Visa is more exposed to debit spending, which is growing quickly amid economic concerns and a shift away from cash, according to MarketWatch.

Article written by Emily Bary, a MarketWatch reporter based in New York.

Visa Inc. and Mastercard Inc. are often viewed as one and the same in the investment community, but the small differences between their businesses are coming into focus as the COVID-19 alters the way people spend their money.

Consumers have been showing an increasing preference for debit cards versus credit cards given the weak economic climate brought on by the pandemic, and right now this skew favors Visa, which has a larger debit business. Visa generated 52% of its volume in the September quarter from debit transactions, compared with 44% for Mastercard.

“What happened in the COVID-19 crisis is that the replacement for cash is basically debit,” Mizuho analyst Dan Dolev told MarketWatch. People may be more hesitant about touching cash, but they’re also less inclined to use credit during a downturn due to unease over spending borrowed money.

What’s more, the purchases people are making right now are ones that normally tilt toward debit anyway, according to Susquehanna analyst James Friedman, who has positive ratings on Visa and Mastercard. “People historically pay for groceries with debit, pay for gas with debit, and pay for travel and restaurants with credit,” he told MarketWatch. The travel and restaurant industries are under pressure, but groceries are a utility purchase.

Both Visa and Mastercard saw worldwide debit volume growth of about 20% in the September quarter, though Visa benefitted more from this momentum given that debit makes up a larger portion of its business. The companies each reported results Wednesday.

The debit and credit businesses are “bifurcating so dramatically,” according to MoffettNathanson analyst Lisa Ellis, magnifying a difference between Visa and Mastercard that’s “normally not a big deal.” In contrast to debit’s 20% volume increase, credit is down about 5% to 10%, she said.

Visa Chief Financial Officer Vasant Prabhu highlighted on the company’s earnings call that debit is growing at twice the rate it was prior to the pandemic, and that the category “stayed resilient through the shutdowns,” posting growth in the U.S. even earlier in the pandemic when there were more restrictions on activities.

“They’re situated perfectly for what’s happening,” Dolev said of Visa, noting that the debit skew could also prove beneficial even during normal economic times given a trend of some younger consumers preferring debit. On trendy peer-to-peer platforms like Square Inc.’s Cash App and PayPal Holdings Inc.’s Venmo, many users choose to fund their accounts with debit cards.

In normal recessionary times, debit stays strong for a while before a swing back into credit takes place after a few years, Ellis said, but the COVID-19 crisis adds a new dimension. In addition to the cyclical shift toward debit because of the pandemic, there’s also been a step up in cash displacement, which is a secular trend that she expects to continue. Much of that movement from cash to cards seems to be happening through debit.

The U.S. and U.K. already had about 70% card penetration prior to the pandemic, and “a lot of what’s left is low dollar amounts and demographics that are less digitally involved, like lower-income or older populations,” Ellis said. When these groups enter the digital arena, they’re more likely to do so with debit, she argued.

Prabhu seemed to hint at these dynamics on Visa’s earnings call, when he said that debit is “the biggest beneficiary of the accelerated growth of e-commerce and the shift away from cash.”

This comment was interesting and not necessarily intuitive, Susquehanna’s Friedman argued, since debit “is such a utility” and not always “used for discretionary spend, which e-commerce is famous for.” That the COVID-19 crisis has moved more debit spending over to online channels is suggestive to him of new e-commerce users coming into the fray.

Ellis said that the debit trends are one reason she tilts toward Visa shares over Mastercard’s these days, though she has buy ratings on both names. She’s also upbeat about the company’s Visa Direct platform, which allows for “push” payments, a popular way for gig economy companies to pay drivers and delivery people. Mastercard has its own version of this, called Send, but Ellis said Visa is investing more in this area and may be benefitting from its larger scale.

The card companies also have different geographical makeups. Visa derived about 45% of volume from the U.S. prior to the pandemic, while Mastercard got about 36%. U.S. card volumes seem to be growing faster than global volumes, partly because of the shift from cash to cards. It’s easier for consumers to make that transition in countries like the U.S. where cards are commonplace and most merchants have the infrastructure to accept them, per Ellis’s analysis.

Visa’s geographic mix may also be proving beneficial as some international travel corridors start to reopen. Both Visa and Mastercard called out a bit of recovery in intra-Europe travel while noting that most international borders remain closed. But Visa sounded slightly more upbeat about current travel dynamics, highlighting that corridors like the U.S., Mexico, and the Caribbean, as well as the Persian Gulf, are starting to reopen.

Wedbush analyst Moshe Katri said that Visa has more exposure to those cross-border corridors outside of Europe where travel activity is doing a bit better. He has outperform ratings on Visa and Mastercard shares.

Mastercard could be due for “a nice trade upward” if international travel resumes upon broad availability of a vaccine, said Mizuho’s Dolev, though he still thinks Visa is “better positioned structurally right now” due to its debit makeup.

Dolev has buy ratings on both stocks.

Mastercard, for its part, is upbeat about a credit rebound. “As travel comes back, you’ll see that reflected in credit,” President Michael Miebach said on the company’s Wednesday earnings call. He stated that Mastercard’s multi-rail strategy allows the company to benefit regardless of how people choose to pay, whether it’s with credit, debit, QR codes, or push payments. “But I do expect credit to come back,” he continued.

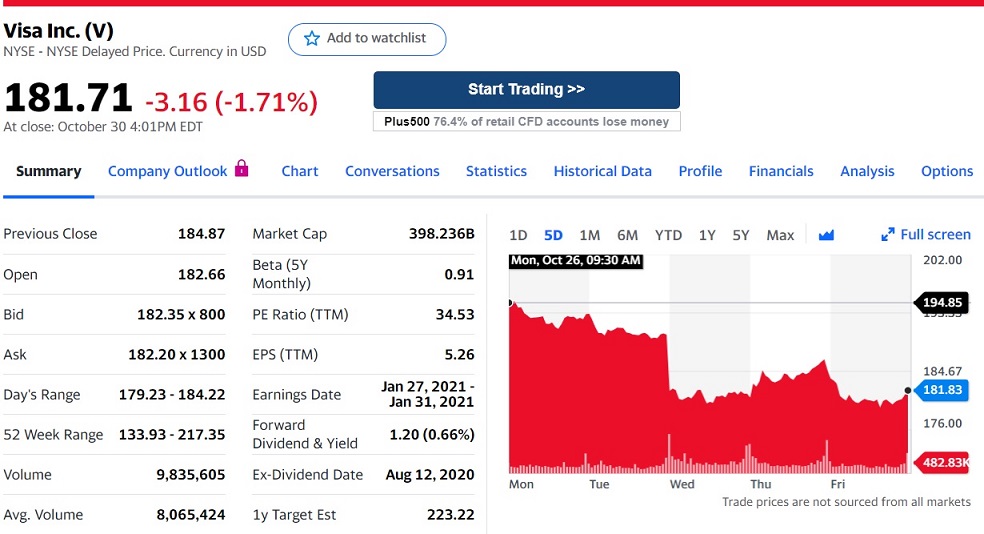

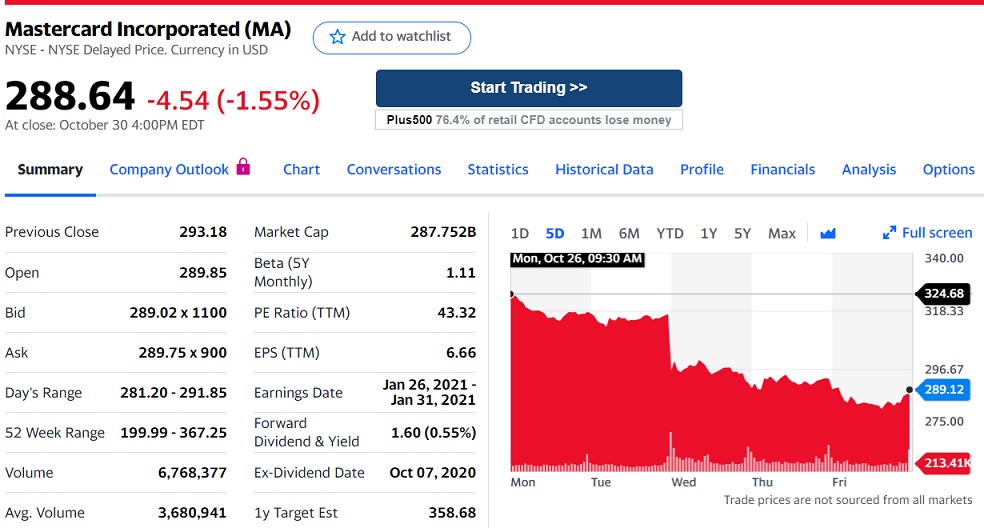

Prior to the pandemic, Mastercard’s stock had been outperforming Visa’s for several years, and it remains to be seen whether the dynamics brought on by COVID-19 will alter that pattern. The two have had similar performances so far this year, with Visa’s stock off 4% and Mastercard’s down 5%.

The performance of Visa and Mastercard shares after the financial results reported on Wednesday did not impress

Source: Yahoo Finance

More useful links:

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: