Study: The highest concern for worldwide bankers is not the business model but the cybercrime

UK and US bankers place fears about cybercrime at the top of a list of 24 possible risks to the financial services industry, beating off traditional worries about excessive regulation and economic growth.

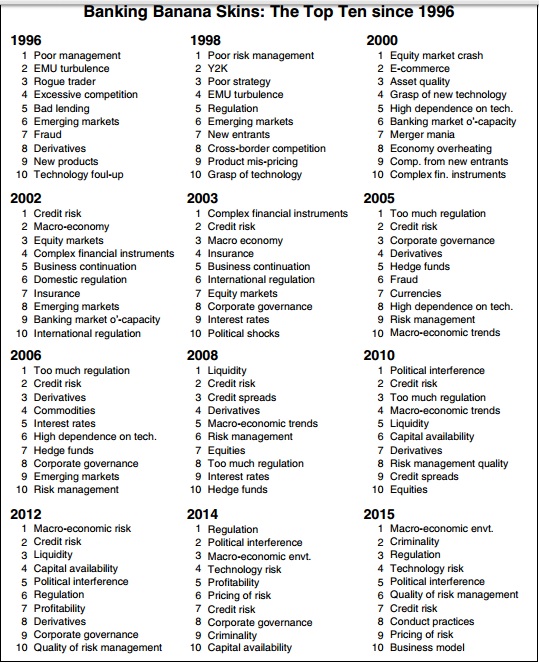

The banking industry is under attack from many angles, not just from traditional risks but also new uncertainties. Results from the CSFI’s latest global annual survey, conducted in association with PwC, ‘Banking Banana Skins 2015’, puts concern about the macro-economic environment at the top of the list of 24 possible risks to banks, knocking excessive regulation, long a high-ranking risk in this survey, from top spot last year to no.3.

The sharpest rise in concern in 2015 was about criminality (including the risks to banks in areas such as money laundering, tax evasion and cyber attack) which rose from No. 9 in 2014 to No. 2 in 2015. This risk coupled with continued concern on technology risk (No. 4) where underinvestment and obsolescence, as well as the boom in new “fintech” present major challenges to banks.

The ability of banks to manage the growth in crime is also under question, as shown by strong concern about the quality of their technology (No. 4) and of their risk management systems (No.6).

Criminality and technology risk are becoming increasingly concerns of banks given the rise in new competitors who are challenging traditional ways of doing things and operate using more nimble systems and lower overheads. Traditional bank earnings models are starting to be threatened as these competitors chip away at many traditional way of doing things. To help them improve margins, banks are experimenting with new industry models which leverage on technology and focus more on customer centricity and less on products; however this could expose them to even higher risks in the areas of cyber crime and financial terrorism.

Another fast-rising concern is over the banks’ business conduct practices (from No. 16 to No. 8), because of what is perceived to be the banks’ failure to achieve sufficient “culture change” in the management of their business practices despite strong regulatory pressure and heavy fines. One banker described unethical business practices as a “perennial risk [which] won’t go away as we make money out of people who don’t pay money back”.

PwC sponsors the Banking Banana Skins survey conducted by the Centre of the Study of Financial Innovation. Each survey identifies potential sources of risks to banks and then ranks them by severity. Also included are industry members’ views about the risks they face, the soundness of financial markets, and other pressing issues.

Pwc asked respondents how well prepared they thought banks were to deal with the risks identified by the survey on a scale where 5=well prepared and 1=poorly prepared. The result was 3.13, slightly better than the 3.04 scored in 2014, and continuing a rising trend since the peak of the financial crisis. Bankers rated their preparedness higher than non-bankers. Geographically perceptions of preparedness were strongest in the Far East Pacific followed by North America and Europe.

The poll is based on responses from more than 670 bankers, banking regulators and close observers of the banking industry in 52 countries (without Romania, this year).

Source: Banking Banana Skins 2015

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: