Virtual card spend to reach $13.8 trillion globally by 2028, driven by API-based issuing

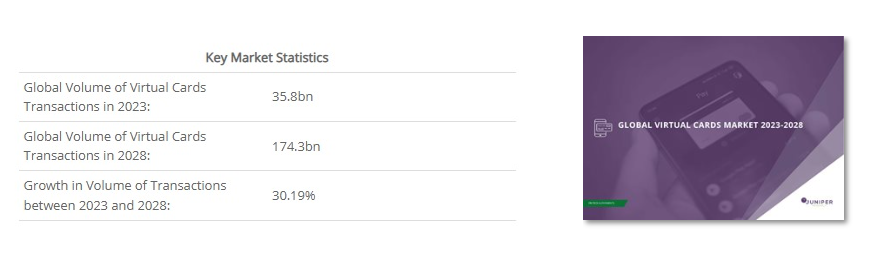

A new study by Juniper Research, found that by 2028, global virtual card spend will have increased by 355%; from $3.1 trillion in 2023. The key driver will be the adoption of API-based virtual card issuing platforms.

Virtual cards use randomly generated and generally temporary card numbers linked to a payment account, which are used to process payments; replacing genuine payment details. Virtual cards provide a secure and fast way to distribute funds, while effectively managing spending limits.

API-based virtual card issuing enables cards to be issued in a more seamless and cheaper way, improving efficiency and unlocking greater use cases within B2B and consumer payments.

Stripe, Revolut and Marqeta Lead

The new Juniper Research Competitor Leaderboard report reveals that Stripe, Revolut and Marqeta are the established leaders in the virtual cards space. The report identified intuitive, API-based platforms, with easy-to-use functionality to securely deploy cards and manage spending restrictions, as the most important factors in their success.

Research author Daniel Bedford commented: “Virtual cards offer an adaptable solution that can be heavily customised, including spending limits and restrictions; enabling businesses to significantly improve their spend management, while reducing costs.”

Incentives Driving Adoption

In the highly competitive consumer virtual cards space, Juniper Research recommends that vendors offer loyalty- and rewards-linked cards, to differentiate themselves. Exclusive offers on partner products, rewards points and cashback on specific merchants can successfully encourage virtual card spending and customer retention. This will require virtual card platforms to build out partnership ecosystems, either by partnering directly with merchants, or with existing loyalty services.

_____________

Find out more about the new report, Global Virtual Cards Market 2023-2028, or download a free sample.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: