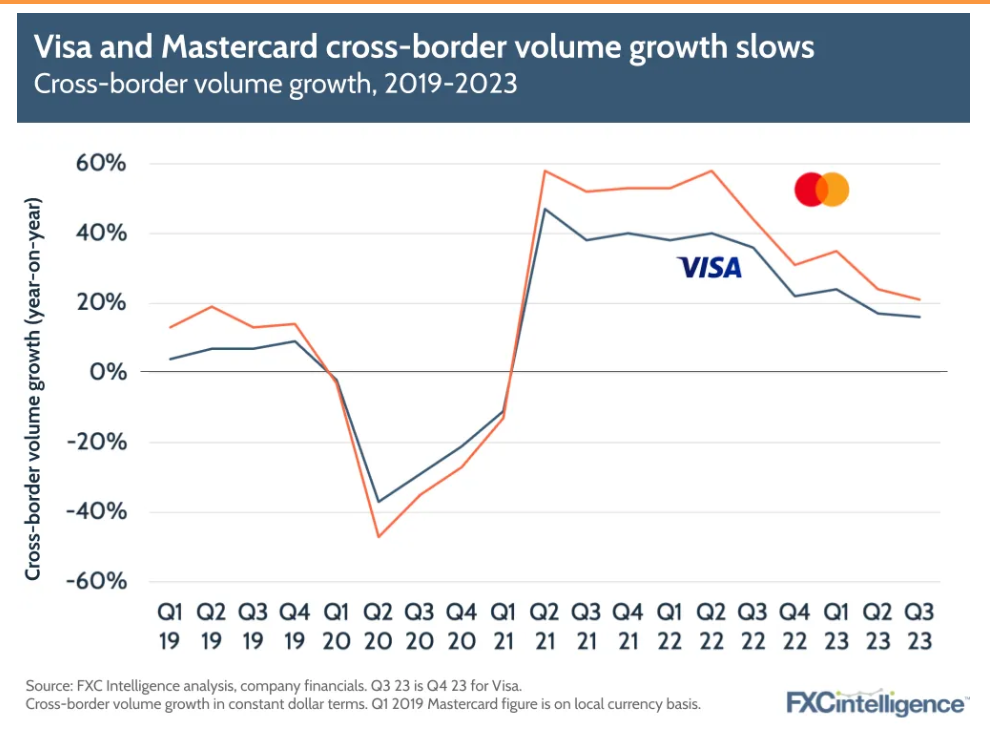

Visa and Mastercard have both reported their latest earnings results – Q4 23 for Visa and Q3 23 for Mastercard, spanning the period from July-September 2023. „Both companies are once again seeing solid cross-border growth on the back of resilient consumer spending, and have formed and expanded several notable partnerships during the quarter.” according to FXCintelligence.

Here are the topline earnings results for both companies:

Revenues increased 11% to $8.6bn, backed by strong cross-border volume growth – 18% excluding transactions within Europe, 16% in total – as well as overall payments volume growth of 9%. Cross-border P2P transactions rose 65% and hit a new record for payments volume in Q4.

Visa has continued to expand Visa Direct, which saw a 19% rise in transactions to 7.5 billion (nearly 30% excluding Russia) in 2023, spanning over 65 use cases and more than 2,800 programmes. The network now has 8.5 billion endpoints, and covers three billion cards and accounts. The company also signed an agreement with Asian commerce giant Tencent, which has grown its total wallet reach for Visa Direct to 2.5 billion, and continues to expand capabilities through its Tink and Currencycloud acquisitions. Visa also expanded a partnership with Paysend to enable its customers to send money to Visa cards across 170 countries and territories, and said that cross-border remittances was a big use case for expansion going forward.

The number of banks signed up to Visa B2B Connect also increased by more than 70% over the course of the year, with the number of transacting banks more than doubling.

Total processed transactions were up 10% to 56 billion, while international transaction revenues grew 10% over the prior year to $3.2bn.

For the full financial year, revenues grew by 11% to $32.7bn, backed by 25% cross-border volume growth excluding Europe (and 20% total growth), as well as 9% payments volume growth.

Visa’s share price has risen in the week after it released its earning figures.

Net revenues rose to $6.5bn, an increase of 14% – or 11% on a currency-neutral basis. This was driven by net revenues for Mastercard’s payment network increasing 12% (10% currency-neutral).

Cross-border volumes increased by 21%, which reflected ongoing strength in both travel and non-travel cross-border spending. In particular, cross-border travel rose to 155% of 2019 levels in Q3. The company also saw cross-border assessments – fees linked to cross-border transactions – increase by 28% to $2.3bn in Q3.

There was no specific mention in the call of Cross-Border Services or Cross-Border Services Express – Mastercard’s tool launched earlier this year allowing financial institutions to set up international payments for consumers and businesses. However, Mastercard executives mentioned that there are substantial untapped flows across commercial payments and the disbursements and remittance space. It is therefore looking to capitalise on this by partnering with Paysend and Remitly. The latter is incorporating Mastercard Send – the company’s competing infrastructure to Visa Direct – into its existing 170-country strong framework to improve the number of options for payouts to recipients.

To date this year, Mastercard has seen revenues rise 13% on the back of a 26% rise in cross-border volumes. However, despite revenue rises, Mastercard’s stock fell by over 20% on the day of its results, which some analysts have linked to a slowdown in its switched volume growth.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: