The last year has been challenging for UK households balancing budgets against rising fuel costs, spiralling inflation and wage pressures. Analysis by global analytics software firm FICO of its proprietary UK credit cards data for March 2023 to March 2024 illustrates the impact these pressures have had on credit card usage and debt management.

Overall, consumer spend was up and payments to balance down year-on-year with credit card balances remaining high, having returned to pre-pandemic levels. The 12-month period also saw greater use of credit cards to withdraw cash.

Highlights

Month-on-month fluctuations in credit card spend followed seasonal trends in 2023, however spending was higher than previous years in every month

December 2023 saw average spend per UK credit card reach £850 – the highest since FICO records began in 2006

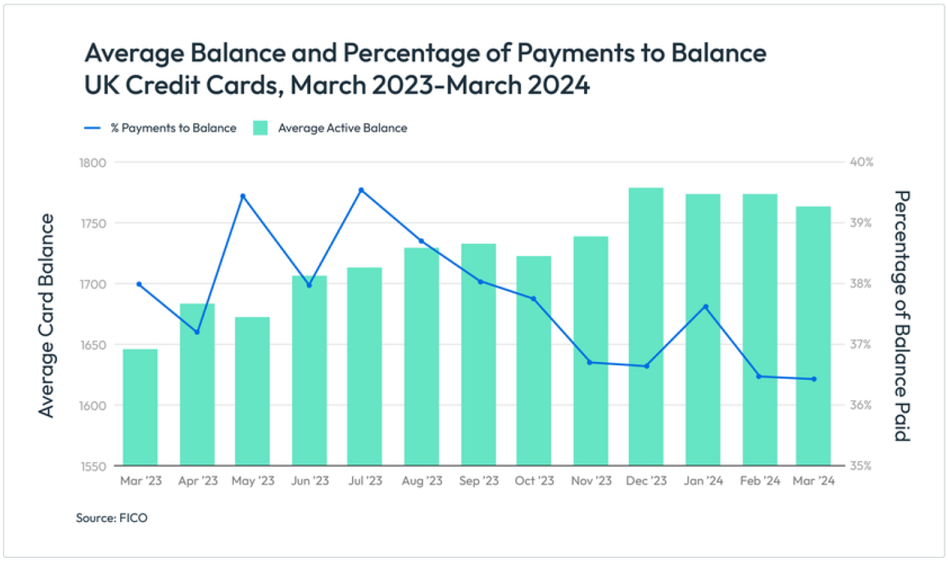

The percentage of payments being made compared to the overall balance has been trending down since July 2023 (apart from the expected seasonal increase in January), and currently stands at 36.4%

Balances are now back to levels seen pre-COVID, after dropping during the pandemic; December 2023 saw a record high of £1,780

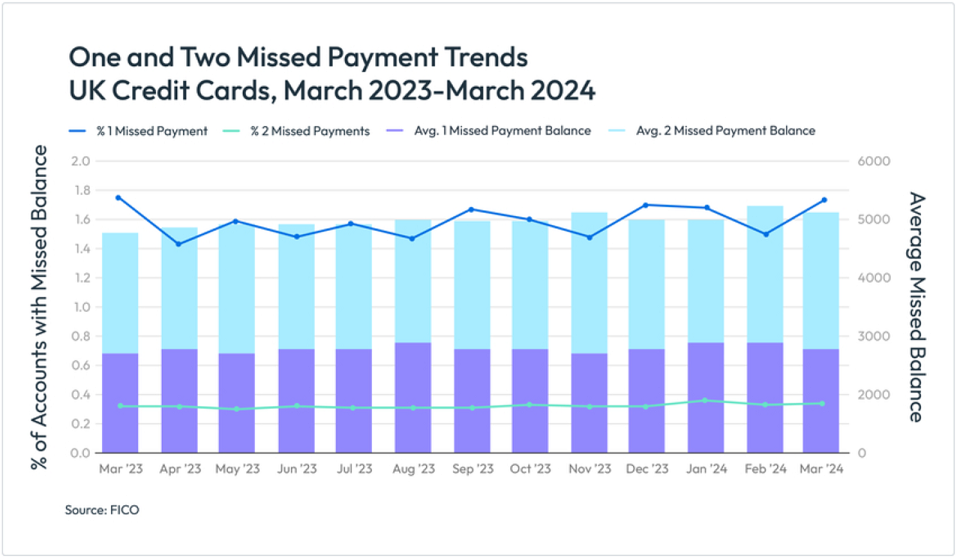

In nearly every month, the proportion of customers missing payments increased year-on-year and established credit card holders (1-5 years) are the most likely to miss payments

The number of customers using credit cards to withdraw cash rose year-on-year but remains lower than pre-pandemic levels

FICO Guidance

With customers paying down less of their balances, more customers will fall into the persistent debt category (over a period of 18 months, a customer pays more in interest, fees and charges than they have repaid of the principal). In a Consumer Duty world, FICO recommends that firms are actively identifying these customers at an early stage and reviewing their communications, to encourage higher payments in support of achieving better value from their credit card. This review should be comprehensive and include payment and communications channels which best engage and empower the customer to manage their finances proactively reaching out to customers before they move into each of the persistent debt stages will help to ensure they are on the right product based on their current affordability needs.

With more customers missing payments compared to this time last year, FICO also recommends implementing pre-delinquent strategies and reviewing those already in production to try and reduce the number and amount of balances moving forwards into delinquency. These strategies will support firms in both their attempts to avoid foreseeable customer harm and also carrying potentially avoidable loss provisions, under IFRS 9

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: