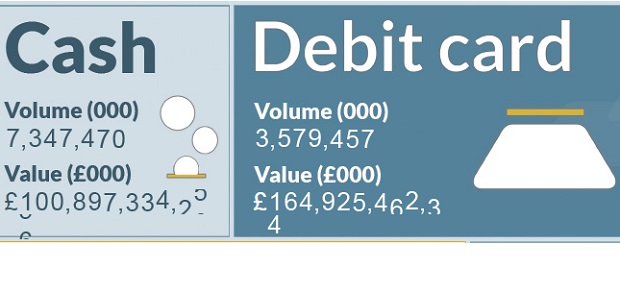

UK: the Payments Council figures shows that cash overtaken by non-cash payments in 2014

2014 data shows total cash payments were overtaken by non-cash* payments in July last year. Despite a steady decline in total cash volumes it is still king with consumers, who use it for more than half of all their transactions. In fact, „there is no prediction for cash to disappear”, according to the Payments Council, the body that represents the payments industry in the UK.

Figures published by The Payments Council show that the total number of cash payments made by consumers, businesses and financial organisations in the UK fell to 48% last year (from 52% in 2013).

This is the first time that ‘non-cash’ payments have exceeded those made with cash, reflecting the steady trend to use automated payment methods and debit cards rather than pay by notes and coins. However, cash remains the most popular payment method by volume, followed by the debit card, which accounted for 24% of all payments last year.

Despite the shift, cash remains the most popular way to pay among consumers, who used it for more than half (52%) of all their transactions in 2014. The current forecast is that this figure will drop below 50% next year (2016), but there is no prediction for cash to disappear, says the Payments Council.

This continued consumer reliance on cash is also reflected in figures available from LINK, the UK’s cash machine network, which show that the number of cash machines across the country grew last year – reaching a new peak of 69,382.

The number of free-to-use cash machines also increased in 2014, reaching 50,506, following an increase of 5.2% during the year, and surpassing the milestone mark of 50,000 for the first time.

„With more cash machines available, as well as the majority being free-to-use, the total number of people using cash machines continues to grow year-on-year. Most people who used a cash machine in 2014 used them often, with 91% of us withdrawing cash from an ATM at least once a month.”, according to the press release.

* Non-cash payments are comprised of: cheques; debit, credit and charge cards; Direct Debits and Direct Credits; standing orders, internet and phone transactions made via Faster Payments and CHAPS transactions.

The Payments Council developed a counter that shows how much money is estimated to be moving in the UK this year to-date by type of payment instruments/channels. For more details follow the link: Payments counter in 2015

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: