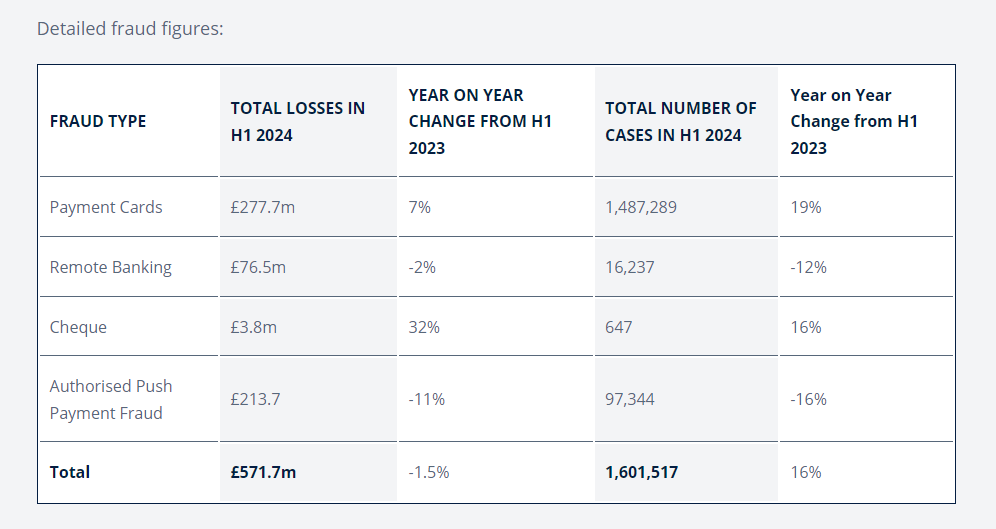

Criminals stole £571.7 million through unauthorised and authorised fraud, a 1.5 per cent decrease compared to the first half of 2023. 72% of APP fraud cases originated from online sources. These cases tend to be lower-value scams, such as purchase scams, and so account for 32% of total losses. 16% of cases originated in telecommunications and these tend to include higher value cases, such as impersonation fraud, and so account for 35 of total losses.

UK Finance releases its Half Year Fraud report, detailing the amount its members reported as stolen through payment fraud and scams in the first half of 2024.

Unauthorised fraud losses

Losses due to unauthorised transactions across payment cards, remote banking and cheques were £358 million in the first half of this year, an increase of five per cent. The total number of recorded cases was just over 1.5 million, an increase of 19 per cent.

One of the main reasons for the overall rise in payment card fraud losses was a 26 per cent increase in card not present cases. Strong Customer Authentication (SCA) has helped to reduce fraud by verifying a customer’s identity; however, evidence has shown that criminals have been socially engineering victims to trick them into divulging one-time passcodes to authenticate online transactions.

Card ID theft cases decreased by 15 per cent with losses down 12 per cent to £29.3 million.

There was a 13 per cent increase in the amount of unauthorised fraud prevented – up to £710.9 million. Victims of unauthorised fraud cases such as these are legally protected against losses and UK Finance research indicates that customers are fully refunded in more than 98 per cent of these fraud cases.

Authorised Push Payment fraud losses

Authorised push payment (APP) fraud losses were £213.7million, down 11 per cent compared with the first half of last year. This comprised £166.5 million of personal losses and £47.2 million of business losses.

The total number of APP cases was down 16 per cent to 97,344, with falls in case numbers across all categories of APP fraud.

The number of purchase scams, where a victim pays in advance for goods or services that are never received decreased by 11 per cent. The number of romance scams, where victims are tricked into believing they are in a relationship, fell by seven per cent and investment scams also decreased in cases by 29 per cent.

The number of fraud cases where criminals impersonate a bank or the police and convince someone to transfer money to a “safe account” fell by 32 per cent and the amount lost to this type of fraud fell by 26 per cent. There has been significant investment made in warning consumers that a bank will never ask someone to transfer money in this way.

In total £126.7 million of APP losses was returned to victims in H1 2024 or 59 per cent of the total loss. New reimbursement rules from the Payment Systems Regulator came into effect on 7 October.

Authorised Push Payment enablers

Authorised push payment fraud losses continued to be driven by the abuse of online platforms and telecommunications. Not only do criminals take advantage of these platforms to encourage the transfer of money through investment, romance or purchase scams but criminals also use scam phone calls, text messages and emails to trick people into handing over personal details and passwords.

Typically, criminals first focus their attempts on socially engineering personal information from their victims with a view to committing APP fraud in which the victim makes the payment themselves. If this is not successful, the criminal often has enough personal information to enable them instead to impersonate their victims, with a view to either taking control of their existing accounts or applying for credit cards in their name.

For more details download the full report: UK Finance – Half year Fraud report, October 2024

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: