UK consumers excited by the new biometric payment cards – data protection and reliability will be crucial factors for mass adoption

Since Apple introduced Touch ID in 2013 the world has embraced fingerprints as a form of identification and authentication. The convenience and security afforded by the technology has led to its rapid adoption and now almost every smartphone has a sensor. Bank cards will soon have one too.

In January 2018 Gemalto launched their first EMV card with fingerprint biometric, and since then banks have shown increasing enthusiasm and trials are ongoing. UK is expected to follow soon. With this in mind, Gemalto have recently commissioned a research to explore whether UK cardholders are ready to adopt the new biometric card.

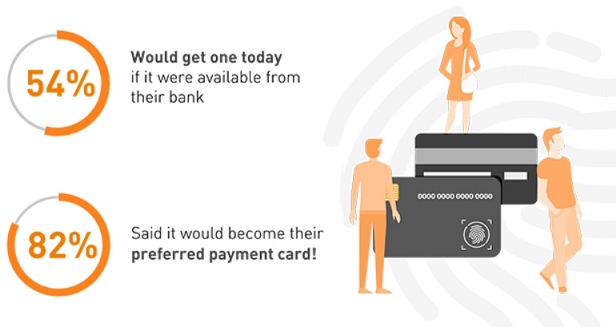

More than half of UK consumers (54 percent) would be ready to use biometric payment cards if they were available at their bank today, according to new research revealed by digital security leader Gemalto and conducted by GfK*. For 82 percent of them, it would even become their preferred payment card – generating a clear ‘top of the wallet’ effect. These innovative cards with integrated fingerprint readers let users authorise payments with a simple touch of their finger on the sensor, as an alternative to the PIN code.

If British consumers are to replace their current payment cards, they need them to be more secure than what they currently have (88 percent), to be offered by a trusted bank (79 percent), to be easy to use (69 percent) and to be one that simplifies their life (60 percent).

For a large majority, biometric cards clearly tick all the boxes. Eight out of 10 consumers believe that this new card will be better in terms of convenience and security. Key advantages include: no need to remember different PIN codes, a more secure experience („no more risk of someone stealing my PIN code when I pay”) and more opportunities to pay contactless thanks to higher spending limits. Additionally, the card doesn’t rely on a battery and only uses power from the payment terminal to work; this means there is no limit on the number of transactions.

UK consumers excited by the new biometric payment cards

Some consumers also expressed concerns about using biometric technology. 41 percent feel afraid that their fingerprint won’t work all the time and more than a third (37%) about it being compromised.

However, these concerns should be alleviated as consumers learn more about the technology. For example, biometric cards will be able to fall back to a PIN code authorisation if for any reason the fingerprint reader malfunctions. The fingerprint data is also securely stored in the card’s chip. It never leaves the card. It’s not kept on the bank’s servers nor sent to a personalization bureau, so to avoid the risk of it being stolen or compromised.

The findings show that Britons are enthusiastic about the potential of biometric cards, but also proves the need to build confidence in order to convince all UK cardholders to take up this new payment method. The majority of them, mainly young active contactless users or multi-banking product owners in the 40-50 age range- are already convinced, but there is also one third of the population that will need more time and proof to feel confident using biometric payments.

Responding to the findings, Howard Berg, SVP Banking and Payment at Gemalto commented, „We are delighted to see that the British public is ready to embrace this new generation of biometric payment cards. Our payment experts have worked hard to design a card that’s not only safe and secure but also easy to use and which provides a more convenient payment experience than ever before. Banks are showing great enthusiasm with ongoing trials and we look forward to launching biometric cards in the UK in the near future.”

*About the research

Research conducted by GfK (821 interviews done on line representative of UK card holders from 05/25 to 06/05/2018).

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: