as Visa, has played an important role in refining the request to pay message standards. We look forward to seeing the offerings developed by the industry and companies like Visa coming to market when request to pay launches later this year.”

„Working with the other pilot participants, Visa played a critical role in developing the request to pay message that forms the basis of the Pay.UK standard. Having successfully completed accreditation to participate in the pilot and subsequently supported the delivery of live request to pay messages, Visa remained in the Pay.UK request to pay pilot to assist other participants in gaining their own request to pay pilot accreditation.”, Visa said.

All participants will now gain full accreditation to join the live request to pay service due to launch later this year.

Banking 4.0 – „how was the experience for you”

„So many people are coming here to Bucharest, people that I see and interact on linkedin and now I get the change to meet them in person. It was like being to the Football World Cup but this was the World Cup on linkedin in payments and open banking.”

Many more interesting quotes in the video below: