Uber launches service to pay drivers instantly – the solution is an alternative to traditional banking

Concerned that its drivers are turning to payday lenders and other loan sharks, Uber is set to introduce a system to allow drivers to be paid as soon as their shifts end.

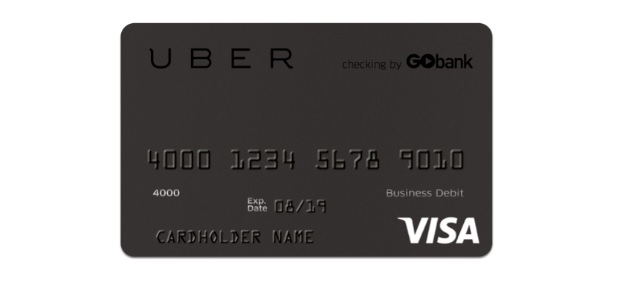

Uber is teaming up with Green Dot, a pre-charge card company to offer a service called GoBank to its drivers. The partnership brings on-demand banking to the on-demand economy.

“The partnership marries technology, banking and payments in an innovative way to give Uber driver-partners the flexibility to receive their pay instantly, and also provides an alternative to traditional banking,” says Green Dot Founder & Chief Executive Officer, Steve Streit.

The ride-sharing service will offer the feature for free to its employees, as long as they access their accounts once every six months. Should that not happen, drivers would be charged a monthly fee of $8.95.

„Our drivers should not have to pay for this technology,” said Wayne Ting, Uber’s general manager for the San Francisco Bay Area.

Uber usually pays its drivers once a week, which can cause a strain on the budgets of its largely low-income workforce. In the past, drivers have turned to payday loans or apps like Clearbanc, which allows drivers to be paid immediately at the cost of $2 per day.

Lyft was the first ride-sharing app to offer immediate payouts when they introduced a similar service recently. However, they require users to deposit at least $50 and charge a fee of 50 cents for each use.

Uber will begin a pilot service for GoBank in select cities, including San Francisco, before expanding nationwide.

Uber’s driver-partners amount to approximately 400,000 drivers in the U.S., which could be significant for Green Dot Corporation.

Uber was founded in 2009 and now it is present in 69 countries and 397cities around the world including Bucharest.

Green Dot Corporation, along with its wholly owned subsidiary bank, Green Dot Bank, is a pro-consumer financial technology innovator with a mission to reinvent personal banking for the masses. Green Dot invented the prepaid debit card industry and is the largest provider of reloadable prepaid debit cards and cash reload processing services in the United States. Green Dot is also a leader in mobile technology and mobile banking with its award-winning GoBank mobile checking account. Through its wholly owned subsidiary, TPG, Green Dot is additionally the largest processor of tax refund disbursements in the U.S. Green Dot’s products and services are available to consumers through a large-scale „branchless bank” distribution network of more than 100,000 U.S. locations, including retailers, neighborhood financial service center locations, and tax preparation offices, as well as online, in the leading app stores and through leading online tax preparation providers.

Source: businesswire.com

More details about Uber/GoBank fees & limits

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: