Visa and MasterCard are two solid investments for common stocks aquisition in 2013

January 7, 2013 – It seems like Visa and MasterCard are two well-programmed money making robots, according to the most widely read American stock market analysis website among investors and financial professionals. Nevertheless, with internet costs declining and connectivity to mobile devices increasing, the largest threat to MasterCard and Visa in 2013 and beyond is likely to arise from a company already in existence such as Amazon.com, Apple, or even revenue strapped Facebook.

January 7, 2013 – It seems like Visa and MasterCard are two well-programmed money making robots, according to the most widely read American stock market analysis website among investors and financial professionals. Nevertheless, with internet costs declining and connectivity to mobile devices increasing, the largest threat to MasterCard and Visa in 2013 and beyond is likely to arise from a company already in existence such as Amazon.com, Apple, or even revenue strapped Facebook.

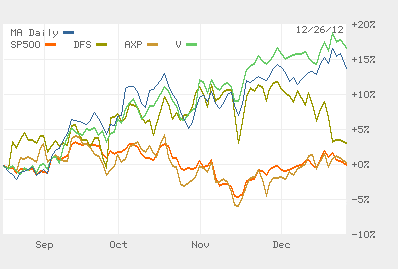

During the past four quarters, both Visa and MasterCard have been able to outperform the average earnings estimate by a single digit percentage. For the latest quarter ending September 30, 2012 Visa earned $1.54 per share vs. an estimate of $1.50 and MasterCard reported earnings per share of $6.17 vs. a consensus forecast of $5.92.

MasterCard is the smaller company as it has a market capitalization of $60 billion compared to $120.5 billion for Visa. Both companies have enterprise values that are slightly lower than their market capitalizations as their cash holdings exceed their debt. And in terms of dividends, MasterCard pays a token quarterly dividend of $0.30 for an annualized yield of 0.25% compared to Visa’s recently increased quarterly dividend of $0.33 for an annualized yield of 0.9%.

The average estimates are for Visa to earn about $7.30 per share for the fiscal year ending September 30, 2013 for a forward looking price to earnings (PE) ratio of about 20. Similarly, MasterCard should earn about $26 per share in 2013 for a 2013 PE ratio of about 18.6. Both companies are expected to continue repurchasing their shares, so the performance per share is likely to improve as the share counts is reduced. As of September 30, 2012, Visa had $1.5 billion left under its most recent share repurchase authorization and MasterCard had $1.1 billion under its own share repurchase program. In addition, MasterCard is likely to increase its dividend payout in 2013 to a more meaningful yield, following the recent 50%+ dividend rise for Visa.

New Developments

There are always new developments with the two global credit card companies and the past four months were no exception. Since August 18, 2012, Visa issued 30 press releases compared to 97 for MasterCard. It will be difficult to discuss all of these press releases here so the ones that are particularly interesting and the reason why they are important are listed below:

- MasterCard

- August 21, 2012 – MasterCard becomes the official sponsor of the Brazilian national football team. Sponsoring the most popular sport in the world in the country where it is most revered ensures that credit card companies will be in the wallets and hearts of football fans in Brazil.

- September 5, 2012 – MasterCard becomes the first credit card company to issue a license to a Myanmar bank. This comes before President Obama’s first official visit to the country on November 18, 2012 and only a few months after the U.S. resumed diplomatic relations with the country. MasterCard and Visa are well positioned to enter new markets that were previously unfriendly to global companies (Cuba and North Korea are potential new customers).

- November 7, 2012 – MasterCard in partnership with ING, a leading Dutch bank, is testing a new way to pay online with the use of cell phones. This will enable MasterCard to establish itself as a leading provider of online and mobile payment solutions that are continuing to see increased demand.

- Visa

- September 19, 2012 – Leading governmental, non-profit, and corporate entities announce that electronic payments help reduce poverty in developing countries by increasing security, transparency, and ease of transacting. This should enable credit cards to become more acceptable in developing countries and ensure their growth there.

- November 13, 2012 – Visa announces that V.me, Visa’s digital wallet service, is adopted by 53 financial institutions and 23 online merchants. Digital wallet is an area of growth where credit card companies are competing with new entrants such as Google (GOOG) Wallet.

- December 11, 2012 – Visa highlights its success in laying the foundations for a cashless payment network in Rwanda. The African continent should offer plenty of growth opportunities for the credit card companies and early entry is indicative of future success.

- December 12, 2012 – Visa partners with five leading Indian banks and the Unique Identification Authority of India to provide access to a credit card account (called Saral money) through Adhaar, the national identification card for Indians. Unique and exclusive partnerships with governments and financial institutions assure the credit card companies growth in one of the most populous and fastest growing economy in the world, India.

What Lies Ahead in 2013

Amazon.com will generate approximately $60 billion of revenues in 2012 but no, or minimal, net income. Assuming the company pays a 3% credit card fee on its sales, Amazon.com has spent about $1.8 billion in credit card fees in 2012. It makes sense, for a company like Amazon.com, to launch its own credit card network in addition to chasing profits on the clouds. A competition from Amazon.com or other large retail companies represent the largest threat to Visa and MasterCard. In fact, a competitor, Discover Financial Services was launched by a retailer, Sears, back in the 1980s. And eBay has its own payment network, PayPal. Many merchants are unhappy by the virtual monopoly and the high pricing of MasterCard and Visa, especially in the current environment of razor thin margins for many retailers. With internet costs declining and connectivity to mobile devices increasing, the largest threat to MasterCard and Visa in 2013 and beyond is likely to arise from a company already in existence such as Amazon.com, Apple, or even revenue strapped Facebook.

While merchants do not like credit cards banks love them as they bring revenues and customers to the banks. In 2013 and beyond, more banks should adopt MasterCard and Visa payment services and brands as demand for cashless payments increase. Banks are still the major holders of people’s cash and this is not likely to change or be disrupted any time soon. MasterCard and Visa are long-term partners for banks and other financial institutions and this should allow them to benefit from the transition to a more cashless society.

Conclusion

MasterCard and Visa common stock offer investors an exposure towards the global trend towards online and mobile payments. While there are potential disruptive competitors, MasterCard and Visa partnership with banks and governments should ensure their stable growth in the foreseeable future. In addition, MasterCard and Visa offer a good inflation hedge as part of their fees are based on the purchase price and as prices rise so will their fees. Based on this two trends, MasterCard and Visa common stock should offer above average returns.

Source: seekingalpha.com

(Seeking Alpha is an American stock market analysis website which was founded in 2004 by former Wall Street analyst, David Jackson. According to the company it has distribution partnerships with MSN Money, Yahoo Finance, CNBC, MarketWatch and Nasdaq. According Seeking Alpha it selects about 250 of the 400 articles submitted daily for publication and accepts 25% of the new authors who apply. Seeking Alpha reports that Nielsen Analytics found its web site to be the most widely read among investors and financial professionals. Seeking Alpha reports it has over 5 million unique users per month.)

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: