UK Payments Council: „twenty years from now even cards may seem archaic”

„The 2000s were the decade of the debit card. The 2010s are likely to be the decade of the mobile phone. Just as we can’t imagine how we ever did without the Internet, many people will soon wonder how we used to be so dependent on cash and cheque. Twenty years from now even cards may seem archaic.” Adrian Kamellard, chief executive, Payments Council, says.

„The quiet revolution in payments has enabled the creation of whole new industries such as e-shopping, it has changed our behaviour, and it has reduced transaction costs, and increased the speed and efficiency with which we can all pay each other. The next ten years will see even faster change. It’s easy to imagine a future where we merely pat our pockets for our keys and phone. The wallet could become a historical curiosity.”

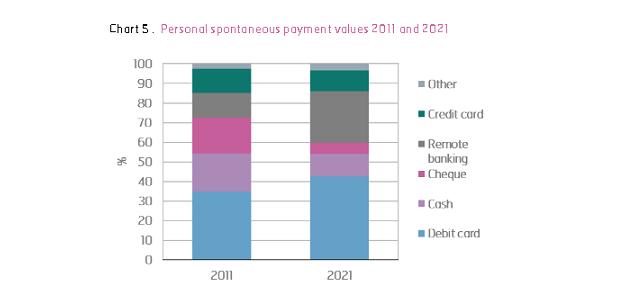

Paying for goods and services has changed dramatically in UK. Cheque usage continues to fall, halving every five years, hand-in-hand with Brits reliance on cash – particularly for regular payments and higher value spontaneous payments.

For example in 2001, an astonishing 40% of home rental payments were made in cash and 43% of our retail spending by value used notes and coins too. By 2011, landlords collected only just over a quarter of rents in cash, while only 30% of shopping was paid for in this way (with the majority of payments being under £5). The rise of the debit card has been responsible for the decline of cash on the high street – indeed debit card spending has risen almost fourfold since 2001- while Direct Debits have completely changed the way Brits make regular payments.

Between 2005 and 2011 the total value of plastic card spending increased by £179 billion. 91% of this growth was attributable to debit cards. In 2011, debit card spending in the UK amounted to £334 billion from 7.3 billion transactions. This was approximately two and half times the amount spent on credit cards of £140 billion from 2.1 billion transactions. This represented an increase of 252% on the corresponding amount spent in the year 2001, making this rate of growth three times higher than that recorded for consumer spending over the decade to 2011.

In the next decade debit card spending in the UK could close to double – as we forecast £664 billion from 14 billion transactions, with credit card spending projected to be £204 billion from 3.1 billion transactions.

Debit card holding is much more widely spread across the social spectrum than credit cards, with 90% ownership across the adult population in 2011 . 98% of AB adults held a debit card compared to 57% of E adults in 2011. For credit cards the figure is 77% v 26% respectively. The wide issuance of debit cards has positive social consequences as it means lower income consumers are able to access the world of e-commerce.

Indeed, without the mass adoption of cards the e-commerce industry could never have developed, and self-service in shops and filling stations would be non-existent. In 2001 online purchases took just 3.3p in every £1 spent on a card. By 2011, that had risen almost quadrupling to 12.8p in every £1, and the total continues to grow.

Indeed, without the mass adoption of cards the e-commerce industry could never have developed, and self-service in shops and filling stations would be non-existent. In 2001 online purchases took just 3.3p in every £1 spent on a card. By 2011, that had risen almost quadrupling to 12.8p in every £1, and the total continues to grow.

By 2011, only 4% of the adult population had no bank account at all. 91% had a current account, and 78% had a savings account. Current account penetration will continue to climb, though a small proportion of the population are likely to remain outside the net permanently. Just under a third of the E adults who tend to be in manual jobs and earn the lowest wages have no current account at present.

Branch banking has declined sharply. By 2011, 30.6 million adults were using telephone or internet banking and a total of 26.8 million were using online banking. Telephone banking use has plateaued while online banking continues to grow very strongly.

Even those who don’t bank online are comfortably shopping online using a card. 37.6 million adults bought something online in 2011, with 6 out of 10 adults doing so at least once a month. This continues to grow sharply as the range of goods and services available on the internet is expanding dramatically.

Young people (25-34), those in higher social classes and those with higher incomes are much more likely to use telephone and/or internet banking. Online banking is now preferred over telephone banking by all groups. The next change is for internet banking to evolve into mobile banking and many financial providers are becoming increasingly active in this area.

2001 doesn’t seem very long ago, but what Brits buy and the way they pay for it has changed enormously over the last decade. In its latest report, „The Way We Pay”, the Payments Council brings together all the big trends over that period for the first time. It shows how many cash payments are continuing to migrate to debit card, how the debit card has won the day for now, but also how it’s possible to see the end of the road for plastic as the mobile phone could take over our payments arsenal.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: