Next-generation biometric payment card products will likely reduce the cost per unit to within the US$13 to US$20 range per card, dependent on volumes.

According to global tech market advisory firm ABI Research, up to 2.5 million biometric payment cards will be issued in 2021 as second-generation architectures hit the market.

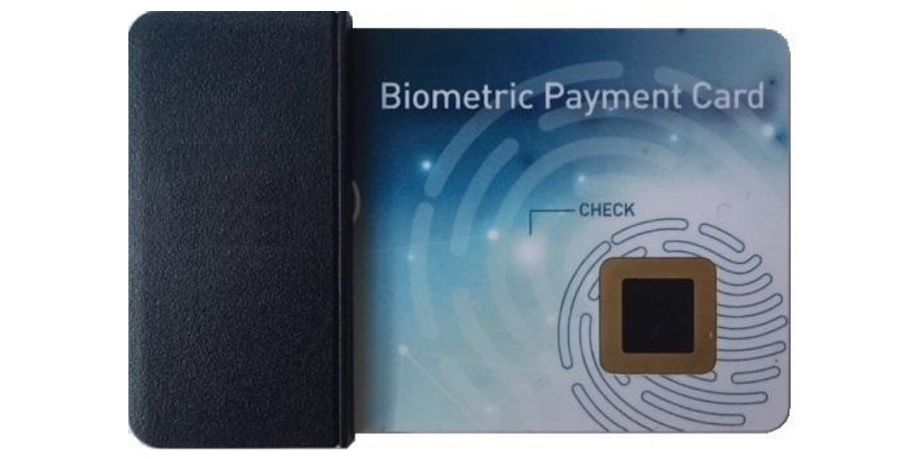

Today over 20 biometric payment card pilots are active globally, and the first commercial launch, by BNP Paribas, was announced earlier in 2020. The biometric payment card is viewed as the next-generation evolutionary card form-factor to help enhance contactless authentication, providing a future contactless payments experience without limits.

“It’s taken time for the biometric payment card market to take shape because it is the most complex card form-factor ever developed. First-generation biometric payment card solutions can command an Average Selling Price (ASP) anywhere between US$20 and US$30, significantly higher than today’s US$1 to US$2 mark for a contact or contactless payment card. Cost is one of the most significant inhibiting factors keeping the biometric payment card form-factor firmly within the piloting and evaluation phase,” explains Phil Sealy, Digital Security Research Director at ABI Research.

The market is moving in two developmental directions, away from discrete components and from distributed component architectures toward integrated solutions. This is being achieved thanks to two primary market developments; 1) a system-on-package approach, integrating some of the componentry onto an ASIC, reducing the total number of components required, 2) a single silicon approach whereby an inlay consists of a single chip and sensor.

According to Sealy, “Next-generation biometric payment card products will likely reduce the cost per unit to within the US$13 to US$20 range per card, dependent on volumes. Most second-generation products will become available at the back end of 2020 or early 2021”.

Despite the many 2020 market positives, the biometric payment card has not proven immune from the COVID-19 pandemic. Many planned pilot projects were deferred by 6 – 9 months. As issuers shifted spending priorities, they became more conservative with innovation spending and pivoted toward emergency management to combat the pandemic, subsequently shifting budgets and priorities.

Although COVID has impacted the biometric payment cards market, it has also stimulated a significant push toward digital payments, particularly contactless. As a direct result of COVID, contactless transaction limits have increased in over 100 countries globally, in a bid to reduce physical interactions at the point of sale and/or physical interaction with communal devices.

“The continued growth of contactless makes it a mouth-watering target market for vendors active across the entire biometric payment card ecosystem including FPC, G+D, IDEMIA, IDEX Biometrics, Infineon, Linxens, NXP, SPS, STM, and Thales, with over 2 billion contactless payment cards issued annually,” Sealy says.

The need to limit interactions and a new emphasis on hygiene is further accelerating contactless issuance. “These higher contactless transaction limits are here to stay and could be considered a significant signal of intent that contactless will ultimately become the de facto digital payment type of the future. This lends itself extremely well to innovative card form-factors, such as the biometric payment card, designed to bring Strong Consumer Authentication (SCA) to address the growing presence of Card Present (CP) contactless fraud, but also privacy, thanks to a biometric match-on-card authentication method,” Sealy concludes.

These findings are from ABI Research’s Biometric Payment Cards application analysis report.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: