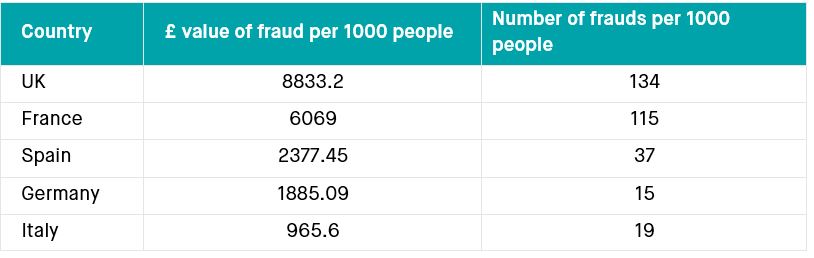

Britons suffer far more card frauds than people in any European country. UK losses from card fraud are also much higher. This is revealed in Social market Foundation (SMF) analysis of European Central Bank data, as demonstrated by the following table.

Context on Card Fraud:

There are several different measurements of the scale of card fraud, all yielding slightly different data that aren’t directly comparable. But all sources suggest that card fraud is roughly half of all fraud activity, and therefore the single most common form of fraud.

The City of London Police (E&W’s lead force for fraud) said that “cheque and card fraud” was the most frequently reported type of fraud (through Action Fraud) in 2020-21, with 336,770 reports.

Card fraud is 45% of all fraud losses, according to UK Finance. (UK Finance also estimate that the total number of instances (cases) of fraud on UK issued cards was 2,835,622 in 2020, up from in 2016, when there were 1,820,726 instances (cases).

According to the Crime Survey for England and Wales, between April 2021 and March 2022 there were 2.3 million “bank and card frauds”, 1.4 million “consumer and retail frauds”, 599,000 “advance fee frauds” and 245,000 “other frauds”. “Bank and card frauds” are 51% of the total recorded frauds committed against residents of E&W and recorded by the CSEW.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: