VC investments totalling $14.8 billion were made in the blockchain sector in 2021 – says GlobalData

Venture capital (VC) investments in the blockchain sector increased from $2.1 billion in 2020 to an impressive $14.8 billion in 2021, as both companies and investors are eager to develop IT solutions built on blockchain technology despite the lack of regulatory framework, says GlobalData, a leading data and analytics company.

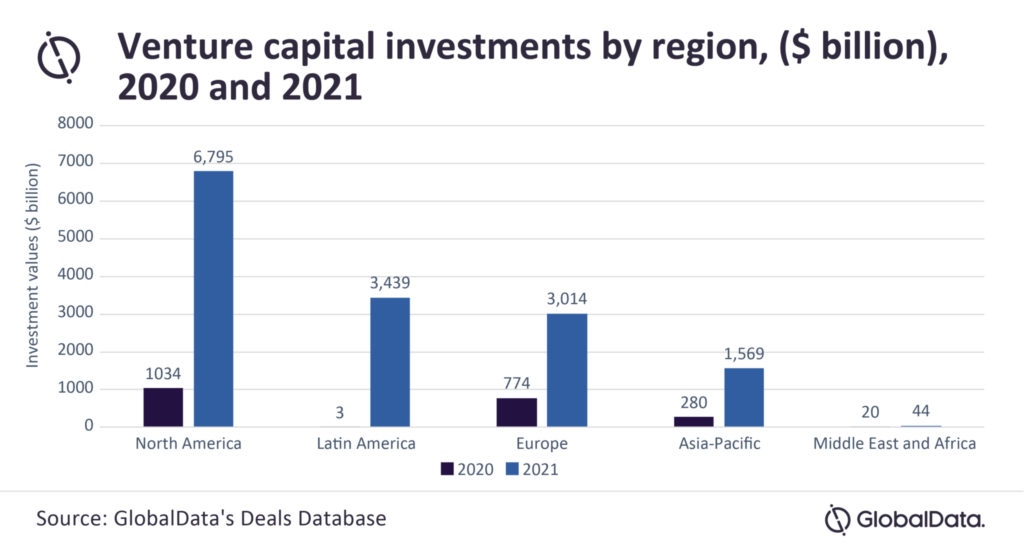

GlobalData’s Deals Database reveals that North America led in VC investments in 2021, with $6.8 billion; followed by Latin America, with $3.4 billion; Europe, with $3 billion; Asia-Pacific, with $1.6 billion; and the Middle East, with $0.44 billion.

Chris Dinga, Payment Analyst at GlobalData, comments: “One sector that is investing heavily in blockchain technology is banking and payments. Blockchain is helping the payments industry manage remittances, central bank digital currencies, and asset tokenization, however it is still a new technology that needs to be fully tested before it can be adopted fully within the payments infrastructure.”

GlobalData’s latest report, ‘Innovation in Blockchain Payments’, reveals that the blockchain software and services market was valued at $4 billion in 2020 and is forecast to reach a whopping $199 billion by 2030. Growth will be driven by the integration of blockchain within core technologies such as remittance infrastructures, real estate and the overall financial industry.

Currently most blockchain integration projects are at the experimental stage, as a lack of regulation and skilled workers has prevented some companies from adopting this technology in their infrastructures.

Dinga continues: “Blockchain technology is still at an infancy level when it comes to being adopted within the financial sector. While cryptocurrency is the most popular application, it only represents one potential application of the technology. However, governments and companies are each exploring different ways to adapt the technology to their needs.”

Over 90 central banks have shown an interest in developing their own central bank digital currencies (CBDC) and most of these will rely on blockchain technology. Currently, only a limited number of countries have managed to launch their own digital currencies but there is a lot of focus around China launching its own digital currency the e-yuan. The e-yuan is already available as a pilot test to Chinese residents in selected regions.

Dinga adds: “If e-yuan is successfully adopted across China, other countries are likely to take notice and determine if they should follow suit. The key to success is mass adoption, and as a communist country China can mandate that businesses and citizens use their digital currency, powers that Western democracies don’t have.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: