VibePay, the company powering the next evolution of payments through Open Banking, has become the first to offer account to account voice activated payments in Europe, according to Fintech Finance.

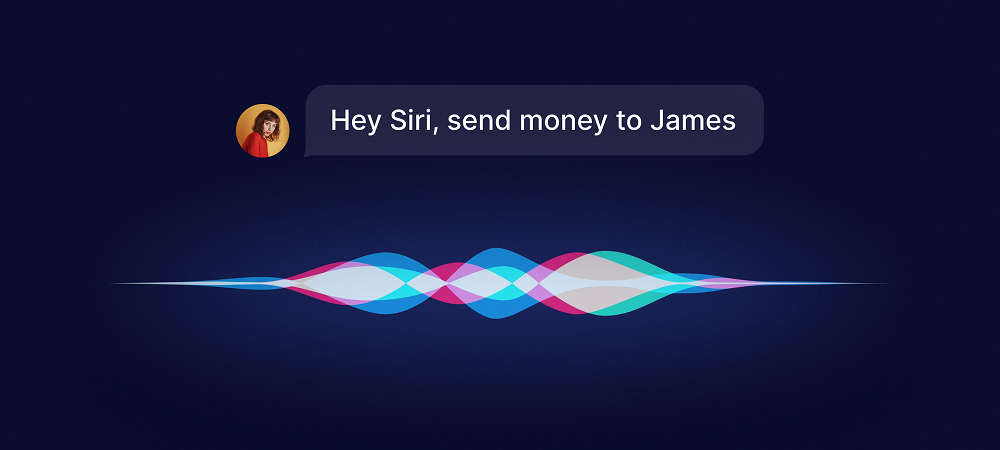

VibePay’s users can now pay or request payment from others with their voice directly (via Siri) and instantly from one UK bank account to another, with no fees. Users can activate the voice-initiated technology using Siri with just a simple sentence.

„On iOS, VibePay users can now add a Siri Shortcut after completing a payment. This prompt allows you to save a shortcut and, from then on, you can ask Siri to pay that user. “Hey Siri, send money to Luke!” – the company says in a blog post.

„Shortcuts can also be added for requesting money and for showing your VibeMe QR code. All shortcuts work from Apple’s Shortcuts.”

It is the latest offering in VibePay’s mission to transform how consumers and businesses interact with payments. It comes ahead of the launch of VibePay Pro later this year, which will enable sellers and entrepreneurs – such as businesses built by content creators, video game streamers, social commerce sellers and in person sellers – to interact with their customers and audiences in new ways.

By leveraging the capabilities of Open Banking, the service ensures sending or receiving money is not the end of a transaction, and instead enables meaningful on-going interactions to occur in-app.

Luke Massie, CEO of VibePay, said: “This first of its kind feature highlights another significant step in the evolution of payments in Europe.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: