E-commerce continues to expand: online retail spending rose 7.8%, driven by early-season promotions and convenience. However, Visa data indicates that online channels accounted for only 27% of total retail spending. Visa and Mastercard preliminary data suggest holiday retail spending rose by about 4%.

Visa, a global leader in digital payments, today released its annual Retail Spend Monitor from Visa Consulting & Analytics (VCA), offering a broad view of U.S. holiday retail activity. „Preliminary data shows that overall holiday retail spending increased 4.2% year over year across all payment types, including cash and check. These figures are not adjusted for inflation.” – according to the press release.

“Whether shoppers were upgrading their tech, refreshing their closets, or stocking up at one‑stop shops, retailers delivered seamless shopping experiences both in stores and online,” said Wayne Best, chief economist at Visa. “This season also marked a turning point, with artificial intelligence shaping how people discover products, compare prices, and interact with offers. This led to a more informed, more intentional consumer, ensuring they could stretch their discretionary spending.”

Holiday season spending highlights include:

. In-store shopping remains strong: 73% of holiday payment volume was in physical stores while 27% of retail spend happened online.

. E-commerce continues to expand: Online retail spending rose 7.8%, driven by early-season promotions and convenience.

. Global holiday retail spending momentum: Markets outside the U.S. saw seasonal spending rise, with Australia (+5.0%), Canada (+4.4%), South Africa (+7.9%) and U.K. (+3.6%).

Mastercard SpendingPulse

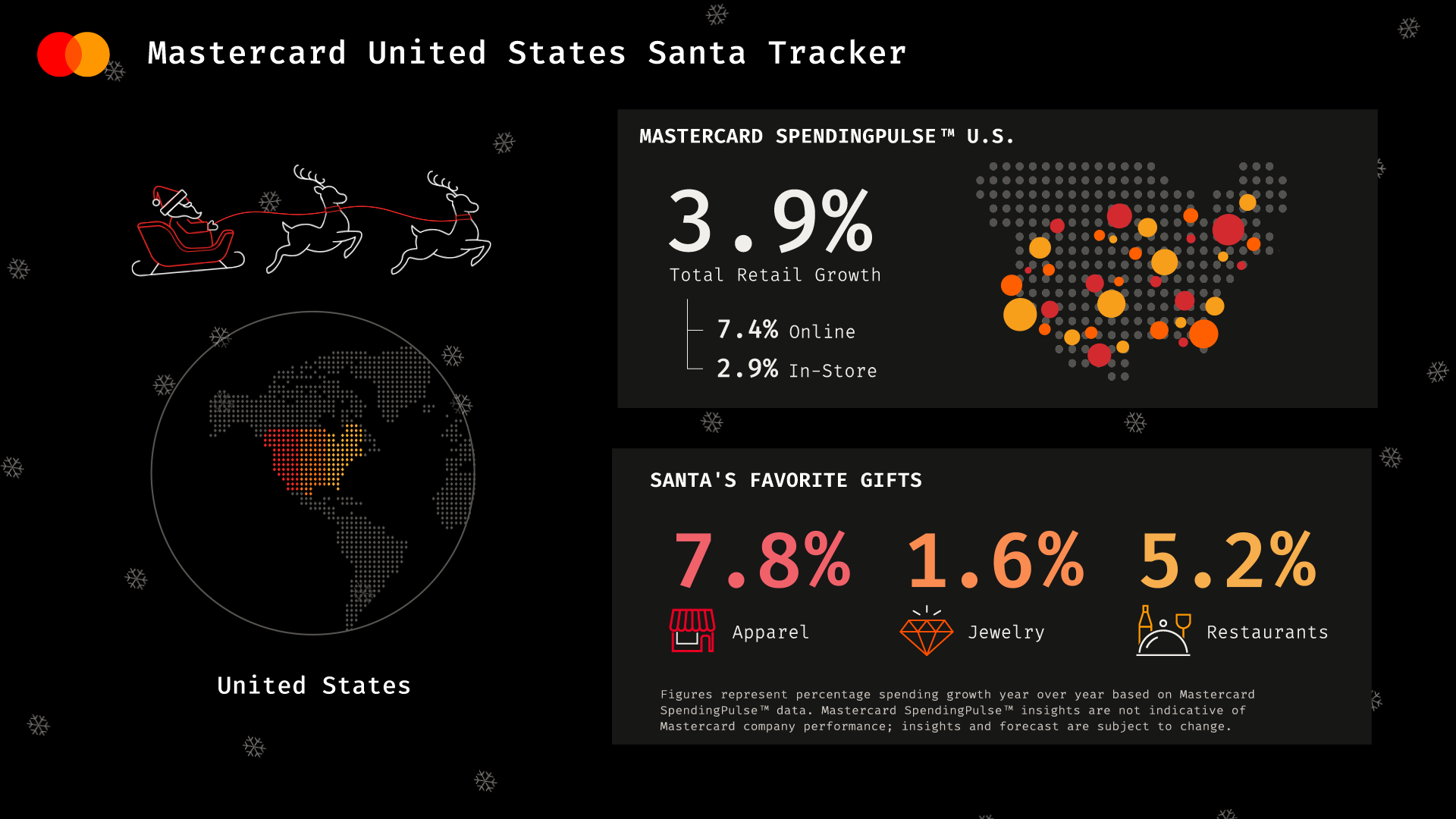

According to preliminary insights from Mastercard SpendingPulse™, U.S. retail sales excluding automotive increased 3.9% year-over-year from November 1 through December 21. Mastercard SpendingPulse measures in-store and online retail sales representing all payment types and is not adjusted for inflation.

“Consumers demonstrated flexibility and confidence this season, shopping early, leveraging promotions, and investing in meaningful experiences and wish-list items. They also blended online and in-store shopping to find the best deals and maximize convenience,” said Michelle Meyer, chief economist, Mastercard Economics Institute.

. Savvy shoppers sought value online and in stores: Consumers didn’t just hunt for deals, they shopped smart across channels, with many combining in-store visits with online browsing to secure the best promotions and maximize convenience. E-commerce sales surged +7.4%, while in-store sales grew +2.9%, underscoring the convergence of blended shopping experiences.

. A season of style with some sparkle: Apparel spending climbed +7.8% as chilly temperatures and seasonal deals likely encouraged wardrobe refreshes and gift giving. Consumers embraced an omnichannel approach, with online sales up +8.5% and in-store sales also rising +7.0%, browsing online for inspiration and price comparisons, then heading in-store to try on and purchase items. Jewelry also rose by +1.6% as shoppers strategically purchased sparkly gifts.

. Dining out as a holiday ritual: Restaurant spending grew +5.2%, highlighting consumers’ continued appetite for experiences and shared moments during the festive season. From celebratory dinners to casual outings, dining out has become an integral part of holiday traditions, signaling that consumers value connection along with tangible gifts.

______________

The VCA Retail Spend Monitor analyzes retail sales activity over a seven-week period beginning November 1, using a subset of Visa payments network data in the U.S.1 and survey-based estimates for other payment methods. It is produced by VCA’s global network of thousands of consultants, data scientists, and product experts from around the world. Their expertise combined with the power of VisaNet data – which represents over 329 billion transactions a year – helps clients identify trends and make data-driven decisions. In the last year, VCA delivered nearly 4,500 consulting engagements that helped clients realize an estimated $6.5 billion in incremental revenue as a result.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: