Developed by the Federal Authority for Identity, Citizenship, Customs, and Port Security (ICP), in partnership with the Central Bank of the UAE, the system aims to deliver faster, more seamless services across public and private sectors.

Currently in its trial phase, „Palm ID” technology was showcased at Gitex Global 2024 as part of the UAE Vision 2031 initiative.

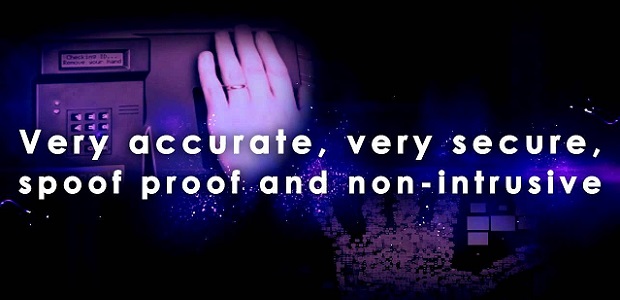

“We’re in the final stages of development. Each person’s palm veins are unique, making this method highly secure. Users will be able to make payments and withdraw cash from ATMs just by scanning their palm,” an ICP spokesperson explained.

Regulations and policies are currently being finalized for a smooth public rollout.

Unlike facial recognition, palm vein scanning is considered less intrusive and ensures privacy, as it cannot be easily shared like credit card details. Registration will require an Emirates ID and can be done through the ICP platform. The system will link palm biometrics to personal profiles, enhancing accuracy and security.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: