UK market: contactless spending jumps 2.7 times following £30 limit increase – London has 39% of all card transactions

The latest Barclaycard Contactless Spending Index, which monitors the shopping trends of millions of UK customers, finds that usage has leapt 173 per cent by value and 112 per cent by volume. The news comes as industry body, The UK Cards Association, announces that contactless spending reached a record high in the first six months of 2016, with consumers splashing out £9.27 billion between January – June, compared to £7.75 billion in the whole of 2015.

Take-up of ‘touch and go’ continues to be highest among Britain’s over 60s, or ‘silver spenders’, with the number of users up 114 per cent, more than any other age group. Usage is climbing so quickly in this age group that the number of silver spenders using the technology is now greater than those aged 18-25. Gender-wise, men and women are adopting contactless in equal measure, with usage rising by 67 per cent amongst both since the limit increase

How’s Britain spending?

The growing popularity of mobile payments and wearables means that ‘touch and go’ payments now extend well beyond contactless cardholders. While the average credit or debit card customer spends £28 a week using contactless, those using alternative forms of payment, such as Android Contactless Mobile from Barclaycard, are quickly catching up, spending £24*. Wearable devices such as Barclaycard’s recently launched bPay Loop – a discreet chip holder that instantly turns thousands of watches and fitness bands into a contactless way to pay – are being used to spend £20 a week.

One of the main benefits of the increased spending limit is that more ‘every day’ purchases can now be made with a single touch of a card, mobile or wearable device. As a result, the average amount Barclaycard customers spend in each transaction has also jumped, rising 29 per cent from £6.77 to £8.70.

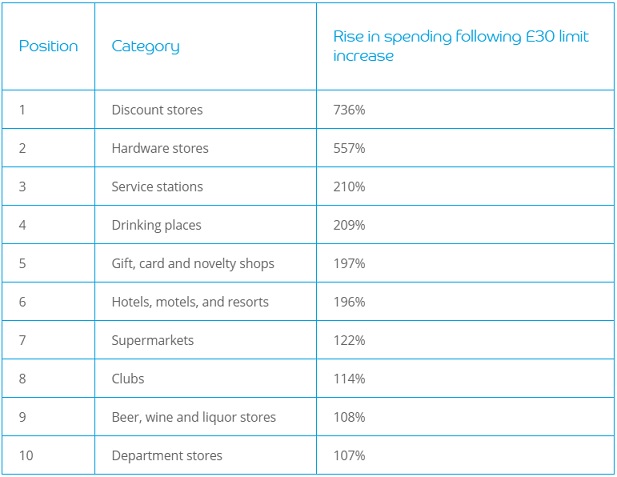

The retail category seeing the biggest increase in the use of contactless technology is discount stores, with a 736 per cent rise, followed by hardware stores (557 per cent) and service stations (210 per cent).

The national picture

Overall, London remains ahead of the rest of the country with almost four in 10 (39 per cent) of all card transactions of £30 and under now paid for with contactless. Usage in the capital is largely due to more merchants accepting the technology, together with the popularity of contactless across the Transport for London Network, and with the night tube having launched last week and set for expansion in the Autumn, this figure could soon shoot up yet again.

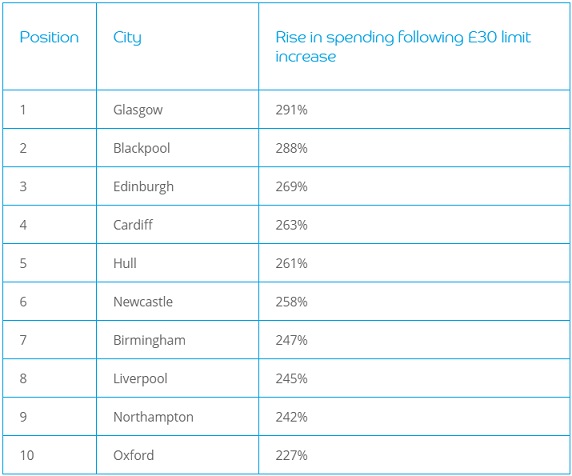

However, the rest of the country is quickly catching up, with huge increases in spending across the UK. Outside London, Glasgow has seen the biggest climb in contactless usage, with the city’s residents spending 291 per cent more so far this year compared to last. Also seeing big leaps in spending are Blackpool (288 per cent), Edinburgh (269 per cent), Cardiff (263 per cent) and Hull (261 per cent), while London where spending is highest overall, comes in 16th spot with spending rising by 116 per cent.

Tami Hargreaves, Commercial Director, Digital Consumer Payments at Barclaycard, said:

“The £30 spending threshold has increased the popularity of contactless payments amongst both existing and new users, both of whom are now using it more frequently and for higher amounts. No longer is ‘touch and go’ reserved for the morning coffee or lunchtime sandwich, instead our data shows shoppers are taking advantage of paying quickly and easily for everyday goods and services such as a few drinks after work or a basket of groceries on their way home.

“Retailers are also responding quickly to consumer demand and updating their payment terminals to accept contactless, or even setting up payment technology for the first time. Contactless can now be used at over 400,000 locations across the country, and with the number set to increase further by the end of 2016, we’re heading for another recording breaking year for ‘touch and go’ spending.”

style=”text-decoration: underline;”>* A Barclaycard study of 2,002 adults aged 18+ (nationally representative) was conducted between 5th and 8th July 2016 by Opinium Research.

Source: barclaycard

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: