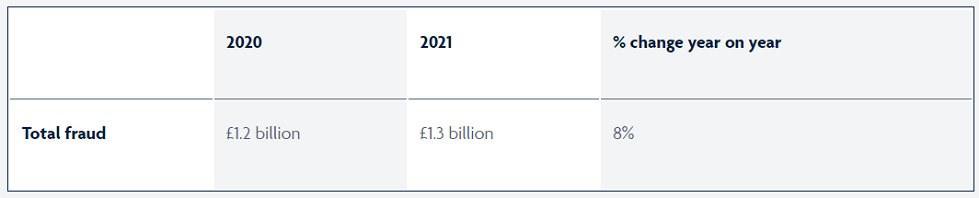

While the industry prevented £1.4 billion of unauthorised fraud, criminals continued to take advantage of the pandemic last year by impersonating a range of organisations to commit fraud, with over £1.3 billion stolen by criminals through authorised and unauthorised fraud in 2021.

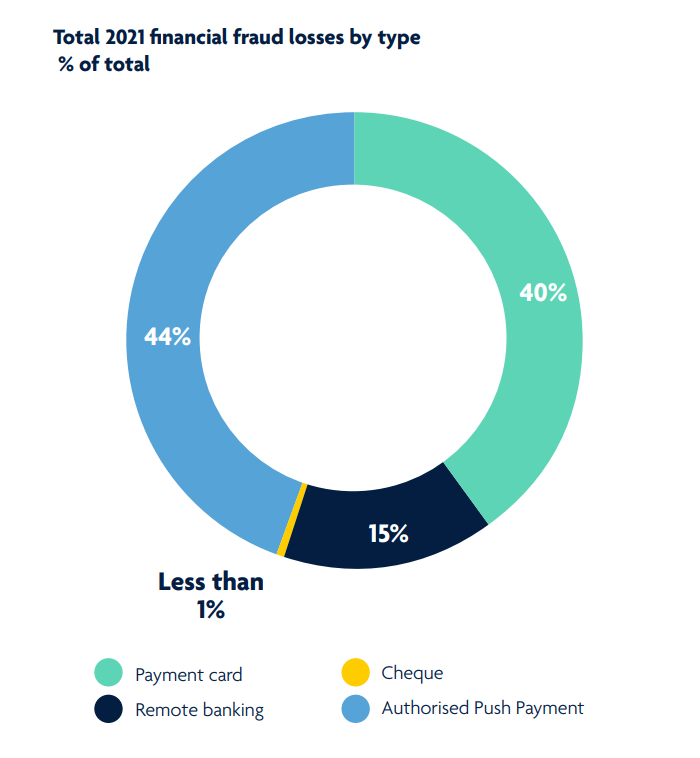

A total of over £1.3 billion was stolen through fraud and scams in 2021: unauthorised fraud was £730.4 million and authorised push payment (APP) fraud was £583.2 million, with nearly 40 per cent of APP losses due to impersonation scams, according to the latest UK Finance fraud report covering 2021.

The banking and finance industry prevented a further £1.4 billion of unauthorised fraud from getting into the hands of criminals.

Katy Worobec, managing director of Economic Crime at UK Finance, said: „Fraud has a devastating impact on victims and the money stolen funds serious organised crime, as well as imposing significant costs on the wider economy.

“Unauthorised fraud losses fell last year, but this type of criminal activity remains a major problem. Through the introduction of new measures such as strong customer authentication, coupled with continued investment in technology, the banking and finance industry prevents significant amounts of fraud from taking place.

“Authorised fraud losses rose again this year as criminals targeted people through a variety of sophisticated scams, with much of the criminal activity taking place outside the banking sector, often involving online and technology platforms. This is why we continue to call for other sectors to play a greater role in helping protect customers from the scourge of fraud.”

2021 fraud losses

Unauthorised fraud: here the account holder themselves does not provide authorisation and the transaction is carried out by a criminal (for example, the victim’s card details are used without their knowledge or consent).

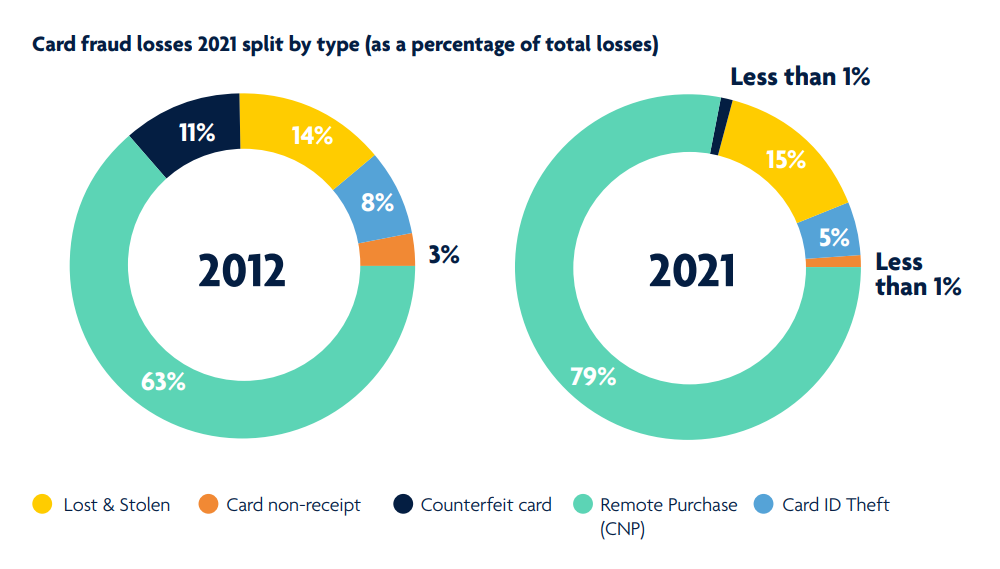

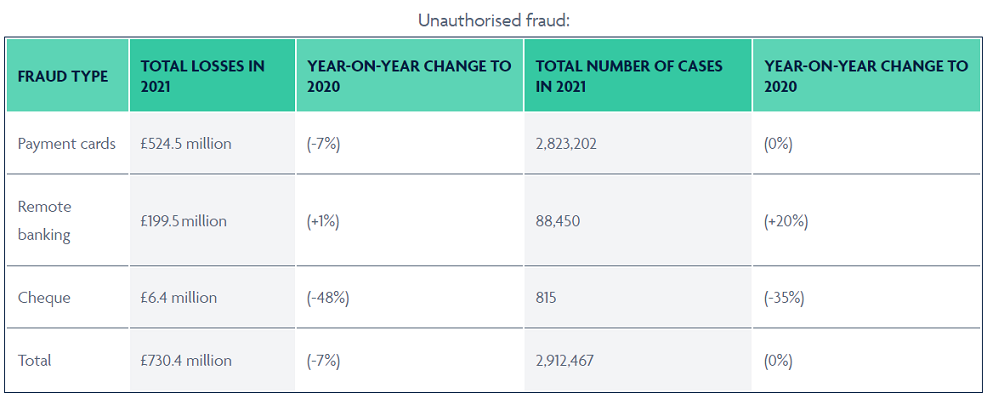

Unauthorised financial fraud losses across payment cards, remote banking and cheques totalled £730.4 million in 2021, a decrease of seven per cent compared to 2020.

Victims of unauthorised payment card fraud are legally protected against losses. Industry analysis shows customers are refunded in excess of 98 per cent of all confirmed cases.

Authorised push payment (APP) fraud: here the customer is tricked into authorising a payment to an account controlled by a criminal.

In 2021, criminals impersonated a range of organisations such as the NHS, banks and government departments via phone calls, text messages, emails, fake websites and social media posts to trick people into handing over their personal and financial information. They subsequently used this information to convince people into authorising a payment.

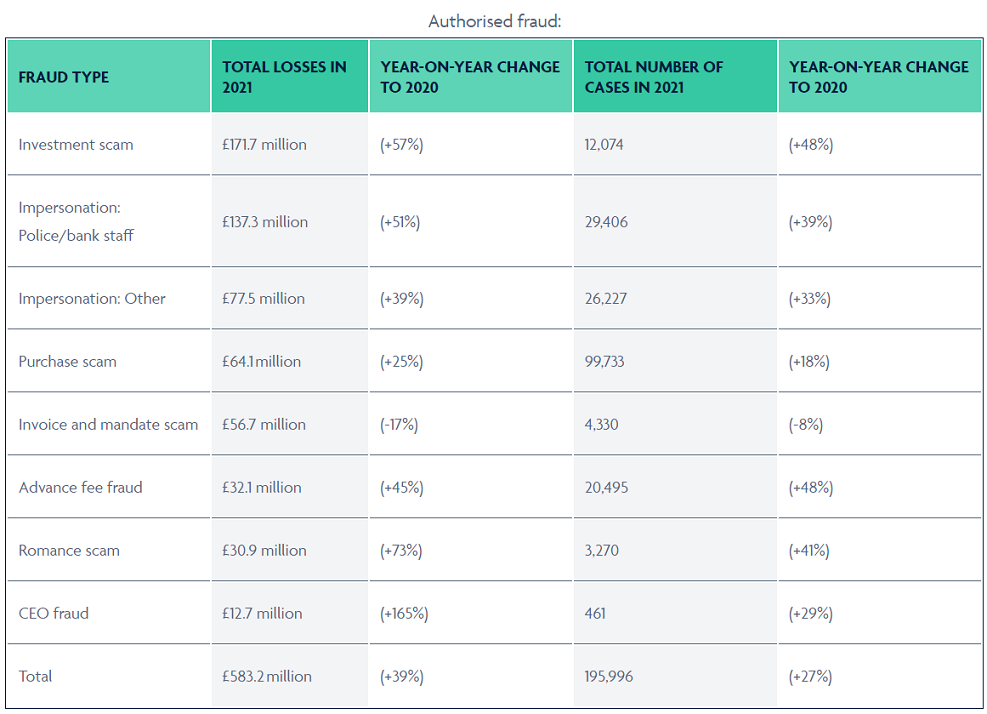

There were 195,996 incidents of APP scams in 2021 with gross losses of £583.2 million, including:

£214.8 million lost to impersonation scams, whereby criminals impersonate a range of organisations to trick people into giving away their personal and financial information. This was the largest category of APP losses.

£171.7 million lost to investment scams, the second largest category of APP losses.

99,733 cases of purchase scams, which means this was the most common type of scam – accounting for 51 per cent of all cases – although total losses were £64.1 million.

A total of £271.2 million of losses were returned to victims of APP scams, accounting for 47 per cent of losses.

UK Finance also collects data on cases assessed under the APP voluntary code. As a subset of the total amount refunded above, £238.1 million of losses were returned to victims under the APP code, accounting for 51 per cent of losses in these cases.

Further details on the authorised and unauthorised fraud figures can be found in the table below.

Detailed fraud figures

____________

UK Finance is the collective voice for the banking and finance industry. Representing around 300 firms across the industry, we act to enhance competitiveness, support customers and facilitate innovation.

3. Update on previous APP figures:

Validation checks we undertook on the fraud data supplied to us prior to publication this year uncovered some issues with historic authorised push fraud (APP) figures. We found that some previously published APP figures had been overstated.

We conducted an audit of the 2020 and 2021 figures and have made the following headline amendments:

– The total number of APP cases in 2020 and in the first half of 2021 have been restated from 149,946 to 154,614 and from 106,164 to 101,540 respectively.

– Total APP losses for 2020 and for the first half of 2021 have been restated from £479 million to £420.7 million and £355.3 million to £301.5 million respectively.

– The total APP reimbursement figures for 2020 and for the first half of 2021 have been restated from £206.9 million to £190.8 million and £150.7 million to £138.2 million respectively.

The component figures, including by scam type, payment type and payment channel, have also been revised to reflect these headline amendments.

These updated figures are all included within this report, along with the new figures for the second half of 2021.

We have not restated any figures for years prior to 2020 as these are not directly comparable with current data. This is because the manner in which APP losses are identified and reported has changed, including through the introduction of UK Finance Best Practice Standards in 2018 and the Contingent Reimbursement Model Code in 2019. In addition, the number of firms reporting APP data to us has increased.

4. The banking and finance industry is tackling fraud by:

Investing in advanced security systems to protect customers from fraud, including realtime transaction analysis. The industry prevented £1.4 billion of unauthorised fraud in 2021, equivalent to 65.3p in every £1 of attempted unauthorised fraud being stopped without a loss occurring.

Working with the government and law enforcement to establish clear strategic priorities, improve accountability and coordination through the Economic Crime Strategic Board (ECSB), jointly chaired by the home secretary and the chancellor. The ECSB has agreed a number of public private priorities, with a focus on Suspicious Activity Reports (SARs) Reform, work on legislative proposals and effectiveness and efficiency.

Advocating for economic crime to be fully included within the Online Safety Bill. We welcome the expansion the scope of the Online Safety Bill to include advertising on social media and search engines.

The jointly published Home Office and UK Finance Economic Crime Plan sets out how to better harness the combined capabilities of the public and private sectors to make the UK a leader in the global fight against economic crime. Industry is working with government on a new Economic Crime Plan and Ten Year Fraud Strategy. The Economic Crime and Corporate Transparency Bill announced in the Queen’s Speech in May 2022 will support this by providing a framework for all sectors working together.

Sharing intelligence on emerging threats with law enforcement, government departments and regulators through the National Economic Crime Centre. This drives down serious organised economic crime, protecting the public and safeguarding the prosperity and reputation of the UK as a financial centre.

Sharing intelligence across the banking and finance industry on emerging threats, data breaches and compromised card details via UK Finance’s Intelligence and Information Unit (I&I Unit). In 2021, 1.6 million compromised card numbers were received through law enforcement and disseminated via the I&I unit to enable card issuers to take the necessary precautions to protect customers. The industry has proposed new powers on information and intelligence sharing to make it easier for regulated sector firms to share information with each other.

Delivering customer education campaigns to help them stay safe from fraud, spot the signs of a scam, and to prevent consumers being duped by criminals. These include our Take Five to Stop Fraud and Don’t Be Fooled campaigns. 35 major banks and building societies have signed up to the Take Five Charter, bringing the industry together to give people simple and consistent fraud awareness advice.

Training staff to spot and stop suspicious transactions. The Banking Protocol rapid response scheme allows branch staff at banks, building societies and Post Offices to alert the police when they think a customer is being scammed, whether in branch, on the telephone, or online banking. The Banking Protocol has prevented £202.8 million in fraud and led to 1,005 arrests since it launched in 2016. In 2021 £60.7 million was stopped through the scheme, 34 per cent more than in 2020.

Sponsoring a specialist police unit, the Dedicated Card and Payment Crime Unit, which tackles the organised criminal groups responsible for financial fraud and scams. In 2021 the DCPCU prevented a record £101 million from being stolen in 2021, the highest amount in the unit’s 20-year history, arrested 67 suspected fraudsters and secured 83 convictions.

Working with the regulator Ofcom to crack down on number spoofing, including the development and enhancements of the ‘do not originate’ list. This work has led to significant successes in preventing criminals from spoofing the phone numbers of trusted organisations such as the numbers on the back of bank cards.

Working with text message providers and law enforcement to block scam text messages including those exploiting the Covid-19 crisis. 2098 unauthorised sender IDs are currently being blocked to prevent them being used to send scam text messages mimicking trusted organisations, including over 450 related to Covid-19.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: